UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FLUX

POWER HOLDINGS, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: N/A | |

| (2) Aggregate number of securities to which transaction applies: N/A | |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A | |

| (4) Proposed maximum aggregate value of transaction: N/A | |

| Total fee paid: N/A | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. |

| (1) Amount Previously Paid: N/A | |

| (2) Form, Schedule or Registration Statement No.: N/A | |

| (3) Filing Party: N/A | |

| (4) Date filed: N/A |

March 14, 2022

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Flux Power Holdings, Inc., or Annual Meeting. We will be conducting the 2022 Annual Meeting as a virtual meeting. The virtual meeting format will allow for greater participation by all of our stockholders, regardless of their geographic location. The Annual Meeting will be held at 10:00 a.m. Pacific Standard Time, on Thursday, April 28, 2022 via a live webcast on the internet.

You may attend the Annual Meeting, submit questions, and vote via the Internet at the following website address: https://agm.issuerdirect.com/flux by entering the 16-digit control number included on your Notice of Internet Availability, your proxy card or in the instructions that accompanied your proxy materials.

The matters expected to be acted upon at the Annual Meeting are listed in the Notice of Annual Meeting of Stockholders and more fully described in the accompanying proxy statement. We have also made available our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, which contains important business and financial information regarding the Company.

Thank you for your continuing support.

| Sincerely, | |

| /s/ Ronald F. Dutt | |

| Ronald F. Dutt | |

Executive Chairman, Chief Executive Officer and President |

YOUR VOTE IS IMPORTANT

Your vote is important. As described in your electronic proxy materials notice or on the enclosed paper proxy card and voting instructions, please vote by: (1) accessing the internet website, (2) calling the toll-free number, or (3) signing and dating the proxy card as promptly as possible and returning it by mail if voting and delivering by mail. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend online.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON APRIL 28, 2022: THE PROXY STATEMENT, PROXY CARD AND ANNUAL REPORT ARE AVAILABLE AT www.iproxydirect.com/FLUX

2685 S. Melrose Drive

Vista, California 92081

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on THURSDAY, April 28, 2022

| Time and Date: | Thursday, April 28, 2022 at 10:00 a.m. Pacific Standard Time |

| Place: | Virtually online at https://agm.issuerdirect.com/flux |

| Items of Business: | The foregoing items of business as more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders. |

| 1. | To elect five (5) persons to the board of directors of the Company, each to serve until the next annual meeting of stockholders of the Company or until such person shall resign, be removed or otherwise leave office; | |

| 2. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022; and | |

| 3. | To conduct any other business properly brought before the Annual Meeting. |

| Record Date: | The record date for the Annual Meeting is March 3, 2022. Stockholders owning the Company’s common stock at the close of business on the record date, or their legal proxy holders, are entitled to vote at the Annual Meeting. |

| Voting: | Each share of common stock that you own represents one vote. |

| Transfer Agent: | For questions regarding your stock ownership, you may contact us at (877) 505-3589 or contact our transfer agent, Issuer Direct Corporation, through its website at www.issuerdirect.com or by phone at (801) 272-9294. |

This notice of the Annual Meeting, proxy statement, form of proxy and our Annual Report on Form 10-K are

being distributed or made available on or about March 14, 2022.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote or submit your proxy via the internet, or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

| Date: March 14, 2022 | By Order of the Board of Directors |

| /s/ Ronald F. Dutt | |

| Ronald F. Dutt | |

| Executive Chairman, Chief Executive Officer and President |

FLUX POWER HOLDINGS, INC.

PROXY STATEMENT FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| i |

2685 S. Melrose Drive

Vista, California 92081

PROXY STATEMENT

2022 ANNUAL MEETING OF STOCKHOLDERS

GENERAL

This proxy statement is furnished to stockholders of Flux Power Holdings, Inc., a Nevada corporation (the “Company”), in connection with the solicitation of proxies for use at the 2022 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held virtually https://agm.issuerdirect.com/flux on Thursday, April 28, 2022 at 10:00 a.m. Pacific Standard Time. This year’s Annual Meeting will be held in a virtual-only meeting format. This solicitation of proxies is made on behalf of our board of directors. Capitalized terms used, but not defined, herein will have the meanings ascribed to them in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 (the “Annual Report”).

Important

Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be Held on Thursday, April 28, 2022

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Internet Availability of Proxy Materials (the “Internet Notice”) to our stockholders of record on March 3, 2022. We are also sending a paper copy of the proxy materials and proxy card to other stockholders of record who have indicated they prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Internet Notice. Such Internet Notice, or this proxy statement and proxy card or voting instruction form, as applicable, is being mailed to our stockholders on or about March 14, 2022.

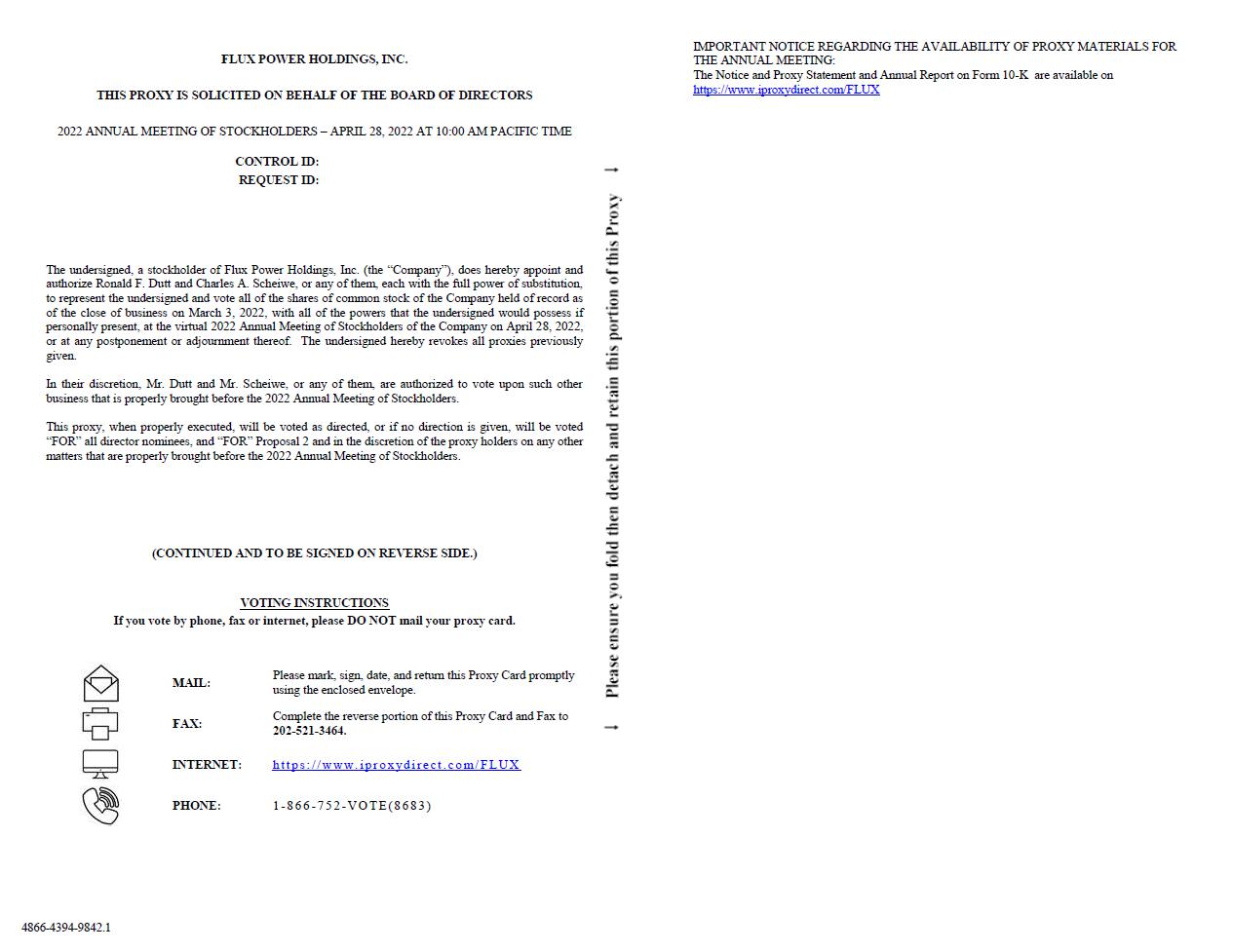

Stockholders will have the ability to access the proxy materials or may request to receive a paper copy of the proxy materials by mail on a one-time or ongoing basis at www.iproxydirect.com/FLUX, or call (866) 752-VOTE (8683), or fax request to (202) 521-3464 or send email to proxy@issuerdirect.com.

