As filed with the Securities and Exchange Commission on May 24,

2019

Registration

No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

|

Flux

Power Holdings, Inc.

|

|

(Exact name of

registrant as specified in its charter)

|

|

Nevada

|

|

3690

|

|

86-0931332

|

|

(State

or jurisdiction of incorporation or

organization)

|

|

(Primary

Standard Industrial Classification Code

Number)

|

|

(I.R.S.

Employer Identification

No.)

|

|

985 Poinsettia

Avenue, Suite A

Vista,

CA 92081

(877)

505-3589

|

|

(Address, including

zip code, and telephone number, including area

code, of registrant’s principal executive

offices)

|

Ronald

F. Dutt

Chief

Executive Officer

Flux

Power Holdings, Inc.

985

Poinsettia Avenue, Suite A,

Vista,

CA 92081

(877)

505-3589

|

|

(Name, address,

including zip code, and telephone number, Including area code, of

agent for service)

|

Copies

to:

|

John P.

Yung, Esq.

Daniel

B. Eng, Esq.

Lewis

Brisbois Bisgaard & Smith LLP

333

Bush Street, Suite 1100

San

Francisco, CA 94104

(415)

362-2580

|

John D.

Hogoboom, Esq.

Lowenstein

Sandler LLP

1251

Avenue of Americas

New

York, NY 10020

(212)

262-6700

|

________________________

Approximate date of commencement of proposed sale to the

public: As soon as practicable after the effective date of

this Registration Statement.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box.

☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller

reporting company

|

☒

|

|

(Do not check if a smaller reporting

company)

|

|

Emerging

growth company

|

☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities

Act

CALCULATION OF REGISTRATION FEE

Title of Each

Class of Securities to be Registered

|

Proposed Maximum

Aggregate Offering Price(1)

|

Amount of

Registration Fee

|

|

Common Stock,

$0.001 par value(2) (3)

|

$15,000,000

|

$1,818.00

|

|

Representatives’

Warrants

|

$990,000

|

$119.99

|

|

Common Stock,

$0.001 par value, issuable upon exercise of the

Representatives’ Warrants(3)

|

--(4)

|

--(4)

|

|

Total

|

$15,990,000

|

$1,937.99

|

(1)

Estimated solely

for the purpose of calculating the registration fee pursuant to

Rule 457(o) under the Securities Act of 1933, as

amended.

(2)

Includes shares

subject to the underwriters’ over-allotment

option.

(3)

Pursuant to Rule

416 under the Securities Act, the securities being registered

hereunder include such indeterminate number of additional shares of

common stock as may be issued after the date hereof as a result of

stock splits, stock dividends or similar transactions.

(4)

Pursuant to Rule

457(g), no separate fee is required.

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may

determine.

The information in this prospectus is not complete and may be

changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 24, 2019

PROSPECTUS

Shares

Common Stock

We are

offering shares of common stock in this offering.

Our

common stock is quoted on the OTCQB marketplace under the symbol

“FLUX.” On May 23, 2019, the closing bid price of our

common stock on the OTCQB was $1.00 per share. We have applied to

list our common stock on The NASDAQ Capital Market under the symbol

“FLUX.” We will not consummate this offering unless our

common stock is approved for listing on The NASDAQ Capital

Market.

The

public offering price per share will be determined between us, the

underwriters and investors based on market conditions at the time

of pricing, and may be at a discount to the current market price of

our common stock. Therefore, the recent market price used

throughout this prospectus may not be indicative of the actual

public offering price.

Investing

in our securities involves a high degree of risk. See “Risk

Factors” beginning on page 7.

|

|

|

|

|

Public offering

price

|

$

|

$

|

|

Underwriting

discount(1)

|

$

|

$

|

|

Proceeds to us

(before expenses)

|

$

|

$

|

|

(1)

|

See

“Underwriting” beginning on page 49 for additional

information regarding the compensation payable to the

underwriters.

|

We have

granted the underwriters a 30-day option to purchase up to an

additional shares from us at the public offering price, less the

underwriting discount, to cover over-allotments, if

any.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

Delivery of the

shares of common stock is expected to be made through the

facilities of the Depository Trust Company on or about ,

2019.

___________________________________

Joint Book-Running Managers

|

Roth

Capital Partners

|

Maxim

Group LLC

|

The

date of this prospectus is , 2019

Table of Contents

Neither we nor the underwriters have authorized anyone to provide

you with information other than that contained in this prospectus

or any free writing prospectus prepared by or on behalf of us or to

which we have referred you. We and the underwriters take no

responsibility for, and can provide no assurance as to the

reliability of, any other information that others may give you. We

and the underwriters are offering to sell, and seeking offers to

buy, common stock only in jurisdictions where offers and sales are

permitted. The information contained in this prospectus is accurate

only as of the date on the front cover page of this prospectus, or

other earlier date stated in this prospectus, regardless of the

time of delivery of this prospectus or of any sale of our common

stock.

No action is being taken in any jurisdiction outside the United

States to permit a public offering of our common stock or

possession or distribution of this prospectus in that jurisdiction.

Persons who come into possession of this prospectus in

jurisdictions outside the United States are required to inform

themselves about and to observe any restrictions as to this

offering and the distribution of this prospectus applicable to that

jurisdiction.

This summary highlights information contained elsewhere or

incorporated by reference in this prospectus. This summary provides

an overview of selected information and does not contain all of the

information you should consider before investing in our securities.

You should read the entire prospectus carefully, especially the

“Risk Factors,” “Management’s Discussions

and Analysis of Financial Condition and Results of

Operations” and our consolidated financial statements and the

accompanying notes to those statements, included elsewhere in this

prospectus, before making an investment decision. Unless the

context requires otherwise, references to the

“Company,” “Flux,” “we,”

“us,” and “our” refer to the combined

business of Flux Power Holdings, Inc., a Nevada corporation and its

wholly-owned subsidiary, Flux Power, Inc. (Flux Power), a

California corporation.

Company

Overview

We

design, develop and sell advanced rechargeable lithium-ion energy

storage solutions for lift trucks, airport ground support equipment

(GSE) and other industrial motive applications. Our

“LiFT” battery packs, including our proprietary battery

management system (BMS), provide our customers with a better

performing, cheaper and more environmentally friendly alternative,

in many instances, to traditional lead-acid and propane-based

solutions.