The Internet Notice will also identify the date, the time and location of the Annual Meeting; the matters to be acted upon at the meeting and the board of directors’ recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request to receive, free of charge, a paper or e-mail copy of this proxy statement, our Annual Report and a form of proxy relating to the Annual Meeting; information on how to access and vote the form of proxy; and information on how to obtain instructions to attend the virtual meeting and vote in person at the virtual meeting, should stockholders choose to do so.

| 2 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

IF I RECEIVED AN INTERNET NOTICE, WILL I RECEIVE ANY PROXY MATERIALS BY MAIL OTHER THAN THE INTERNET NOTICE?

No. If you received an Internet Notice, you will not receive any other proxy materials by mail unless you request a paper or electronic copy of the proxy materials. To request that a full set of the proxy materials be sent to your specified postal or email address, please go to www.iproxydirect.com/FLUX or call (866) 752-VOTE (8683), or fax request to (202) 521-3464 or send email to proxy@issuerdirect.com.

HOW DO I ATTEND THE VIRTUAL MEETING?

This year our Annual Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted online. To participate in the virtual meeting, visit https://agm.issuerdirect.com/flux (“Annual Meeting Website”) and enter the control number included on your Internet Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten (10) days prior to the Annual Meeting for any purpose germane to the meeting at our corporate headquarters at 2685 S. Melrose Drive, Vista, California 92081. The stockholder list will also be available to registered stockholders during the Annual Meeting upon written request submitted by the registered stockholder at the Annual Meeting Website.

To participate in the Annual Meeting, you will need the 16-digit control number found on your Internet Notice, your proxy card or the instructions that accompany your proxy materials. If your shares are held in the name of a bank, broker or other holder of record, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the Annual Meeting.

WILL I BE ABLE TO ASK QUESTIONS AT THE MEETING?

You will be able to submit written questions during the Annual Meeting by following the instructions that will be available on the Annual Meeting Website during the Annual Meeting. Only questions pertinent to meeting matters or the Company will be answered during the meeting, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition.

WHAT AM I VOTING ON?

At the Annual Meeting, stockholders will be asked to take action on the following matters:

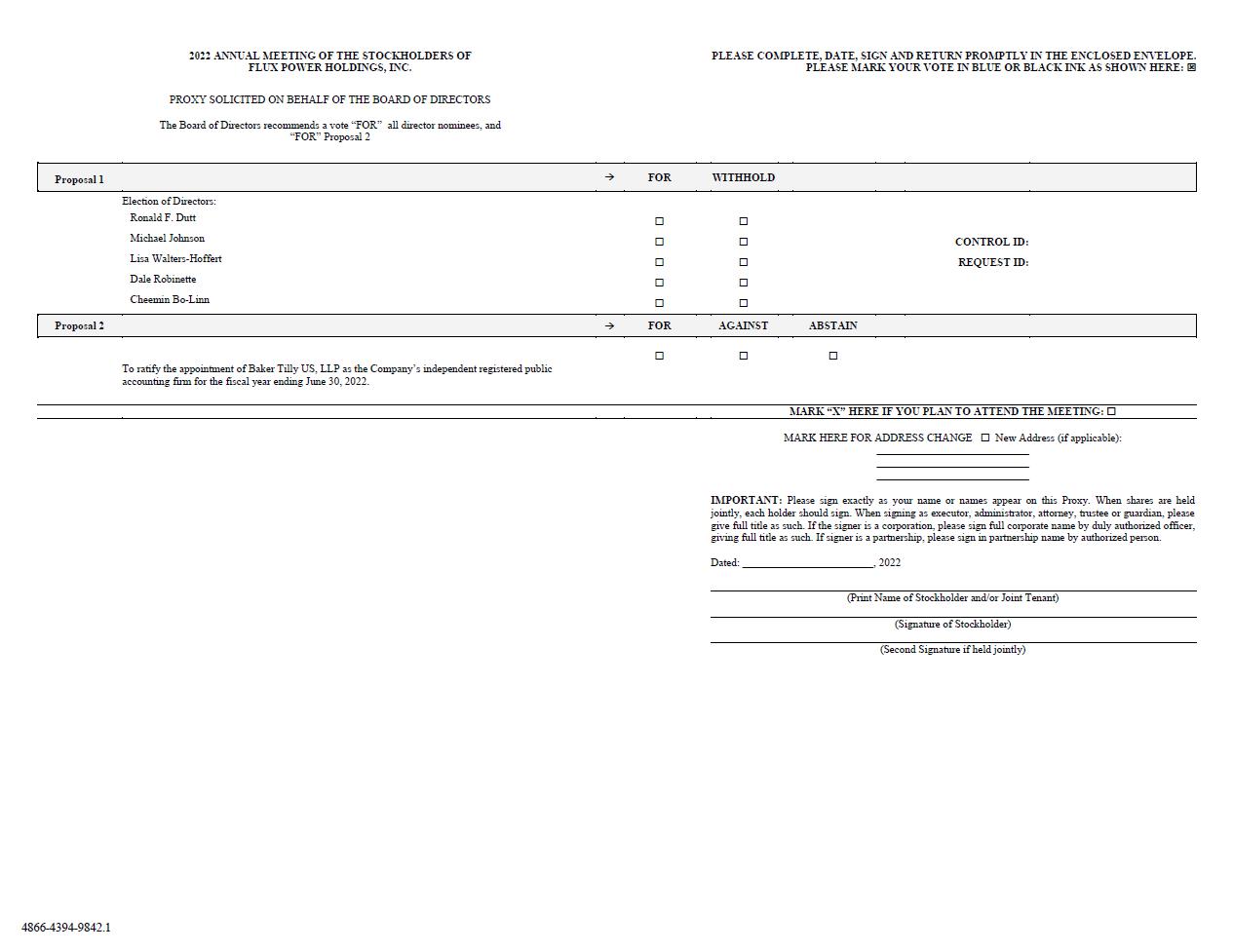

| 1. | To elect five (5) persons to the board of directors of the Company, each to serve until the next annual meeting of stockholders of the Company or until such person shall resign, be removed or otherwise leaves office; | |

| 2. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022; and | |

| 3. | To conduct any other business properly brought before the Annual Meeting. |

| 3 |

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Only holders of record of our common stock at the close of business on March 3, 2022 (the “Record Date”) will receive notice of, and be entitled to vote at, our Annual Meeting. At the close of business on the Record Date 15,992,080 shares of common stock, par value $0.001 per share, were outstanding and entitled to vote. Our common stock is our only class of outstanding voting securities.

Each share of our common stock as of the close of business on the Record Date is entitled to one vote on each matter presented at the Annual Meeting. There is no cumulative voting.

| ● | Stockholder of Record: Shares Registered in Your Name. If, on March 3, 2022, your shares were registered directly in your name with our transfer agent, Issuer Direct Corporation, then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. | |

| ● | Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Agent. If, on March 3, 2022, your shares were held not in your name, but rather in an account at a bank, brokerage firm, or other agent or nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your bank, broker or other agent or nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting or by proxy unless you request and obtain a power of attorney or other proxy authority from your bank, broker or other agent or nominee. |

WHAT CONSTITUTES A QUORUM FOR THE ANNUAL MEETING?

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of at least a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. On the Record Date, there were 15,992,080 shares of common stock outstanding and entitled to vote. At least 7,996,041 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

HOW ARE VOTES COUNTED AND HOW ARE BROKER NON−VOTES TREATED?

Votes will be counted by the inspector of election appointed for the Annual Meeting who will separately count “For” votes, “Against” votes, abstentions, withheld votes and broker non-votes. Votes withheld, broker non-votes and abstentions are deemed as “present” at the Annual Meeting and are counted for quorum purposes.

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our board of directors on all matters and as the proxy holder may determine in his/her discretion with respect to any other matters properly presented for a vote before the Annual Meeting.

If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 2 - Ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm is commonly considered as a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 2 If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 - Election of Directors. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

| 4 |

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

| ● | Proposal 1 - the election of five (5) directors, requires a plurality of the votes cast to elect a director. The five (5) nominees receiving the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Only votes “FOR” will affect the outcome. Withheld votes or broker non-votes will not affect the outcome of the vote on Proposal 1. | |

| ● | Proposal 2- the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. |

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the Annual Meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the Annual Meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the Annual Meeting.

WHO CONDUCTS THE PROXY SOLICITATION AND HOW MUCH DOES IT COST?

We are soliciting the proxies and will bear the entire cost of this solicitation, including the preparation, assembly, printing and mailing of this proxy statement and any additional materials furnished to our stockholders. Copies of solicitation material will be furnished to banks, brokerage houses and other agents holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to these beneficial owners. In addition, if asked, we will reimburse these persons for their reasonable expenses in forwarding the solicitation material to the beneficial owners. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. The original solicitation of proxies by mail may be supplemented by telephone, fax, Internet and personal solicitation by our directors, officers or other employees. Directors, officers and employees will not be paid any additional compensation for soliciting proxies.

| 5 |

HOW CAN I VOTE?

If you are a stockholder of record, you may:

| ● | VOTE AT THE ANNUAL MEETING - if you would like to vote at the Annual Meeting, please follow the instructions that will be available at https://agm.issuerdirect.com/flux during the Annual Meeting; | |

| ● | VOTE BY MAIL IN ADVANCE OF THE ANNUAL MEETING - if you request a paper proxy card, complete, sign and date the enclosed proxy card, then follow the instructions on the card: or | |

| ● | VOTE VIA THE INTERNET OR VIA TELEPHONE IN ADVANCE OF THE ANNUAL MEETING - if you would like to vote in advance of the Annual Meeting by phone please call 1(866) 752-VOTE (8683) or follow the instructions on the proxy card and have the proxy card available when you access the internet website or place your telephone call. |

If you submit your vote by fax or mail, your completed, signed and dated proxy card must be received prior to the Annual Meeting. Submitting your proxy, whether via the internet, via telephone or by mail if you requested a paper proxy card, will not affect your right to vote at the Annual Meeting should you decide to attend the meeting.

If you are not a stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE?

If you receive more than one Internet Notice or proxy card from us or your bank, this usually means that your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card via the internet, telephone or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

How Your Shares Will Be Voted

Shares represented by proxies that are properly executed and returned, and not revoked, will be voted as specified. If you sign a proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you hold your shares in street name and do not vote, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

| 6 |

HAS THE BOARD OF DIRECTORS MADE A RECOMMENDATION REGARDING THE MATTERS TO BE ACTED UPON AT THE ANNUAL MEETING?

Yes. Our board of directors recommends that you cast your vote:

| 1. | “FOR” the election of the five nominees for directors named in this proxy statement; and | |

| 2. | “FOR” the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022. |

CAN I CHANGE MY VOTE OR REVOKE MY VOTE IF I VOTE BY PROXY?

Yes. As a stockholder of record, if you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You may revoke your proxy by doing any of the following:

| 1. | Delivering a written notice that you are revoking your proxy to our Corporate Secretary at the address indicated below prior to the Annual Meeting. | |

| 2. | Signing and delivering another properly completed proxy card with a later date pursuant instructions on the proxy card. | |

| 3. | Voting again via internet or by telephone no later than 10 a.m. Pacific Time on April 28, 2022. | |

| 4. | Attending the Annual Meeting and vote at the meeting. Simply attending the meeting will not, by itself, revoke your proxy. |

Any written notice of revocation should be delivered to:

| Flux Power Holdings, Inc. | |

| Attn: Charles A. Scheiwe, Corporate Secretary | |

| 2685 S. Melrose Drive | |

| Vista, California 92081 |

If your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE ANNUAL MEETING?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our Current Report on Form 8-K within four (4) business days following the Annual Meeting.

ARE THERE ANY Interest of Officers and Directors in Matters to Be Acted Upon?

None of the Company’s officers or directors has any interest in any of the matters to be acted upon, except to the extent that a director is named as a nominee for election to the board of directors or a director.

| 7 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to all of our directors, officers, and employees. Any waivers of any provision of this Code for our directors or officers may be granted only by our board of directors, or also Board, or a committee appointed by our board of directors.

We have filed a copy of the Code with the SEC and have made it available on our website at https://www.fluxpower.com/corporate-governance. In addition, we will provide any person, without charge, a copy of this Code. Requests for a copy of the Code may be made by writing to the Company at c/o Corporate Secretary, Flux Power Holdings, Inc., 2685 S. Melrose Drive, Vista, California 92081. We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code by posting such information on our website.

Board Leadership Structure and Role in Risk Oversight

Our Board of Directors (“Board”) recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to provide independent oversight of management. Our Board is currently led by a Chairman of the Board who also serves as our Chief Executive Officer. The Board understands that the right Board leadership structure may vary depending on the circumstances, and our independent directors periodically assess these roles and the Board leadership to ensure the leadership structure best serves the interests of the Company and stockholders.

On September 10, 2021, the Board adopted the Lead Independent Director Guidelines (“Guidelines.). The Guidelines provide that when the positions of Chief Executive Officer and Chairman of the Board are combined or the Chairman is not an independent director, the independent directors will appoint a lead independent director to serve with the authority and responsibility described in these Guidelines, and as the Board and/or the independent directors may determine from time to time. The Guidelines are available on our website at www.fluxpower.com.

Mr. Dutt currently holds the Chairman and Chief Executive Officer roles. Mr. Robinette currently serves as the Lead Independent Director elected by the majority of the Board on September 10, 2021. The responsibilities of the Lead Independent Director include, among others: (i) serving as primary intermediary between non-employee directors and management; (ii) working with the Chairman of the Board to approve the agenda and meeting schedules for the Board; (iii) working with the Chairman of the Board as to the quality, quantity and timeliness of the information provided to directors; (iv) in consultation with the Nominating and Governance Committee reviewing and reporting on the results of the Board and Committee performance self-evaluations; (v) calling additional meetings of independent directors; and (vi) serving as liaison for consultation and communication with stockholders.