We have

received Underwriters Laboratory (UL) Listing on our Class 3 Walkie

Pallet Jack (Class 3 Walkie) LiFT pack product line in 2016 and

expect to seek UL Listing during calendar 2019 for our other

product lines, which include Class 1 Counterbalance/Sit

down/Ride-on (Class 1 Ride-on) LiFT packs , Class 2 Narrow Aisle

LiFT packs, and Class 3 End Rider LiFT packs. We believe that a UL

Listing demonstrates the safety, reliability and durability of our

products and gives us an important competitive advantage over other

lithium-ion energy suppliers. Our Class 3 Walkie LiFT packs have

been approved for use by leading industrial motive manufacturers,

including Toyota Material Handling USA, Inc., Crown Equipment

Corporation, and Raymond Corporation.

Within

our industrial market segments, we believe that our LiFT pack

solutions provide cost and performance benefits over existing

lead-acid power products including:

●

longer operation

and more shifts with fewer batteries;

●

reduced energy and

maintenance costs;

Additionally, the

toxic nature of lead-acid batteries presents significant safety and

environmental issues as they are subject to Environmental

Protection Agency lead-acid battery reporting requirements, may

create an environmental hazard in the event of a cell breach, and

emit combustible gases during charging.

As a

result of the advantages lithium-ion battery technology provide

over lead-acid batteries, we have experienced significant growth in

our business. We believe we are at the very early stage of a trend

toward the adoption of lithium-ion technology and the displacement

of lead-acid and propane-based energy storage solutions, which

based on North American sales data from the Industrial Truck

Association (ITA), we estimate to be a multi-billion dollar per

year market.

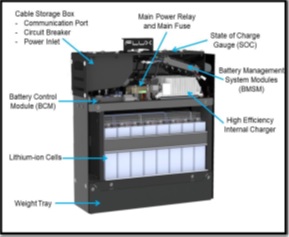

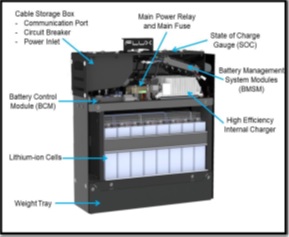

Critical to our

success is our innovative and proprietary high power BMS that both

optimizes the performance of our LiFT packs and provides a platform

for adding new battery pack features, including customized

telemetry for customers. The BMS serves as the brain of the battery

pack, managing cell balancing, charging, discharging, monitoring

and communication between the pack and the forklift.

Our

engineers design, develop, service, and test our products. We

source our battery cells from multiple suppliers in China and the

remainder of the components primarily from vendors in the United

States. Final assembly, testing and shipping of our products is

done from our ISO 9001 certified facility in Vista, California,

which includes three assembly lines.

Our

Strengths

We have

leveraged our experience in lithium-ion technology to design and

develop a suite of LiFT pack product lines that we believe provide

attractive solutions to customers seeking an alternative to

lead-acid and propane-based power products. We believe that the

following attributes are significant contributors to our

success:

Engineering and integration

experience in lithium-ion for motive

applications: We have been developing

lithium-ion applications for the advanced energy storage market

since 2010, starting with products for automotive electric vehicle

manufacturers. We believe our experience enables us to develop

superior solutions.

UL Listing: We

launched our Class 3 Walkie LiFT pack product line in 2014 and

obtained UL Listing for all three different power configurations in

January 2016. We believe this UL Listing gives us a significant

competitive advantage and provides assurance to customers that our

technology has been rigorously tested by an independent third party

and determined to be safe, durable and reliable.

Original equipment

manufacturer (OEM) approvals: Our Class 3 Walkie LiFT packs

have been tested and approved for use by Toyota Material Handling

USA, Inc., Crown Equipment Corporation, and Raymond Corporation,

among the top global lift truck manufacturers by revenue according

to Material Handling & Logistics. We also provide a

“private label” Class 3 Walkie LiFT pack to a major

forklift OEM.

Broad product offering and

scalable design: We offer LiFT packs for use in a variety of

industrial motive applications. We believe that our modular and

scalable design enables us to optimize design, inventory, and part

count to accommodate natural product extensions of our products to

meet customer requirements. Based on our Class 3 Walkie LiFT pack

design, we have expanded our product lines to include Class 1

Ride-on, Class 2 Narrow Aisle, and Class 3 End Rider LiFT pack

product lines as well as airport GSE packs.

Significant advantages over

lead acid and propane solutions: We believe that lithium-ion

battery systems have significant advantages over existing

technologies and will displace lead-acid batteries and

propane-based solutions, in most applications. Relative to

lead-acid batteries, such advantages include environmental

benefits, no water maintenance, faster charge times, greater cycle

life and longer run times that provide operational and financial

benefits to customers. Compared to propane solutions, lithium-ion

systems avoid the generation of exhaust emissions and associated

odor and environmental contaminates, and maintenance of an internal

combustion engine, which has substantially more parts than an

electric motor.

Proprietary Battery

Management System:

We have developed a high power BMS that is incorporated into our

entire product family. The BMS serves as the brain of the battery

pack, managing cell balancing, charging, discharging, monitoring

and communication between the pack and the forklift. Our BMS is

specifically designed for the industrial motive application

environment and is adaptable to meet custom

requirements.

Our Products

We have

developed, tested, and sold our LiFT packs for use in a broad range

of lift trucks, as pictured below, including Class 3 Walkie and End

Riders, Class 2 Narrow Aisle, and Class 1 Ride-on, as well as for

airport GSE, as outlined below.

Our

LiFT packs use lithium iron phosphate (LiFePO4) battery cells,

which we source from a variety of overseas suppliers that meet our

power, reliability, safety and other specifications. Because our

BMS is not designed to work with a specific battery chemistry, we

believe we can readily adapt our LiFT packs as new chemistries

become available in the market or customer preferences

change. We also offer

24-volt onboard chargers for our Class 3 Walkie LiFT packs, and

smart “wall mounted” chargers for larger applications.

Our smart charging solutions are designed to interface with our

BMS.

Industry

Overview

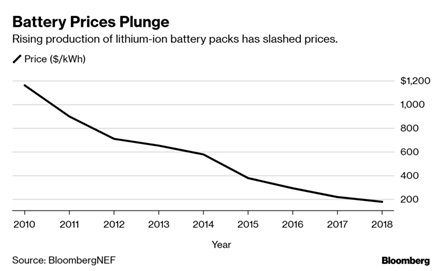

Driven

by overall growth in global demand for lithium-ion battery

solutions, the supply of lithium-ion batteries has rapidly

expanded, leading to price declines of eighty-five percent (85%)

since 2010 according to BloombergNEF. BloombergNEF also estimates

that lithium-ion battery pack prices, which averaged $1,160 per

kilowatt hour in 2010, were $176 per kWh in 2018 and could drop

below $100 in 2024.

The

sharp decline in the price of lithium-ion batteries has commenced a

shift in customer preferences away from lead-acid and propane-based

solutions for power lift equipment to lithium-ion based solutions.

We believe our position as a pioneer in the field and our extensive

experience providing lithium-ion based storage solutions makes us

uniquely positioned to take advantage of this shift in customer

preferences.

Lift Equipment - Material Handling Equipment

We

focus on energy storage solutions for lift equipment and GSE

because we believe they represent large and growing markets that

are just beginning to adopt lithium-ion based technology. These

markets include not only the sale of lithium-ion battery solutions

for new equipment but also a replacement market for existing lead

acid battery packs.

Historically, larger lift trucks were powered by

internal combustion engines, using propane as a fuel, with smaller

equipment powered by lead-acid batteries. Over the past thirty (30)

years, there has been a significant shift toward electric power.

According to Liftech/ITA, over this time period the percentage of

lift trucks powered electrically has doubled from approximately

thirty percent (30%) to over sixty percent

(60%).

According to

McKinsey & Co., worldwide new lift truck orders reached

approximately 1.4 million units in 2017 and had been over 1.2

million units per year for the prior five (5) years. The Industrial

Truck Association has estimated that approximately 200,000 lift

trucks had been sold yearly since 2013 in North America (Canada,

the United States and Mexico), including approximately 253,000

units sold in 2017, with sales relatively evenly distributed

between electric rider (Class 1 and Class 2), motorized hand (Class

3), and internal combustion engine powered lift trucks (Class 4 and

Class 5). The ITA estimates that electric lift trucks represented

approximately sixty-four percent (64%) of the North American market

in 2017. Driven by growth in global manufacturing, e-commerce and

construction, Research and Markets expects that the global lift

truck market will grow at a compound annual growth rate of six and

four-tenths percent (6.4%) through 2024.

Customers

Some of

the end users of our LiFT packs include companies in a number of

different industries, as shown in the graphic below:

Marketing

and Sales

We sell

our products through a number of different channels, including

directly to end users, OEMs and lift equipment dealers or through

battery distributors. Our four-person direct sales staff is

assigned to major geographies nation-wide to collaborate with our

sales partners who have an established customer base. In addition,

we have developed a nation-wide sales network of relationships with

equipment OEMs, their dealers, and battery

distributors.

We have

worked directly with a number of OEMs to secure “technical

approval” for compatibility of our LiFT packs with their

equipment. Once we receive that approval, we focus on developing a

sales network utilizing existing battery distributors and equipment

dealers, along with the OEM corporate national account sales force,

to drive sales through this channel.

As our

LiFT packs have gained acceptance in the marketplace, we have seen

an increase in direct-to-end-customer sales, ranging from small

enterprises to Fortune 500 companies. To expand our customer reach, we

have begun to market directly to end users, primarily focusing on

large fleets operated by Fortune 500 companies seeking productivity

improvements.

To

support our products, we have a nation-wide network of service

providers, typically forklift equipment dealers and battery

distributors, who provide local support to large customers. We also

maintain a call center and provide Tech Bulletins and training to

our service and sales network out of our corporate headquarters.

Our warranty policy for forklift product lines includes a limited

five-year warranty.

Risks Associated with Our Business

Our

business is subject to a number of risks of which you should be

aware before making a decision to invest in our common stock. These

risks are more fully described in the section titled “Risk

Factors” beginning on page 7 of this prospectus.

Corporate Information

We were

incorporated in Nevada in 1998. In May 2012, we changed our name to

Flux Power Holdings, Inc. We operate our business through our

wholly-owned subsidiary, Flux Power, Inc. (Flux Power). Flux Power

was incorporated in October 2009 to provide solutions to exploit

the lithium-ion battery market for lift equipment and related

verticals. Our principal executive office is located at 985

Poinsettia Avenue, Suite A, Vista, CA 92081. The telephone number

at our principal executive office is (760) 741-3589

(FLUX).

|

Common

Stock offered by us

|

shares

of our common stock ( shares if the underwriters exercise the

over-allotment option in full).

|

|

Common

Stock to be outstanding after this offering

|

shares

of common stock(1) ( shares if the

underwriters exercise the over-allotment option in

full).

|

|

Use of

Proceeds

|

We intend to use the net proceeds of this offering for working

capital and general corporate purposes. See ‘‘Use of

Proceeds’’ on page 16 of this prospectus.

|

|

Risk

Factors

|

Investing

in our securities involves a high degree of risk. See “Risk

Factors” beginning on page 7.

|

|

OTCQB

Symbol

|

Our

common stock is quoted on the OTCQB under the symbol

“FLUX.”

|

|

Proposed

NASDAQ Listing and symbol

|

We have

applied to list our common stock on The NASDAQ Capital Market under

the symbol “FLUX.” We will not consummate this offering

unless our common stock is approved for listing on The NASDAQ

Capital Market.

|

(1)

The number of

shares of common stock outstanding immediately after this offering

is based on 51,000,868 shares of common stock outstanding as of May

10, 2019, and excludes, as of that date, the

following:

●

5,839,773 shares of

common stock issuable upon exercise of outstanding stock options,

at a weighted average exercise price of $0.96 per

share;

●

10 million shares

of common stock reserved under our Equity Incentive Plan;

and

●

83,333 shares of

common stock issuable upon exercise of outstanding warrants, at a

weighted average exercise price of $2.00.

Except

as otherwise indicated herein, all information in this prospectus

reflects the 1 for 10 reverse split of our common stock effected on

August 10, 2017, and assumes no exercise by the underwriters of

their over-allotment option to purchase additional

shares.

An investment in our common stock involves a high degree of risk.

You should carefully consider the risks described below, together

with all of the other information included in this prospectus,

before making an investment decision. If any of the following risks

actually occur, our business, financial condition or results of

operations could suffer. In that case, the trading price of our

common stock could decline, and you may lose all or part of your

investment. You also should read the section entitled

“Special Note Regarding Forward Looking

Statements.”

Risk

Factors Relating to Our Business

We have a history of losses and negative working

capital.

For the

nine months ended March 31, 2019, and the year ended June 30, 2018,

we had net losses of $9,139,000 and $6,965,000, respectively. We

have historically experienced net losses and until we generate

sufficient revenue, we anticipate to continue to experience losses

in the near future.

In

addition, as of March 31, 2019 and June 30, 2018, we had a negative

working capital of $488,000 and $7,446,000, respectively. As of

March 31, 2019, we had a cash balance of $900,000. We expect that

our existing cash balances, credit facilities, and the expected net

proceeds of this offering will be sufficient to fund our existing

and planned operations for the next twelve months from the date of

this prospectus. Until such time as we generate sufficient cash to

fund our operations, we will need additional capital to continue

our operations thereafter.