We believe the current leadership structure, with combined Chairman and Chief Executive Officer roles and a Lead Independent Director, best serves the Company and its stockholders at this time. Mr. Robinette possesses understanding and knowledge of the business and affairs of the Company and has the ability to devote a substantial amount of time to serve in this capacity. In addition, we believe having one leader serving as both the Chairman and Chief Executive Officer provides decisive, consistent and effective leadership, as well as clear accountability to our stockholders and customers. This enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and suppliers. The Board believes the appointment of a strong Lead Independent Director and the use of regular executive sessions of the non-management directors, along with a majority the Board being composed of independent directors, allow it to maintain effective oversight of management. We believe that the combination of the Chairman and Chief Executive Officer roles is appropriate in the current circumstances and, based on the relevant facts and circumstances, separation of these offices would not serve our best interests and the best interests of our stockholders at this time.

In addition, our Board as a whole has responsibility for risk oversight. Our Board exercises this risk oversight responsibility directly and through its committees. The risk oversight responsibility of our Board and its committees is informed by reports from our management teams to provide visibility to our Board about the identification, assessment and management of key risks, and our management’s risk mitigation strategies. Our Board has primary responsibility for evaluating strategic and operational risk, including related to significant transactions. Our audit committee has primary responsibility for overseeing our major financial and accounting risk exposures, and, among other things, discusses guidelines and policies with respect to assessing and managing risk with management and our independent auditor. Our compensation committee has responsibility for evaluating risks arising from our compensation and people policies and practices. Our nominating and corporate governance committee has responsibility for evaluating risks relating to our corporate governance practices. Our committees and management provide reports to our Board on these matters.

In its governance role, and particularly in exercising its duty of care and diligence, our Board is responsible for ensuring that appropriate risk management policies and procedures are in place to protect the Company’s assets and business. Our Board has broad and ultimate oversight responsibility for our risk management processes and programs and executive management is responsible for the day-to-day evaluation and management of risks to the Company.

Board Composition, Committees and Independence

Under the rules of NASDAQ, “independent” directors must make up a majority of a listed company’s Board of Directors. In addition, applicable NASDAQ rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent within the meaning of the applicable NASDAQ rules. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act.

Our Board has undertaken a review of the independence of each director and considered whether any director has a material relationship with us that could compromise the director’s ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board determined that Ms. Walters-Hoffert, Dr. Bo-Linn, and Mr. Robinette are independent directors as defined in the listing standards of NASDAQ and SEC rules and regulations. A majority of our directors are independent, as required under applicable NASDAQ rules. As required under applicable NASDAQ rules, our independent directors will meet in regularly scheduled executive sessions at which only independent directors are present.

| 8 |

Board Committees

Our Board has established an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. The composition and responsibilities of each of the committees is described below.

Audit Committee

Audit Committee. The Audit Committee of the Board of Directors currently consists of three independent directors of which at least one, the Chairperson of the Audit Committee, qualifies as a qualified financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Ms. Walters-Hoffert is the Chairperson of the Audit Committee and financial expert. Dr. Bo-Linn and Mr. Robinette are the other directors who are members of the Audit Committee. The Audit Committee’s duties are to recommend to our Board of Directors the engagement of the independent registered public accounting firm to audit our consolidated financial statements and to review our accounting and auditing principles. The Audit Committee reviews the scope, timing and fees for the annual audit and the results of audit examinations performed by any internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. The Audit Committee will at all times be composed exclusively of directors who are, in the opinion of our Board of Directors, free from any relationship that would interfere with the exercise of independent judgment as a committee member and who possess an understanding of consolidated financial statements and generally accepted accounting principles. Our Audit Committee operates under a written charter, which is available on our website at www.fluxpower.com.

Compensation Committee

Compensation Committee. The Compensation Committee currently consists of three independent directors. The Compensation Committee establishes our executive compensation policy, determines the salary and bonuses of our executive officers and recommends to the Board stock option grants or other incentive equity awards for our executive officers. Mr. Robinette is the Chairperson of the Compensation Committee, and Ms. Walters-Hoffert and Dr. Bo-Linn are also members of the Compensation Committee. Each of the members of our Compensation Committee are independent under NASDAQ’s independence standards for compensation committee members. Our chief executive officer often makes recommendations to the Compensation Committee and the Board concerning compensation of other executive officers. The Compensation Committee seeks input on certain compensation policies from the chief executive officer. Our Compensation Committee operates under a written charter, which is available on our website at www.fluxpower.com.

Nominating and Governance Committee

Nominating and Governance Committee. The Nominating and Governance Committee currently consists of three independent directors. The Nominating and Governance Committee is responsible for matters relating to the corporate governance of our Company and the nomination of members of the Board and committees of the Board. Dr. Bo-Linn is the Chairperson of the Nominating and Governance Committee. Ms. Walters-Hoffert and Mr. Robinette are also members of the Nominating and Governance Committee. Each of the members of our Nominating and Governance Committee is independent under NASDAQ’s independence standards. The Nominating and Governance Committee operates under a written charter, which is available on our website at www.fluxpower.com.

We seek directors with established strong professional reputations and experience in areas relevant to the strategy and operations of our business. We seek directors who possess the qualities of integrity and candor, who have strong analytical skills and who are willing to engage management and each other in a constructive and collaborative fashion. We also seek directors who have the ability and commitment to devote significant time and energy to serve on the Board and its committees. We believe that all of our directors meet the foregoing qualifications. We do not have a formal policy with respect to diversity.

Board and Committee Meetings and Attendance

Our Board and audit committee meet regularly throughout the year, and also hold special meetings and act by written consent. During fiscal year ended June 30, 2021, or Fiscal 2021: (i) our Board met 7 times; (ii) our Audit Committee met 4 times; (iii) our Compensation Committee met 8 times; and (iv) our Nominating and Corporate Governance Committee met 2 times. During Fiscal 2021, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

| 9 |

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. All of our directors intend to attend the Annual Meeting.

Executive Sessions

The independent directors meet in executive sessions without management present. The independent directors met 5 times in such sessions during Fiscal 2021.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson or lead independent director, if any) may do so by letters addressed to the attention of our Corporate Secretary. All communications are reviewed by the Corporate Secretary and provided to the members of our board of directors as appropriate. The address for these communications is:

Flux Power Holdings, Inc.

Attn: Charles A. Scheiwe, Corporate Secretary

2685 S. Melrose Drive

Vista, California 92081

| 10 |

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

The nominating and corporate governance committee, or governance committee, is responsible for recommending to the board of directors the nominees for election to our board of directors at each annual meeting of stockholders and for identifying one or more candidates to fill any vacancies that may occur on our board of directors. New candidates may be identified through recommendations from existing directors or members of management, consultants or third-party search firms, discussions with other persons who may know of suitable candidates to serve on our board of directors, and stockholder recommendations. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications by the nominating and corporate governance committee, interviews with the committee as a whole, one or more members of the committee, or one or more other board members, and discussions within the committee and the full board. The nominating and corporate governance committee then recommends candidates to the full board, with the full board of directors selecting the candidates to be nominated for election by the stockholders or to be appointed by the board of directors to fill a vacancy.

The nominating and corporate governance committee will consider director candidates proposed by stockholders as well as recommendations from other sources. Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth in section titled “Stockholder Proposals for the 2023 Annual Meeting.”

Director Qualifications

In accordance with its charter, the nominating and corporate governance committee develops and recommends to our board of directors appropriate criteria, including desired qualifications, expertise, skills and characteristics, for selection of new directors and periodically reviews the criteria adopted by our board of directors and, if appropriate, recommends changes to such criteria.

Board Diversity

Our board of directors seeks members from diverse professional backgrounds who combine a strong professional reputation and knowledge of our business and industry with a reputation for integrity. Our board of directors does not have a formal policy with respect to diversity and inclusion, but is in process of establishing a policy on diversity. Diversity of experience, expertise and viewpoints is one of many factors the nominating and corporate governance committee considers when recommending director nominees to our board of directors. Further, our board of directors is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. Our board of directors also seeks members that have experience in positions with a high degree of responsibility or are, or have been, leaders in the companies or institutions with which they are, or were, affiliated, but may seek other members with different backgrounds, based upon the contributions they can make to our company.