We have

relied on equity financings, borrowings under our credit facilities

and/or previously cash flows from operating activities to fund our

operations. However, there is no guarantee we will be able to

obtain additional funds in the future or that funds will be

available on terms acceptable to us, if at all. See “Risk

Factors” – “We will need

to raise additional capital or financing after this offering to

continue to execute and expand our business”

and “We are dependent on

our existing credit facility to finance our operations and in the

event of default, such default could adversely affect our business,

financial condition, results of operations or

liquidity.”

Any

future financing may result in dilution of the ownership interests

of our stockholders. If such funds are not available on acceptable

terms, we may be required to curtail our operations or take other

actions to preserve our cash, which may have a material adverse

effect on our future cash flows and results of

operations.

We will need to raise additional capital or financing after this

offering to continue to execute and expand our

business.

While

we expect that our available cash, credit facilities, and the

expected net proceeds from this offering will be sufficient to

sustain our operations for the next twelve months from the date of

this prospectus, we will need to raise additional capital after

this offering to support our operations and execute on our business

plan. We may be required to pursue sources of additional capital

through various means, including joint venture projects, sale and

leasing arrangements, and debt or equity financings. Any new

securities that we may issue in the future may be sold on terms

more favorable for our new investors than the terms of this

offering. Newly issued securities may include preferences, superior

voting rights, and the issuance of warrants or other convertible

securities that will have additional dilutive effects. We cannot

assure that additional funds will be available when needed from any

source or, if available, will be available on terms that are

acceptable to us. Further, we may incur substantial costs in

pursuing future capital and/or financing, including investment

banking fees, legal fees, accounting fees, printing and

distribution expenses and other costs. We may also be required to

recognize non-cash expenses in connection with certain securities

we may issue, such as convertible notes and warrants, which will

adversely impact our financial condition and results of operations.

Our ability to obtain needed financing may be impaired by such

factors as the weakness of capital markets, and the fact that we

have not been profitable, which could impact the availability and

cost of future financings. If the amount of capital we are able to

raise from financing activities, together with our revenues from

operations, is not sufficient to satisfy our capital needs, we may

have to reduce our operations accordingly.

We are dependent on our existing credit facility to finance our

operations and in the event of default, such default could

adversely affect our business, financial condition, results of

operations or liquidity.

We have

substantial indebtedness and have relied on our credit facilities

to provide working capital. As of March 31, 2019 and June 30, 2018,

we have an outstanding balance of $3,405,000 and $2,405,000,

respectively, under an Amended and Restated Credit Facility

Agreement dated March 28, 2019 (LOC) with Esenjay Investment, LLC

(Esenjay), a majority shareholder and a company owned and

controlled by Michael Johnson, a director, and Cleveland Capital,

L.P., our minority stockholder (Cleveland and Esenjay, together

with additional parties that may join as additional lenders,

collectively the Lenders). We currently have $3,595,000 available

for future draws. However, our ability to borrow under the LOC is

at the discretion of the Lenders. Also, the Lenders have no

obligation to disburse such funds and have the right not to advance

funds under the LOC. In addition, as a secured party, upon an event

of default, the Lenders will have a right to the collateral granted

to them under the line of credit, and we may lose our ownership

interest in the assets. A loss of our collateral will have material

adverse effect on our operations, our business and financial

condition.

Our independent auditors have expressed substantial doubt about our

ability to continue as a going concern.

In

their audit report issued in connection with our financial

statements for the year ended June 30, 2018, and for the years then

ended, our independent registered public accounting firm included a

going concern explanatory paragraph which stated there was

substantial doubt about our ability to continue as a going

concern. We have prepared our financial statements on a

going concern basis that contemplates the realization of assets and

the satisfaction of liabilities in the normal course of business

for the foreseeable future. Our financial statements do not include

any adjustments that would be necessary should we be unable to

continue as a going concern and, therefore, be required to

liquidate our assets and discharge our liabilities in other than

the normal course of business and at amounts different from those

reflected in our financial statements. If we are unable

to continue as a going concern, our stockholders may lose all or a

substantial portion or all of their investment.

We are dependent on a few customers for the majority of our net

revenues, and our success depends on demand from OEMs and other

users of our battery products.

Historically a

majority of our product sales were generated from a small number of

OEMs and end-user customers, including two customers who made up

77% of our sales for the year ended June 30, 2018. As a result, our

success depends on demand from this small group of customers and

their willingness to incorporate our battery products in their

equipment. The loss of a significant customer would have an adverse

effect on our revenues. There is no assurance that we will be

successful in our efforts to convince end users to accept our

products. Our failure to gain acceptance of our products could have

a material adverse effect on our financial condition and results of

operations.

Additionally, OEMs,

their dealers and battery distributors may be subject to changes in

demand for their equipment which could significantly affect our

business, financial condition and results of

operations.

We do not have long term

contracts with our customers.

We do

not have long-term contracts with our customers. Future agreements

with respect to pricing, returns, promotions, among other things,

are subject to periodic negotiation with each customer. No

assurance can be given that our customers will continue to do

business with us. The loss of any of our significant customers will

have a material adverse effect on our business, results of

operations, financial condition and liquidity. In addition, the

uncertainty of product orders can make it difficult to forecast our

sales and allocate our resources in a manner consistent with actual

sales, and our expense levels are based in part on our expectations

of future sales. If our expectations regarding future sales are

inaccurate, we may be unable to reduce costs in a timely manner to

adjust for sales shortfalls.

Real or perceived hazards associated with Lithium-ion battery

technology may affect demand for our products.

Press

reports have highlighted situations in which lithium-ion batteries

in automobiles and consumer products have caught fire or exploded.

In response, the use and transportation of lithium-ion batteries

has been prohibited or restricted in certain circumstances. This

publicity has resulted in a public perception that lithium-ion

batteries are dangerous and unpredictable. Although we believe our

battery packs are safe, these perceived hazards may result in

customer reluctance to adopt our lithium-ion based

technology.

Our products may experience quality problems from time to time that

could result in negative publicity, litigation, product recalls and

warranty claims, which could result in decreased revenues and harm

to our brands.

A

catastrophic failure of our battery modules could cause personal or

property damages for which we would be potentially liable. Damage

to or the failure of our battery packs to perform to customer

specifications could result in unexpected warranty expenses or

result in a product recall, which would be time consuming and

expensive. Such circumstances could result in negative publicity or

lawsuits filed against us related to the perceived quality of our

products which could harm our brand and decrease demand for our

products.

We may be subject to

product liability claims.

If one

of our products were to cause injury to someone or cause property

damage, including as a result of product malfunctions, defects, or

improper installation, then we could be exposed to product

liability claims. We could incur significant costs and liabilities

if we are sued and if damages are awarded against us. Further, any

product liability claim we face could be expensive to defend and

could divert management’s attention. The successful assertion

of a product liability claim against us could result in potentially

significant monetary damages, penalties or fines, subject us to

adverse publicity, damage our reputation and competitive position,

and adversely affect sales of our products. In addition, product

liability claims, injuries, defects, or other problems experienced

by other companies in the solar industry could lead to unfavorable

market conditions for the industry as a whole, and may have an

adverse effect on our ability to attract new customers, thus

harming our growth and financial performance. Although we carry

product liability insurance, it may be insufficient in amount to

cover our claims.

Tariffs that might be imposed on lithium-ion batteries by the

United States government or a resulting trade war could have a

material adverse effect on our results of operations.

In

2018, the United States government announced tariffs on certain

steel and aluminum products imported into the United States, which

has led to reciprocal tariffs being imposed by the European Union

and other governments on products imported from the United States.

The United States government has implemented tariffs on goods

imported from China, and additional tariffs on goods imported from

China are under consideration.

The

lithium-ion battery industry has not been subjected to tariffs

implemented by the United States government on goods imported from

China. If the U.S. and China are not able to resolve their

differences, new and additional tariffs may be put in place and

additional products, including lithium-ion batteries, may become

subject to tariffs. Since all of our lithium-ion batteries are

manufactured in China, potential tariffs on lithium-ion batteries

imported by us from China would increase our costs, require us to

increase prices to our customers or, if we are unable to do so,

result in lower gross margins on the products sold by

us.

The

President of the United States has, at times, threatened to

institute even wider ranging tariffs on all goods imported from

China. China has already imposed tariffs on a wide range of

American products in retaliation for the American tariffs on steel

and aluminum. Additional tariffs could be imposed by China in

response to actual or threatened tariffs on products imported from

China. The imposition of additional tariffs by the United States

could trigger the adoption of tariffs by other countries as well.

Any resulting escalation of trade tensions, including a

“trade war,” could have a significant adverse effect on

world trade and the world economy, as well as on our results of

operations. At this time, we cannot predict how the recently

enacted tariffs will impact our business. Tariffs on

components imported by us from China could have a material adverse

effect on our business and results of operations.

Economic conditions may adversely affect consumer spending and the

overall general health of our retail customers, which, in turn, may

adversely affect our financial condition, results of operations and

cash resources.

Uncertainty about

the existing and future global economic conditions may cause our

customers to defer purchases or cancel purchase orders for our

products in response to tighter credit, decreased cash availability

and weakened consumer confidence. Our financial success is

sensitive to changes in general economic conditions, both globally

and nationally. Recessionary economic cycles, higher interest

borrowing rates, higher fuel and other energy costs, inflation,

increases in commodity prices, higher levels of unemployment,

higher consumer debt levels, higher tax rates and other changes in

tax laws or other economic factors that may affect consumer

spending or buying habits could continue to adversely affect the

demand for our products. If credit pressures or other financial

difficulties result in insolvency for our customers it could

adversely impact our financial results. There can be no assurances

that government and consumer responses to the disruptions in the

financial markets will restore consumer confidence.

We are dependent on a limited number of suppliers for our battery

cells, and the inability of these suppliers to continue to deliver,

or their refusal to deliver, our battery cells at prices and

volumes acceptable to us would have a material adverse effect on

our business, prospects and operating results.

We do

not own or operate any manufacturing facilities. Our battery cells,

which are an integral part of our battery products and systems, are

sourced from one manufacturer, which is located in China and has

distribution in the United States. While we obtain components for

our products and systems from multiple sources whenever possible,

we have spent a great deal of time in developing and testing our

battery cells that we receive from this manufacturer. We refer to

the battery cell supplier as our limited source supplier. To date,

we have no qualified alternative sources for our battery cells

although we research and assess cells from other suppliers on an

ongoing basis. We generally do not maintain long-term agreements

with our limited source suppliers. While we believe that we will be

able to establish an additional supplier relationship for our

battery cells, we may be unable to do so in the short term or at

all at prices, quality or costs that are favorable to

us.

Changes

in business conditions, wars, regulatory requirements, economic

conditions and cycles, governmental changes and other factors

beyond our control could also affect our suppliers’ ability

to deliver components to us on a timely basis or cause us to terminate our

relationship with them and require us to find replacements, which

we may have difficulty doing. Furthermore, if we experience

significant increased demand, or need to replace our existing

suppliers, there can be no assurance that additional supplies of

component parts will be available when required on terms that are

favorable to us, at all, or that any supplier would allocate

sufficient supplies to us in order to meet our requirements or fill

our orders in a timely manner. In the past, we have replaced

certain suppliers because of their failure to provide components

that met our quality control standards. The loss of any limited

source supplier or the disruption in the supply of components from

these suppliers could lead to delays in the deliveries of our

battery products and systems to our customers, which could hurt our

relationships with our customers and also materially adversely

affect our business, prospects and operating results.

Increases in costs, disruption of supply or shortage of raw

materials, in particular lithium-ion phosphate cells, could harm

our business.

We may

experience increases in the costs or a sustained interruption in

the supply or shortage of raw materials. Any such increase or

supply interruption could materially negatively impact our

business, prospects, financial condition and operating results. For

instance, we are exposed to multiple risks relating to price

fluctuations for lithium-iron phosphate cells.

These

risks include:

●

the

inability or unwillingness of battery manufacturers to supply the

number of lithium-iron phosphate cells required to support our

sales as demand for such rechargeable battery cells

increases;

●

disruption

in the supply of cells due to quality issues or recalls by the

battery cell manufacturers; and

●

an

increase in the cost of raw materials, such as iron and phosphate,

used in lithium-iron phosphate cells.

Our

business may be subject to disruption as a result of the planned

relocation of our production facility.

We are

in the process of relocating and expanding our production facility.

We may experience disruption to our business as a result of that

relocation due to factors beyond our control. Any prolonged

business interruption may adversely affect our business, prospects

and operating results. If we fail to meet demand from our customers

due to insufficient production capacity or as a result of prolong

interruption to our business as a result of the relocation, our

business may be materially and adversely affected.