We believe that our current board composition reflects our commitment to diversity in the areas of gender and professional background.

Board Diversity Matrix (as of March 3, 2022)

| Total Number of Directors | 5 | ||||

| Female | Male | ||||

| Part I: Gender Identity | |||||

| Directors | 2 | 3 | |||

| Part II: Demographic Background | |||||

| Asian | 1 | 0 | |||

| White | 1 | 3 |

| 11 |

ELECTION OF DIRECTORS

General

Our board of directors, or Board, has the authority to fix the number of director seats on our Board and, effective as of the date of the Annual Meeting of Stockholders, our Board has approved fixing the number of directors at five (5). Directors serve for a term of one (1) year and stand for election at our annual meeting of stockholders. Pursuant to our Amended and Restated Bylaws, a majority of directors may appoint a successor to fill any vacancy that occurs on the Board between annual meetings. At the Meeting, stockholders will be asked to elect the nominees for director listed below.

Nominees for Director

The nominees for director have consented to being named as nominees in this proxy statement and have agreed to serve as directors, if elected. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the five (5) nominees named below. If any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present board of directors to fill the vacancy. The board of directors has no reason to believe that any of the nominees will be unavailable for election. The Directors who are elected will hold office until the next Annual Meeting of Stockholders or until their earlier death, resignation or removal, or until their successors are elected and qualified. There are no arrangements or understandings between any of our directors and any other person pursuant to which any director was selected to serve as a director of our company. Directors are elected until their successors are duly elected and qualified. There are no family relationships among our directors or officers. There are no arrangements or understandings between our directors and executive officers and any other person pursuant to which any director or officer was or is to be selected as a director or officer.

The following sets forth the persons nominated by the board of directors for election and certain information with respect to those individuals:

| Director Nominee | Age | Position | Director Since | |||

| Ronald F. Dutt | 75 | Director, Chief Executive Officer and President | 2014 | |||

| Michael Johnson | 73 | Director | 2012 | |||

| Lisa Walters-Hoffert(1)(2) | 63 | Director | 2019 | |||

| Dale Robinette(1)(3) | 57 | Director | 2019 | |||

| Cheemin Bo-Linn(1)(4) | 68 | Director | 2022 |

| (1) | Independent Director |

| (2) | Chairperson of the Audit Committee, Member of Compensation Committee, Member of Governance Committee |

| (3) | Chairperson of the Compensation Committee, Member of Audit Committee, Member of Governance Committee |

| (4) | Chairperson of the Governance Committee, Member of Audit Committee, Member of Compensation Committee |

Biographies of Nominees

Ronald F. Dutt. Chairman, Chief Executive Officer, President, and Director. Mr. Dutt has been our chief executive officer, former interim chief financial officer and director since March 19, 2014. He became our chairman on June 28, 2019. On September 19, 2017, he was also appointed as our president, chief financial officer and corporate secretary. He resigned as chief financial officer and corporate secretary as of December 16, 2018. Previously, he was our chief financial officer since December 7, 2012, and our interim chief executive officer since June 28, 2013. Mr. Dutt has served as the Company’s interim corporate secretary since June 28, 2013. Prior to Flux Power, Mr. Dutt provided chief financial officer and chief operating officer consulting services during 2008 through 2012. In this capacity Mr. Dutt provided financial consulting, including strategic business modeling and managed operations. Prior to 2008, Mr. Dutt served in several capacities as executive vice president, chief financial officer and treasurer for various public and private companies including SOLA International, Directed Electronics, Fritz Companies, DHL Americas, Aptera Motors, Inc., and Visa International. Mr. Dutt holds an MBA in Finance from University of Washington and an undergraduate degree in Chemistry from the University of North Carolina. Additionally, Mr. Dutt served in the United States Navy and received an honorable discharge as a Lieutenant.

| 12 |

Michael Johnson, Director. Mr. Johnson has been our director since July 12, 2012. Mr. Johnson has been a director of Flux Power since it was incorporated. Since 2002, Mr. Johnson has been a director and the chief executive officer of Esenjay Petroleum Corporation (Esenjay Petroleum), a Delaware company located in Corpus Christi, Texas, which is engaged in the business oil exploration and production. Mr. Johnson’s primary responsibility at Esenjay Petroleum is to manage the business and company as chief executive officer. Mr. Johnson is a director and beneficial owner of Esenjay Investments LLC, a Delaware limited liability company engaged in the business of investing in companies, and an affiliate of the Company owning approximately 32.5% of our outstanding shares, including common stock underlying options, and warrants that were exercisable or convertible or which would become exercisable or convertible within sixty (60) days. As a result of Mr. Johnson’s leadership and business experience, he is an industry expert in the natural gas exploration industry and brings a wealth of management and successful company building experience to the board. Mr. Johnson received a Bachelor of Science degree in mechanical engineering from the University of Southwestern Louisiana.

Lisa Walters-Hoffert, Director. Ms. Walters-Hoffert was appointed to our Board on June 28, 2019. Ms. Walters-Hoffert was a co-founder of Daré Bioscience, Inc. and following the company’s merger with Cerulean Pharma, Inc. in July of 2017, became Chief Financial Officer of the surviving public company (NASDAQ: DARE). For over twenty-five (25) years, Ms. Walters-Hoffert was an investment banker focused on small-cap public companies in the technology and life science sectors. From 2003 to 2015, Ms. Walters-Hoffert worked at Roth Capital Partners as Managing Director in the Investment Banking Division. Ms. Walters-Hoffert has held various positions in the corporate finance and investment banking divisions of Citicorp Securities in San José, Costa Rica and Oppenheimer & Co, Inc. in New York City, New York. Ms. Walters-Hoffert has served as a member of the Board of Directors of the San Diego Venture Group, as Past Chair of the UCSD Librarian’s Advisory Board, and as Past Chair of the Board of Directors of Planned Parenthood of the Pacific Southwest. Ms. Walters-Hoffert currently serves as a member of the Board of Directors of The Elementary Institute of Science in San Diego. Ms. Walters-Hoffert graduated magna cum laude from Duke University with a B.S. in Management Sciences. As a senior financial executive with over twenty-five years of experience in investment banking and corporate finance and based on Ms. Walters-Hoffert’s expertise in audit, compliance, valuation, equity finance, mergers, and corporate strategy, the Company believes Ms. Walters-Hoffert is qualified to be on the Board.

Dale T. Robinette, Director. Mr. Robinette was appointed to our Board on June 28, 2019 and our lead independent director on September 10, 2021. Mr. Robinette has been a CEO Coach and Master Chair since 2013 as an independent contractor to Vistage Worldwide, Inc., an executive coaching company. In addition, since 2013 Mr. Robinette has been providing business consulting related to top-line growth and bottom-line improvement through his company EPIQ Development. From 2013 to 2019, Mr. Robinette was the Founder and CEO of EPIQ Space, a marketing website for the satellite industry, a member-based community of suppliers promoting their offerings. Mr. Robinette was with Peregrine Semiconductor, Inc., a manufacturer of high-performance RF CMOS integrated circuits, from 2007 to 2013 in two roles as a Director of Worldwide Sales as well as the Director of the High Reliability Business Unit. Mr. Robinette started his career from 1991 to 2007 at Tyco Electronics Ltd. (known today as TE Connectivity Ltd.), a passive electronics manufacturer, in various sales, sales leadership and product development leadership roles. Mr. Robinette received a Bachelor of Science degree in Business Administration, Marketing from San Diego State University. Based on the above qualifications, the Company believes Mr. Robinette is qualified to be on the Board.