In

connection with the relocation and expanding of our production

facility, our new facility will have to be recertified for ISO 9001

compliance. We may be required to incur unforeseen costs or be

subject to unexpected delays in connection with obtaining such

certification.

Our success depends on our ability to develop new products and

capabilities that respond to customer demand, industry trends or

actions by our competitors and failure to do so may cause us to

lose our competitiveness in the battery industry and may cause our

profits to decline.

Our

success will depend on our ability to develop new products and

capabilities that respond to customer demand, industry trends or

actions by our competitors. There is no assurance that we will be

able to successfully develop new products and capabilities that

adequately respond to these forces. In addition, changes in

legislative, regulatory or industry requirements or in competitive

technologies may render certain of our products obsolete or less

attractive. If we are unable to offer products and capabilities

that satisfy customer demand, respond adequately to changes in

industry trends or legislative changes and maintain our competitive

position in our markets, our financial condition and results of

operations would be materially and adversely affected.

The

research and development of new products and technologies is costly

and time consuming, and there are no assurances that our research

and development of new products will be either successful or

completed within anticipated timeframes, if at all. Our failure to

technologically evolve and/or develop new or enhanced products may

cause us to lose competitiveness in the battery market. In

addition, in order to compete effectively in the renewable battery

industry, we must be able to launch new products to meet our

customers’ demands in a timely manner. However, we cannot

provide assurance that we will be able to install and certify any

equipment needed to produce new products in a timely manner, or

that the transitioning of our manufacturing facility and resources

to full production under any new product programs will not impact

production rates or other operational efficiency measures at our

manufacturing facility. In addition, new product introductions and

applications are risky, and may suffer from a lack of market

acceptance, delays in related product development and failure of

new products to operate properly. Any failure by us to successfully

launch new products, or a failure by our customers to accept such

products, could adversely affect our results.

Our business will be adversely affected if we are unable to protect

our intellectual property rights from unauthorized use or

infringement by third parties.

Any

failure to protect our proprietary rights adequately could result

in our competitors offering similar products, potentially resulting

in the loss of some of our competitive advantage and a decrease in

our revenue, which would adversely affect our business, prospects,

financial condition and operating results. Our success depends, at

least in part, on our ability to protect our core technology and

intellectual property. To accomplish this, we rely on a combination

of patents, patent applications, trade secrets, including know-how,

employee and third party nondisclosure agreements, copyright laws,

trademarks, intellectual property licenses and other contractual

rights to establish and protect our proprietary rights in our

technology.

The

protection provided by the patent laws is and will be important to

our future opportunities. However, such patents and agreements and

various other measures we take to protect our intellectual property

from use by others may not be effective for various reasons,

including the following:

●

the

patents we have been granted may be challenged, invalidated or

circumvented because of the pre-existence of similar patented or

unpatented intellectual property rights or for other

reasons;

●

the

costs associated with enforcing patents, confidentiality and

invention agreements or other intellectual property rights may make

aggressive enforcement impracticable; and

●

existing

and future competitors may independently develop similar technology

and/or duplicate our systems in a way that circumvents our

patents.

Our patent applications may not result in issued patents, which may

have a material adverse effect on our ability to prevent others

from commercially exploiting products similar to ours.

Our

patent applications may not result in issued patents, which may

have a material adverse effect on our ability to prevent others

from commercially exploiting products similar to ours.

We

cannot be certain that we are the first creator of inventions

covered by pending patent applications or the first to file patent

applications on these inventions, nor can we be certain that our

pending patent applications will result in issued patents or that

any of our issued patents will afford protection against a

competitor. In addition, patent applications that we intend to file

in foreign countries are subject to laws, rules and procedures that

differ from those of the United States, and thus we cannot be

certain that foreign patent applications related to issue United

States patents will be issued. Furthermore, if these patent

applications issue, some foreign countries provide significantly

less effective patent enforcement than in the United

States.

The

status of patents involves complex legal and factual questions and

the breadth of claims allowed is uncertain. As a result, we cannot

be certain that the patent applications that we file will result in

patents being issued, or that our patents and any patents that may

be issued to us in the near future will afford protection against

competitors with similar technology. In addition, patents issued to

us may be infringed upon or designed around by others and others

may obtain patents that we need to license or design around, either

of which would increase costs and may adversely affect our

business, prospects, financial condition and operating

results.

We rely on trade secret protections through confidentiality

agreements with our employees, customers and other parties; the

breach of such agreements could adversely affect our business and

results of operations.

We rely

on trade secrets, which we seek to protect, in part, through

confidentiality and non-disclosure agreements with our employees,

customers and other parties. There can be no assurance that these

agreements will not be breached, that we would have adequate

remedies for any such breach or that our trade secrets will not

otherwise become known to or independently developed by

competitors. To the extent that consultants, key employees or other

third parties apply technological information independently

developed by them or by others to our proposed projects, disputes

may arise as to the proprietary rights to such information that may

not be resolved in our favor. We may be involved from time to time

in litigation to determine the enforceability, scope and validity

of our proprietary rights. Any such litigation could result in

substantial cost and diversion of effort by our management and

technical personnel.

Our business depends substantially on the continuing efforts of the

members of our senior management team, and our business may be

severely disrupted if we lose their services.

We

believe that our success is largely dependent upon the continued

service of the members of our senior management team, who are

critical to establishing our corporate strategies and focus, and

ensuring our continued growth. We are a smaller company with a

limited number of personnel. Because of this dependence, the

Company may be more adversely affected by the loss of a member of

our senior management than at a larger company. Our continued

success will depend on our ability to attract and retain a

qualified and competent management team in order to manage our

existing operations and support our expansion plans. Although we

are not aware of any change, if any of the members of our senior

management team are unable or unwilling to continue in their

present positions, we may not be able to replace them readily.

Therefore, our business may be severely disrupted, and we may incur

additional expenses to recruit and retain their replacement. In

addition, if any of the members of our senior management team joins

a competitor or forms a competing company, we may lose some of our

customers.

We may be required to obtain the approval of various government

agencies to market our products.

Our

products are subject to product safety regulations by Federal,

state, and local organizations. Accordingly, we may be required, or

may voluntarily determine to, obtain approval of our products from

one or more of the organizations engaged in regulating product

safety. These approvals could require significant time and

resources from our technical staff, and, if redesign were

necessary, could result in a delay in the introduction of our

products in various markets and applications. There can be no

assurance that we will obtain any or all of the approvals that may

be required to market our products.

We may face significant costs relating to environmental regulations

for the storage and shipment of our lithium-ion battery

packs.