Cheemin Bo-Linn, Director. Dr. Bo-Linn was appointed to the Board of Directors on January 2022. Dr. Bo-Linn is presently the Chief Executive Officer of Peritus Partners, Inc., a global business valuation accelerator and information technology operations and consulting company since February 2008 through 2022. Dr. Bo-Linn also currently serves as a director of Data I/O Corp (Nasdaq: DAIO), a manufacturer of programming and automated device handling systems for programmable integrated circuits and security software for consumer electronics, electric automotive, and medical since December 2021, as director and audit chair of KORE Inc. (NYSE: KORE), a company specializing in wireless IoT Internet of Things (“IoT”) connectivity technology since October 2021, and as the lead independent director of Blackline Safety Corp., a Canadian public company (TSX: BLN) and global software-as-a-service (SaaS) leader in IoT connected worker technologies and gas detection since November 2020. In addition, Dr. Bo-Linn has held various executive corporate positions and been elected to the board of directors of multiple private and midcap public companies in e-commerce retail, manufacturing and distribution, telecommunications, healthcare, software as a service software, and marketing. Prior she was Vice-President of IBM Corporation. From April 2017 to June 2021, she served as a director and audit chair of Sphere 3D Corp (NASDAQ: ANY), a company delivering containerization, virtualization, and data management solutions. From April 2017 to October 2020, she served as a director of SNOMED International, an international non-profit organization that owns SNOMED CT, a leading clinical terminology used in electronic health records. From May 2019 to January 2021, she served as a director and Chair of the Technology committee of BMC Stock Holdings, Inc., a construction supply and e-commerce company. Dr. Bo-Linn holds a Doctor of Education in “Computer-based Management Information Systems and Organizational Change” from the University of Houston. The Board believes that Dr. Bo-Linn’s extensive executive management and board experience in private and public companies qualifies her to serve on the Board of Directors.

| 13 |

Director Qualifications and Diversity

We seek directors with established strong professional reputations and experience in areas relevant to the strategy and operations of our businesses. We seek directors who possess the qualities of integrity and candor, who have strong analytical skills and who are willing to engage management and each other in a constructive and collaborative fashion. We also seek directors who have the ability and commitment to devote significant time and energy to serve on the Board and its committees. We believe that all of our directors meet the foregoing qualifications. We do not have a formal policy with respect to diversity.

Director Compensation

Director Compensation Table

From time to time, our directors have received compensation in the form of cash and equity grant for their services on the Board. Below is summary of compensation accrued or paid to our non-executive directors during Fiscal 2021 and fiscal year ended June 30, 2020 (“Fiscal 2020”). Mr. Dutt, our chief executive officer and president, received no compensation for his service as a director and is not included in the table. The compensation Mr. Dutt receives as an employee of the Company is included in the section titled “Executive Compensation.”

| Name | Year | Fees Earned or Paid in Cash ($) | Stock Awards(2) ($) | Option Awards(3) ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

| Lisa Walters-Hoffert | 2021 | $ | 58,125 | 50,000 | $ | - | - | $ | 108,125 | |||||||||||||||

| 2020 | 29,375 | - | 28,287 | - | 57,662 | |||||||||||||||||||

| Dale Robinette | 2021 | $ | 55,625 | 50,000 | $ | - | - | $ | 105,625 | |||||||||||||||

| 2020 | 28,125 | - | 28,287 | - | 56,412 | |||||||||||||||||||

| John A. Cosentino Jr.(4) | 2021 | $ | 55,000 | 50,000 | $ | - | - | $ | 105,000 | |||||||||||||||

| 2020 | 13,750 | - | 23,095 | - | 36,845 | |||||||||||||||||||

| Michael Johnson | 2021 | $ | 42,500 | 50,000 | $ | - | - | $ | 92,500 | |||||||||||||||

| 2020 | 17,500 | - | 28,287 | - | 45,787 | |||||||||||||||||||

| James Gevarges (1) | 2020 | $ | 13,750 | - | $ | 28,287 | - | $ | 42,037 | |||||||||||||||

| (1) | Mr. Gevarges resigned as our director on May 6, 2020. |

| (2) | Represent the fair value of the RSUs granted using the volume weighted average price of the ten days of trading prior to grant date. |

| (3) | The amounts shown in this column represent the full grant date fair value of the award granted, excluding any as computed in accordance with Financial Accounting Standards Board (“FASB”). |

| (4) | Mr. Cosentino resigned as our director on March 1, 2022. |

| 14 |

The following table shows the aggregate number of stock options held by non-employee directors as of June 30, 2021 and June 30, 2020:

| Name | Year | Vested Stock Options | ||||||

| Lisa Walters-Hoffert | 2021 | 2,467 | ||||||

| 2020 | 493 | |||||||

| Dale Robinette | 2021 | 2,467 | ||||||

| 2020 | 493 | |||||||

| John A. Cosentino Jr.(1) | 2021 | 1,740 | ||||||

| 2020 | - | |||||||

| Michael Johnson | 2021 | 10,904 | ||||||

| 2020 | 8,180 | |||||||

| James Gevarges(2) | 2020 | 6,761 | ||||||

| (1) | Mr. Cosentino resigned as our director on March 1, 2022. | |

| (2) | Mr. Gevarges resigned as our director on May 6, 2020. |

Compensation of Non-Executive Directors

In December 2019, our Board approved non-executive director compensation packages as recommended by the Compensation Committee. Below are the compensation packages for non-executive directors approved by the Board for 2020 calendar year, as follows:

Independent Non-Executive Director | Position | Base Retainer | Chair Fee | Committee Member | Stock Options | Total Comp | ||||||||||||||||||

| Lisa Walters-Hoffert | X | Audit Chair | $ | 35,000 | $ | 15,000 | $ | 8,750 | $ | 35,000 | $ | 93,750 | ||||||||||||

| Dale Robinette | X | Compensation Chair | $ | 35,000 | $ | 10,000 | $ | 11,250 | $ | 35,000 | $ | 91,250 | ||||||||||||

| John A. Cosentino Jr. | X | Governance Chair | $ | 35,000 | $ | 7,500 | $ | 12,500 | $ | 35,000 | $ | 90,000 | ||||||||||||

| Michael Johnson | Board Member | $ | 35,000 | $ | - | $ | - | $ | 35,000 | $ | 70,000 | |||||||||||||

In December 2020, pursuant to the recommendation and advice of the Compensation Committee, the Board approved the annual compensation package for non-executive directors of the Company for calendar year 2021, as follows:

Independent Non-Executive Director | Position | Base Retainer | Chair Fee | Committee Member | Total Comp | |||||||||||||||

| Lisa Walters-Hoffert | X | Audit Chair | $ | 50,000 | $ | 7,500 | $ | - | $ | 57,500 | ||||||||||

| Dale Robinette | X | Compensation Chair | $ | 50,000 | $ | 5,000 | $ | - | $ | 55,000 | ||||||||||

| John A. Cosentino Jr. | X | Governance Chair | $ | 50,000 | $ | 5,000 | $ | - | $ | 55,000 | ||||||||||

| Michael Johnson | Board Member | $ | 50,000 | $ | - | $ | - | $ | 50,000 | |||||||||||

On January 14, 2022, pursuant to the recommendation and advice of the Compensation Committee of the Board of the Company, the Board approved the following annual compensation package for non-executive directors of the Company for calendar year 2022, as follows:

| Name | Independent Non-Executive Director | Position | Base Retainer (cash) | Chair Fee (cash) | Lead Independent Director (cash) | |||||||||||

| Lisa Walters-Hoffert | X | Audit Chair | $ | 50,000 | $ | 7,500 | $ | - | ||||||||

| Dale Robinette | X | Compensation Chair | $ | 50,000 | $ | 5,000 | $ | 20,000 | ||||||||

| John A. Cosentino Jr.(1) | X | Governance Chair | $ | 50,000 | $ | 5,000 | (1) | $ | - | |||||||

| Cheemin Bo-Linn (2) | X | Board Member | $ | 50,000 | $ | - | $ | - | ||||||||

| Michael Johnson | Board Member | $ | 50,000 | $ | - | $ | - | |||||||||

(1) Mr. Cosentino resigned as our director on March 1, 2022. As appreciation for Mr. Cosentino’s board services, the Board approved to (i) accelerate the vesting of the following securities the Board granted in connection with his board services: 435 unvested options and 4,578 restricted stock awards, and (iii) pay his board fees for 3rd quarter of Fiscal 2022.

(2) Dr. Bo-Linn was appointed as Chairperson of the Governance Committee on March 3, 2022. For Dr. Bo-Linn’s services as Chairperson, she will be entitled to Chair Fee of $5,000 for calendar year 2022.

Restricted Stock Units

In addition, our directors are eligible to receive an annual equity grant of restricted stock units, which terms are determined at the time of grant.

| 15 |

Vote Required

Directors are elected by a plurality of the votes properly cast in person or by proxy. If a quorum is present and voting, the five (5) nominees receiving the highest number of affirmative votes will be elected. Our Amended and Restated Articles of Incorporation do not permit stockholders to cumulate their votes for the election of directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five (5) nominees. Abstentions and broker non-votes will have no effect on the outcome of the election of directors.

Recommendation of the Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” THE ELECTION OF ALL THE DIRECTOR NOMINEES.

| 16 |

RATIFICATION

OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of the board of directors is responsible for the selection of our independent registered public accounting firm. The audit committee has selected and retained the public accounting firm of Baker Tilly US, LLP (“Baker Tilly”) as independent registered public accounting firm to audit our financial statements for the fiscal year ending June 30, 2022. Squar Milner LLP, which was the Company’s independent public accounting firm for fiscal year ended June 30, 2020 and 2019, merged with Baker Tilly on November 1, 2020. Although the audit committee is directly responsible for selecting and retaining our independent auditor and even though ratification is not required by our Amended and Restated Bylaws, the board of directors is submitting the selection of Baker Tilly to our stockholders for ratification as a matter of good corporate practice and we are asking our stockholders to approve the appointment of Baker Tilly. In the event our stockholders fail to ratify the appointment, the audit committee may reconsider this appointment.

The Company has been advised by Baker Tilly that neither the firm nor any of its associates had any relationship with the Company other than the usual relationship that exists between independent registered public accountant firms and their clients during the last fiscal year. A representative of Baker Tilly is expected to be present in person or by electronic conferencing at the Annual Meeting, and will be afforded an opportunity to make a statement at the Annual Meeting if the representative desires to do so. It is also expected that such representative will be available at the Annual Meeting to respond to appropriate questions by stockholders.

Independent Auditor

For the years ended June 30, 2021 and 2020, the Company’s independent public accounting firm was Baker Tilly US, LLP (formerly Squar Milner LLP, which, effective as of November 1, 2020, merged with Baker Tilly US, LLP).

Fees Paid to Principal Independent Registered Public Accounting Firm

The aggregate fees billed by our Independent Registered Public Accounting Firm, for the years ended June 30, 2021 and 2020 are as follows:

| 2021 | 2020 | |||||||

| Audit fees(1) | $ | 134,000 | $ | 222,000 | ||||

| Audit related fees(2) | - | - | ||||||

| Tax fees(3) | - | - | ||||||

| All other fees(4) | - | - | ||||||

| Total | $ | 134,000 | $ | 222,000 | ||||

| (1) | Audit fees represent fees for professional services provided in connection with the audit of our annual financial statements and the review of our quarterly financial statements and those services normally provided in connection with statutory or regulatory filings or engagements including comfort letters, consents and other services related to SEC matters. |

| (2) | Audit-related fees represent fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and not reported above under “Audit Fees.” No such fees were incurred during the fiscal years ended June 30, 2021 or 2020. |

| (3) | Baker Tilly US, LLP did not provide us with tax compliance, tax advice or tax planning services. |

| (4) | All other fees include fees billed by our independent auditors for products or services other than as described in the immediately preceding three categories. No such fees were incurred during the fiscal years ended June 30, 2021 or 2020. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm, the scope of services provided by our independent registered public accounting firm and the fees for the services to be performed. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget.

| 17 |

Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by our independent registered public accounting firm in accordance with this preapproval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our audit committee.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following is the report of the Audit Committee of the Board of Directors of Flux Power Holdings, Inc. (the “Company”) submitted to the Board of Directors of the Company with respect to the Company’s audited financial statements for the fiscal year ended June 30, 2021, included in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on September 27, 2021. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

The Audit Committee of the Board of Directors currently consists of non-executive directors. The Board determined that each of the members of the Audit Committee is an “independent director” under the listing standards of the NASDAQ.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the responsibility for the financial statements and the reporting process, including internal control systems. The Company’s independent registered public accounting firm for the fiscal year ended June 30, 2021, Baker Tilly US, LLP (“Baker Tilly”) was responsible for expressing an opinion as to the conformity of our audited financial statements with generally accepted accounting principles.

Review with Management

The Audit Committee reviewed and discussed the audited financial statements with management of the Company.

Review and Discussions with Independent Accountants

The Audit Committee met with Baker Tilly to review the financial statements for the fiscal year ended June 30, 2021. The Audit Committee discussed with a representative of Baker Tilly applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. In addition, the Audit Committee met with Baker Tilly, with and without management present, to discuss the overall scope of Baker Tilly’s audit, the results of its examinations and the overall quality of the Company’s financial reporting. The Audit Committee received the written disclosures and the letter from Baker Tilly required by the applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence. In addition, the Audit Committee has discussed with Baker Tilly its independence and satisfied itself as to the independence of Baker Tilly.

| 18 |

Conclusion

Based on the above review, discussions, and representations received, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended June 30, 2021 be included in the Company’s Annual Report on Form 10-K filed with the SEC on September 27, 2021.

| The Audit Committee of the Board of Directors: | |

| /s/ Lisa Walters-Hoffert, Chair | |

| /s/ Dale Robinette | |

| /s/ John A. Cosentino(1) |

(1) Resigned as a director on March 1, 2022

Vote Required

The ratification of the appointment of Baker Tilly as our independent auditor requires the approval by the holders of a majority of the shares of our common stock issued and outstanding, present in person or voting by proxy.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” THE ELECTION OF ALL THE DIRECTOR NOMINEES

| 19 |

The following table set forth the names and ages of our executive officers as of March 3, 2022.

| Name | Age | Position | Officer Since | |||

| Ronald F. Dutt | 75 | Director, Chief Executive Officer and President | 2012 | |||

| Charles A. Scheiwe | 55 | Chief Financial Officer and Secretary | 2018 | |||

| Jonathan A. Berry | 54 | Chief Operating Officer | 2016 |

Below is the biography of each executive officer. Mr. Dutt’s biography is provided under “Proposal 1- Election of Directors.”

Charles A. Scheiwe, Chief Financial Officer and Secretary. Mr. Scheiwe joined the Company in July of 2018 and has been acting as the Company’s Controller since July 9, 2018. He was appointed as our chief financial officer and secretary on December 17, 2018. Prior to joining the Company, Mr. Scheiwe was the controller of Senstay, Inc. and provided financial and accounting consulting services to start-up companies from 2016 to 2018. From 2006 to 2016, Mr. Scheiwe was the vice president of finance and controller for GreatCall, Inc. Mr. Scheiwe’s experience in accounting, financial planning and analysis, business intelligence, cash management, and equity management has prepared and qualified him for the position of chief financial officer and secretary of the Company. Mr. Scheiwe has a Bachelor of Science degree in Business Management, with emphasis in Accounting, from the University of Colorado. Mr. Scheiwe also holds a CPA certificate.