Federal, state, and

local regulations impose significant environmental requirements on

the manufacture, storage, transportation, and disposal of various

components of advanced energy storage systems. Although we believe

that our operations are in material compliance with applicable

environmental regulations, there can be no assurance that changes

in such laws and regulations will not impose costly compliance

requirements on us or otherwise subject us to future liabilities.

Moreover, Federal, state, and local governments may enact

additional regulations relating to the manufacture, storage,

transportation, and disposal of components of advanced energy

storage systems. Compliance with such additional regulations could

require us to devote significant time and resources and could

adversely affect demand for our products. There can be no assurance

that additional or modified regulations relating to the

manufacture, storage, transportation, and disposal of components of

advanced energy systems will not be imposed.

Natural disasters, public health crises, political crises and other

catastrophic events or other events outside of our control may

damage our sole facility or the facilities of third parties on

which we depend, and could impact consumer spending.

Our

sole production facility is located in southern California near

major geologic faults that have experienced earthquakes in the

past. An earthquake or other natural disaster or power shortages or

outages could disrupt our operations or impair critical systems.

Any of these disruptions or other events outside of our control

could affect our business negatively, harming our operating

results. In addition, if our sole facility, or the facilities of

our suppliers, third-party service providers or customers, is

affected by natural disasters, such as earthquakes, tsunamis, power

shortages or outages, floods or monsoons, public health crises,

such as pandemics and epidemics, political crises, such as

terrorism, war, political instability or other conflict, or other

events outside of our control, our business and operating results

could suffer. Moreover, these types of events could negatively

impact consumer spending in the impacted regions or, depending upon

the severity, globally, which could adversely impact our operating

results. Similar disasters occurring at our vendors’

manufacturing facilities could impact our reputation and our

consumers’ perception of our brands.

Risks

Related to the Offering, Our Common Stock and Market

If you purchase shares of common stock in this offering, you will

suffer immediate and substantial dilution of your

investment.

Because

the public offering price per share of our common stock in this

offering is expected to exceed the net tangible book value per

share of our common stock, you will suffer immediate and

substantial dilution in the net tangible book value of the common

stock you purchase in this offering. Therefore, if you purchase

shares of our common stock in this offering, you may pay a price

per share that substantially exceeds our net tangible book value

per share after this offering. Assuming the sale of shares of our

common stock at a public offering price of $per share, the closing

bid price of our common stock on the OTCQB on , 2019, after

deducting the underwriting discount and estimated offering expenses

payable by us, you will incur immediate dilution of $per share. See

the section entitled “Dilution” below for a more

detailed discussion of the dilution you will incur if you

participate in this offering. To the extent shares are issued under

outstanding options and warrants at exercise prices lower than the

public offering price of our common stock in this offering, you

will incur further dilution.

You may experience future dilution as a result of future equity

offerings.

In

order to raise additional capital, we may at any time offer

additional shares of our common stock or other securities

convertible into or exchangeable for our common stock at prices

that may not be the same as the price per share in this offering.

We may sell shares or other securities in any other offering at a

price per share that is less than the public offering price per

share in this offering, and investors purchasing shares or other

securities in the future could have rights superior to existing

stockholders. The price per share at which we sell additional

shares of our common stock, or securities convertible or

exchangeable into common stock, in future transactions may be

higher or lower than the public offering price per share paid by

investors in this offering.

We have broad discretion in the use of our cash and cash

equivalents, including the net proceeds we receive in this

offering, and may not use them effectively.

Our

management has broad discretion to use our cash and cash

equivalents, including the net proceeds we receive in this

offering, to fund our operations and could spend these funds in

ways that do not improve our results of operations or enhance the

value of our common stock, and you will not have the opportunity as

part of your investment decision to assess whether the net proceeds

are being used appropriately. The failure by our management to

apply these funds effectively could result in financial losses that

could have a material adverse effect on our business, cause the

price of our common stock to decline. Pending their use to fund our

operations, we may invest our cash and cash equivalents, including

the net proceeds from this offering, in a manner that does not

produce income or that loses value.

The market price of our common stock can become volatile, leading

to the possibility of its value being depressed at a time when you

may want to sell your holdings.

The

market price of our common stock can become volatile. Numerous

factors, many of which are beyond our control, may cause the market

price of our common stock to fluctuate significantly. These factors

include:

●

our

earnings releases, actual or anticipated changes in our earnings,

fluctuations in our operating results or our failure to meet the

expectations of financial market analysts and

investors;

●

changes

in financial estimates by us or by any securities analysts who

might cover our stock;

●

speculation

about our business in the press or the investment

community;

●

significant

developments relating to our relationships with our customers or

suppliers;

●

stock

market price and volume fluctuations of other publicly traded

companies and, in particular, those that are in our

industry;

●

limited

“public float” in the hands of a small number of

persons whose sales or lack of sales could result in positive or

negative pricing pressure on the market price for our common

stock;

●

customer

demand for our products;

●

investor

perceptions of our industry in general and our Company in

particular;

●

general

economic conditions and trends;

●

announcements

by us or our competitors of new products, significant acquisitions,

strategic partnerships or divestitures;

●

changes

in accounting standards, policies, guidance, interpretation or

principles;

●

loss

of external funding sources;

●

sales

of our common stock, including sales by our directors, officers or

significant stockholders; and

●

additions

or departures of key personnel.

The ownership of our stock is highly concentrated in our

management, and we have one controlling stockholder.

As of

April 30, 2019, our directors and executive officers, and their

respective affiliates beneficially owned approximately 65.6% of our

outstanding common stock, including common stock underlying

options, warrants and convertible debt that were exercisable or

convertible or which would become exercisable or convertible within

60 days. Michael Johnson, our director and beneficial owner

of Esenjay, beneficially owns approximately 61.4% of such

outstanding common stock. As a result of their ownership, our

directors and executive officers and their respective affiliates

collectively, and Esenjay, individually, are able to significantly

influence all matters requiring stockholder approval, including the

election of directors and approval of significant corporate

transactions. This concentration of ownership may also

have the effect of delaying or preventing a change in

control.

We do not intend to pay dividends on shares of our common stock for

the foreseeable future.

We have

never declared or paid any cash dividends on shares of our common

stock. We intend to retain any future earnings to fund the

operation and expansion of our business and, therefore, we do not

anticipate paying cash dividends on shares of our common stock in

the foreseeable future.

Our common stock is illiquid and the lack of liquidity may

adversely affect the trading price of our common

stock.

The

trading volume of our common stock is relatively small. Because of

the lack of liquidity in our common stock, small fluctuations in

the demand for our common stock may have significant impact on the

trading price of our common stock. The lack of liquidity may impact

your ability to sell your shares of common stock at an acceptable

price, if at all.

Preferred Stock may be issued under our Articles of Incorporation

which may have superior rights to our common stock.

Our

Articles of Incorporation authorize the issuance of up to 5,000,000

shares of preferred stock. The preferred stock may be issued in one

or more series, the terms of which may be determined at the time of

issuance. These terms may include voting rights including the right

to vote as a series on particular matters, preferences as to

dividends and liquidation, conversion rights, redemption rights and

sinking fund provisions. In addition, these voting, conversion and

exchange rights of preferred stock could negatively affect the

voting power or other rights of our common stockholders. The

issuance of any preferred stock could diminish the rights of

holders of our common stock, or delay or prevent a change of

control of our Company, and therefore could reduce the value of

such common stock.

SPECIAL NOTE REGARDING FORWARD LOOKING

STATEMENTS

This

prospectus contains forward-looking statements. The forward-looking

statements are contained principally in the sections entitled

“Description of Business,” “Risk Factors,”

and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” These statements

involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to

be materially different from any future results, performances or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the factors described in the section captioned

“Risk Factors” below. In some cases, you can identify

forward-looking statements by terms such as

“anticipates,” “believes,”

“could,” “estimates,”

“expects,” “intends,” “may,”

“plans,” “potential,”

“predicts,” “projects,”

“should,” “would,” and similar expressions

intended to identify forward-looking statements. Forward-looking

statements reflect our current views with respect to future events

and are based on assumptions and subject to risks and

uncertainties. You should read these factors and the other

cautionary statements made in this prospectus and in the documents

we incorporate by reference into this prospectus as being

applicable to all related forward-looking statements wherever they

appear in this prospectus or the documents we incorporate by

reference into this prospectus. If one or more of these factors

materialize, or if any underlying assumptions prove incorrect, our

actual results, performance or achievements may vary materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements.

Given

these uncertainties, you should not place undue reliance on these

forward-looking statements. These forward-looking statements

include, among other things, statements relating to:

●

our

ability to secure sufficient funding and alternative source of

funding to support our existing and proposed

operations;

●

our

anticipated growth strategies and our ability to manage the

expansion of our business operations effectively;

●

our

ability to maintain or increase our market share in the competitive

markets in which we do business;

●

our

ability to keep up with rapidly changing technologies and evolving

industry standards, including our ability to achieve technological

advances;

●

our

dependence on the growth in demand for our products;

●

our

ability to diversify our product offerings and capture new market

opportunities;

●

our

ability to source our needs for skilled labor, machinery, parts,

and raw materials economically; and

●

the

loss of key members of our senior management.

Also,

forward-looking statements represent our estimates and assumptions

only as of the date of this prospectus. You should read this

prospectus and the documents that we reference and file as exhibits

to this prospectus completely and with the understanding that our

actual future results may be materially different from what we

expect. Except as required by law, we assume no obligation to

update any forward-looking statements publicly, or to update the

reasons actual results could differ materially from those

anticipated in any forward-looking statements, even if new

information becomes available in the future.

We

obtained statistical data, market data and other industry data and

forecasts used throughout this Prospectus from market research,

publicly available information and industry publications which we

believe are reliable. However, investors should not place undue

reliance on such information.

Unless

otherwise indicated, information contained in this prospectus

concerning our industry and the markets in which we operate is

based on information obtained by us from various sources, including

independent industry publications, which we believe to be reliable.

In presenting this information, we have also made assumptions based

on such data and other similar sources, and on our knowledge of,

and our experience to date in, the potential markets for our

products. The industry in which we operate is subject to a high

degree of uncertainty and risk due to a variety of factors,

including those described in the section entitled “Risk

Factors.” Accordingly, investors should not unduly rely on

such estimates.

We estimate that the net proceeds from this offering will be

approximately $ ($ if the underwriters exercise their

over-allotment option in full), after deducting the underwriting

discount and estimated offering expenses payable by

us.

We intend to use the net proceeds of this offering for working

capital and general corporate purposes. We will retain broad

discretion over the use of the net proceeds of this offering.

Pending such use, we intend to invest the net proceeds in

interest-bearing investment-grade securities or government

securities.

Our

common stock is quoted on the OTCQB under the stock symbol

“FLUX.” The following table sets forth the high and low

closing bid prices for our common stock during each quarter for the

past two fiscal years and the current fiscal year as set forth

below. The information presented below has been adjusted

retroactively to reflect the 1 for 10 reverse stock split of our

common stock, effective August 10, 2017. Such prices reflect

inter-dealer prices, without retail mark-up, mark-down or

commission and may not necessarily represent actual

transactions.

Year

Ending June 30, 2019

|

|

|

|

First

Quarter

|

$3.20

|

$1.40

|

|

Second

Quarter

|

$2.35

|

$1.01

|

|

Third

Quarter

|

$1.85

|

$1.12

|

|

Fourth Quarter

(through May 23, 2019)

|

$1.60

|

$0.80

|

|

|

|

|

|

First

Quarter

|

$1.00

|

$0.39

|

|

Second

Quarter

|

$0.63

|

$0.14

|

|

Third

Quarter

|

$0.52

|

$0.35

|

|

Fourth

Quarter

|

$3.35

|

$0.44

|

|

|

|

|

|

First

Quarter

|

$0.50

|

$0.38

|

|

Second

Quarter

|

$0.42

|

$0.15

|

|

Third

Quarter

|

$0.55

|

$0.33

|

|

Fourth

Quarter

|

$0.50

|

$0.24

|

Holders of Common Stock

As of

April 30, 2019, we had approximately 1,400 record holders of our

common stock, based on information provided by our transfer agent.

The foregoing number of record holders does not include an unknown

number of stockholders who hold their stock in “street

name.”

Dividend Policy

We have

never declared or paid any cash dividends. We presently do not

expect to declare or pay such dividends in the foreseeable future

and expect to reinvest all undistributed earnings to expand our

operations, which the management believes would be of the most

benefit to our stockholders. The declaration of dividends, if any,

will be subject to the discretion of our Board of Directors, which

may consider such factors as our results of operations, financial

condition, capital needs and acquisition strategy, among others.

Therefore, there can be no assurance that any dividends on our

common stock will ever be paid.

Equity

Compensation Plan Information

Information for our

equity compensation plans in effect as of June 30, 2018 is as

follows:

|

|

|

|

|

|

|

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column a)

|

|

Equity

compensation plans approved by security holders(1)

|

3,165,000

|

0.76

|

6,835,000

|

Equity

compensation plans not approved by security holders(2)

|

379,000

|

1.43

|

-