Jonathan A. Berry, Chief Operating Officer. Mr. Berry joined the Company in 2016 and has been our director of operations since 2016. On June 29, 2018, he was appointed as our chief operating officer. Prior to joining the Company in 2016, Mr. Berry was Clean Air Power, Inc.’s group operations director and general manager of the USA operations from 2014 to 2016, and operations director of the UK, Australia, and USA market from 2012 to 2014. Mr. Berry’s experience in the development, implementation, and management of all aspects of supply chain, production, and sales has prepared and qualified him for the position of chief operating officer. Mr. Berry attended the Senior Executive Program at Hult Ashridge Business School in London, England, and has an undergraduate degree in Electrical Engineering from the University of Leeds.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten (10) years, none of our directors or executive officers were involved in any of the following: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two (2) years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

| 20 |

Compensation for our Named Executive Officers

The following table sets forth information concerning all forms of compensation earned by our named executive officers during Fiscal 2021 and Fiscal 2020 for services provided to the Company and its subsidiary.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards(1) ($) | Option Awards(2) ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

| Ronald F. Dutt, Chief Executive | 2021 | $ | 242,288 | $ | 133,525 | $ | 234,681 | $ | - | $ | - | $ | - | $ | 610,494 | |||||||||||||||||

| Officer, President, and Chairman | 2020 | $ | 195,000 | $ | 34,047 | $ | - | $ | - | $ | - | $ | - | $ | 229,047 | |||||||||||||||||

| Charles A. Scheiwe | 2021 | $ | 187,635 | $ | 77,055 | $ | 124,853 | $ | - | $ | - | $ | - | $ | 389,543 | |||||||||||||||||

| Chief Financial Officer and Corporate Secretary | 2020 | $ | 155,000 | $ | 27,063 | $ | - | $ | - | $ | - | $ | - | $ | 182,063 | |||||||||||||||||

| Jonathan Berry, Chief Operating Officer | 2021 | $ | 188,077 | $ | 77,055 | $ | 124,853 | $ | - | $ | - | $ | - | $ | 389,985 | |||||||||||||||||

| 2020 | $ | 160,000 | $ | 27,936 | $ | - | $ | - | $ | - | $ | - | $ | 187,936 | ||||||||||||||||||

| (1) | Represent the fair value of the RSUs granted on grant date. |

| (2) | The grant date fair value was determined in accordance with the provisions of FASB ASC Topic No. 718 using the Black-Scholes valuation model with assumptions described in more detail in the notes to our audited financial statements included in the Annual Report on Form 10-K. |

Benefit Plans

We do not have any profit sharing plan or similar plans for the benefit of our officers, directors or employees. However, we may establish such plan in the future.

Equity Compensation Plan Information

In connection with the reverse acquisition of Flux Power, Inc. in 2012, we assumed the 2010 Option Plan. As of June 30, 2021, the number of options outstanding to purchase common stock under the 2010 Option Plan was 22,536. No additional options to purchase common stock may be granted under the 2010 Option Plan.

On February 17, 2015, our shareholders approved our 2014 Equity Incentive Plan (“2014 Option Plan”), which was amended on July 23, 2018 and on November 5, 2020. The 2014 Option Plan authorizes the issuance of awards for up to 1,000,000 shares of our common stock in the form of incentive stock options, non-statutory stock options, stock appreciation rights, restricted stock units, restricted stock awards and unrestricted stock awards to officers, directors and employees of, and consultants and advisors to, the Company or its affiliates. No options were granted during Fiscal 2021. We granted 153,177 restricted stock units under the 2014 Option Plan during Fiscal 2020.

On April 29, 2021, at the Company’s annual stockholders meeting, the 2021 Equity Incentive Plan (the “2021 Plan”) was approved by our stockholders. The 2021 Plan authorizes the issuance of awards for up to 2,000,000 shares of our common stock in the form of incentive stock options, non-statutory stock options, stock appreciation rights, restricted stock units, restricted stock awards and unrestricted stock awards to officers, directors and employees of, and consultants and advisors to, the Company or its affiliates. No awards were granted under the 2021 Plan during Fiscal 2021.”

As of June 30, 2021, we had 490,323 options exercisable and 531,205 options outstanding, under the 2014 Option Plan and the 2010 Option Plan. There were no options outstanding under the 2021 Plan as of June 30, 2021.

The following table sets forth certain information concerning unexercised options, stock that has not vested, and equity compensation plan awards outstanding as of June 30, 2021 for the named executive officers below:

| Option Awards (1) | Stock Awards | |||||||||||||||||||||||||||||||||||

| Name | Award Grant Date | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested | Equity Incentive Plan: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | ||||||||||||||||||||||||||

| Ronald Dutt | 3/15/2019 | 40,625 | 9,375 | 9,375 | $ | 13.60 | 3/15/2029 | - | $ | - | - | $ | - | |||||||||||||||||||||||

| 7/25/2018 | 33,527 | - | - | 19.80 | 7/25/2028 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 6/29/2018 | 50,000 | - | - | 14.40 | 6/29/2028 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 10/26/2017 | 50,000 | - | - | 4.60 | 10/26/2027 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 12/22/2015 | 19,000 | - | - | 5.00 | 12/22/2025 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 7/30/2013 | 17,500 | - | - | 10.00 | 7/29/2023 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 6,607 | $ | 58,670 | 6,607 | $ | 58,670 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 6,607 | $ | 58,670 | 6,607 | $ | 58,670 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 13,214 | $ | 117,340 | 13,214 | $ | 117,340 | |||||||||||||||||||||||||

| Charles Scheiwe | 3/15/2019 | 24,375 | 5,625 | 5,625 | 13.60 | 3/15/2029 | - | $ | - | - | $ | - | ||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 3,515 | $ | 31,213 | 3,515 | $ | 31,213 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 3,515 | $ | 31,213 | 3,515 | $ | 31,213 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 7,030 | $ | 62,426 | 7,030 | $ | 62,426 | |||||||||||||||||||||||||

| Jonathan Berry | 3/15/2019 | 24,375 | 5,625 | 5,625 | 13.60 | 3/15/2029 | - | $ | - | - | $ | - | ||||||||||||||||||||||||

| 6/29/2018 | 45,500 | - | - | 14.40 | 6/29/2028 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 10/26/2017 | 22,500 | - | - | 4.60 | 10/26/2027 | - | $ | - | - | $ | - | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 3,515 | $ | 31,213 | 3,515 | $ | 31,213 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 3,515 | $ | 31,213 | 3,515 | $ | 31,213 | |||||||||||||||||||||||||

| 11/12/2020 | - | - | - | - | 11/11/2030 | 7,030 | $ | 62,426 | 7,030 | $ | 62,426 | |||||||||||||||||||||||||

| (1) | The fair value of each option grant is estimated at the date of grant using the Black-Scholes option pricing model. Expected volatility is calculated based on the historical volatility of the Company’s stock. The risk free interest rate is based on the U.S. Treasury yield for a term equal to the expected life of the options at the time of grant. The fair value of each restricted stock unit is the fair value of the Company’s common stock on the grant date. |

| 21 |

Aggregated Option/Stock Appreciation Right (“SAR”) exercised and Fiscal year-end Option/SAR value table

Neither our executive officers nor the other individuals listed in the tables above, exercised options or SARs during Fiscal 2021.

Long-term incentive plans

No long term incentive awards were granted by us in Fiscal 2021.

Equity Compensation Plan Information

The following table provides certain information with respect to our equity compensation plans in effect as of June 30, 2021: