UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

FLUX

POWER HOLDINGS, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: N/A | |

| (2) Aggregate number of securities to which transaction applies: N/A | |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A | |

| (4) Proposed maximum aggregate value of transaction: N/A | |

| Total fee paid: N/A | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. |

| (1) Amount Previously Paid: N/A | |

| (2) Form, Schedule or Registration Statement No.: N/A | |

| (3) Filing Party: N/A | |

| (4) Date filed: N/A |

March 15, 2021

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Flux Power Holdings, Inc., or Annual Meeting. We will be conducting the 2021 Annual Meeting as a virtual meeting. The virtual meeting format will allow for greater participation by all of our stockholders, regardless of their geographic location. The Annual Meeting will be held at 10:00 a.m. Pacific Standard Time, on Thursday, April 29, 2021 via a live webcast on the internet.

You may attend the Annual Meeting, submit questions, and vote via the Internet at the following website address: https://agm.issuerdirect.com/flux by entering the 16-digit control number included on your Notice of Internet Availability, your proxy card or in the instructions that accompanied your proxy materials.

The matters expected to be acted upon at the Annual Meeting are listed in the Notice of Annual Meeting of Stockholders and more fully described in the accompanying proxy statement. We have also made available our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, which contains important business and financial information regarding the Company.

Thank you for your continuing support.

| Sincerely, | |

| /s/ Ronald F. Dutt | |

| Ronald F. Dutt | |

Executive Chairman, Chief Executive Officer and President |

YOUR VOTE IS IMPORTANT

Your vote is important. As described in your electronic proxy materials notice or on the enclosed paper proxy card and voting instructions, please vote by: (1) accessing the internet website, (2) calling the toll-free number, or (3) signing and dating the proxy card as promptly as possible and returning it by mail if voting and delivering by mail. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend online.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON APRIL 29, 2021: THE PROXY STATEMENT, PROXY CARD AND ANNUAL REPORT ARE AVAILABLE AT www.iproxydirect.com/FLUX

2685 S. Melrose Drive

Vista, California 92081

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on THURSDAY, April 29, 2021

| Time and Date: | Thursday, April 29, 2021 at 10:00 a.m. Pacific Standard Time |

| Place: | Virtually online at https://agm.issuerdirect.com/flux |

| Items of Business: | The foregoing items of business as more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders. |

| 1. | To elect five (5) persons to the board of directors of the Company, each to serve until the next annual meeting of stockholders of the Company or until such person shall resign, be removed or otherwise leave office; | |

| 2. | To approve our 2021 Equity Incentive Plan; | |

| 3. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2021; | |

| 4. | To approve, on an advisory basis, the compensation of our named executive officers; | |

| 5. | To indicate, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers; and | |

| 6. | To conduct any other business properly brought before the Annual Meeting. |

| Record Date: | The record date for the Annual Meeting is March 1, 2021. Stockholders owning the Company’s common stock at the close of business on the record date, or their legal proxy holders, are entitled to vote at the Annual Meeting. |

| Voting: | Each share of common stock that you own represents one vote. |

| Transfer Agent: | For questions regarding your stock ownership, you may contact us at (877) 505-3589 or contact our transfer agent, Issuer Direct Corporation, through its website at www.issuerdirect.com or by phone at (801) 272-9294. |

This notice of the Annual Meeting, proxy statement, form of proxy and our Annual Report on Form 10-K are

being distributed or made available on or about March 15, 2021.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote or submit your proxy via the internet, or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

| Date: March 15, 2021 | By Order of the Board of Directors |

| /s/ Ronald F. Dutt | |

| Ronald F. Dutt | |

| Executive Chairman, Chief Executive Officer and President |

FLUX POWER HOLDINGS, INC.

PROXY STATEMENT FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

2685 S. Melrose Drive

Vista, California 92081

PROXY STATEMENT

2021 ANNUAL MEETING OF STOCKHOLDERS

GENERAL

This proxy statement is furnished to stockholders of Flux Power Holdings, Inc., a Nevada corporation (the “Company”), in connection with the solicitation of proxies for use at the 2021 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held virtually https://agm.issuerdirect.com/flux on Thursday, April 29, 2021 at 10:00 a.m. Pacific Standard Time. In light of the continuing public health risk posed by the coronavirus, or COVID-19, outbreak, this year’s Annual Meeting will be held in a virtual-only meeting format. This solicitation of proxies is made on behalf of our board of directors. Capitalized terms used, but not defined, herein will have the meanings ascribed to them in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 (the “Annual Report”).

Important

Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be Held on Thursday, April 29, 2021

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Internet Availability of Proxy Materials (the “Internet Notice”) to our stockholders of record on March 1, 2021. We are also sending a paper copy of the proxy materials and proxy card to other stockholders of record who have indicated they prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Internet Notice. Such Internet Notice, or this proxy statement and proxy card or voting instruction form, as applicable, is being mailed to our stockholders on or about March 15, 2021.

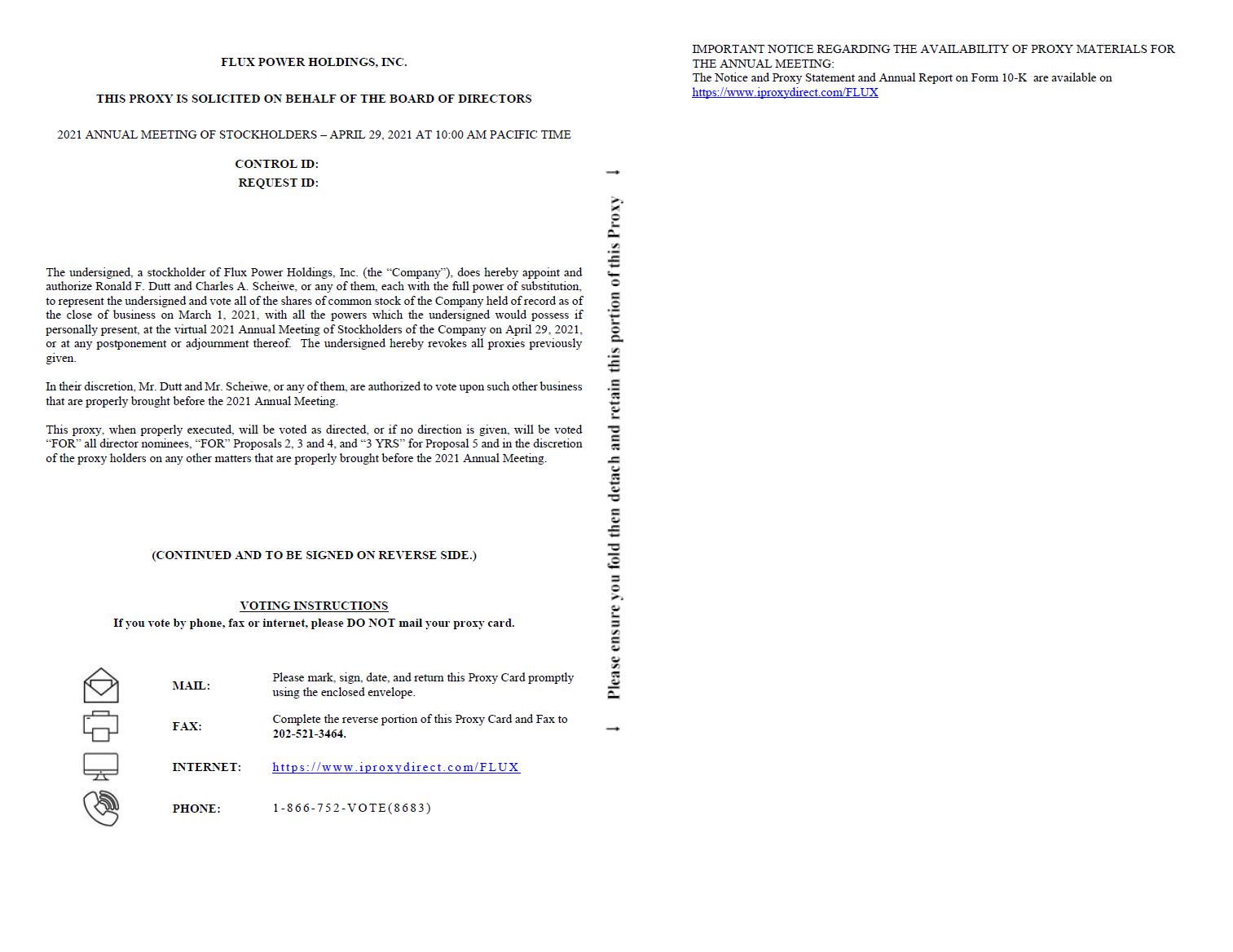

Stockholders will have the ability to access the proxy materials or may request to receive a paper copy of the proxy materials by mail on a one-time or ongoing basis at www.iproxydirect.com/FLUX, or call (866) 752-VOTE (8683), or fax request to (202) 521-3464 or send email to proxy@issuerdirect.com.

The Internet Notice will also identify the date, the time and location of the Annual Meeting; the matters to be acted upon at the meeting and the board of directors’ recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request to receive, free of charge, a paper or e-mail copy of this proxy statement, our Annual Report and a form of proxy relating to the Annual Meeting; information on how to access and vote the form of proxy; and information on how to obtain instructions to attend the virtual meeting and vote in person at the virtual meeting, should stockholders choose to do so.

| 1 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

IF I RECEIVED AN INTERNET NOTICE, WILL I RECEIVE ANY PROXY MATERIALS BY MAIL OTHER THAN THE INTERNET NOTICE?

No. If you received an Internet Notice, you will not receive any other proxy materials by mail unless you request a paper or electronic copy of the proxy materials. To request that a full set of the proxy materials be sent to your specified postal or email address, please go to www.iproxydirect.com/FLUX or call (866) 752-VOTE (8683), or fax request to (202) 521-3464 or send email to proxy@issuerdirect.com.

HOW DO I ATTEND THE VIRTUAL MEETING?

This year our Annual Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted online. To participate in the virtual meeting, visit https://agm.issuerdirect.com/flux (“Annual Meeting Website”) and enter the control number included on your Internet Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten (10) days prior to the Annual Meeting for any purpose germane to the meeting at our corporate headquarters at 2685 S. Melrose Drive, Vista, California 92081. The stockholder list will also be available to registered stockholders during the Annual Meeting upon written request submitted by the registered stockholder at the Annual Meeting Website.

To participate in the Annual Meeting, you will need the 16-digit control number found on your Internet Notice, your proxy card or the instructions that accompany your proxy materials. If your shares are held in the name of a bank, broker or other holder of record, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the Annual Meeting.

WILL I BE ABLE TO ASK QUESTIONS AT THE MEETING?

You will be able to submit written questions during the Annual Meeting by following the instructions that will be available on the Annual Meeting Website during the Annual Meeting. Only questions pertinent to meeting matters or the Company will be answered during the meeting, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition.

WHAT AM I VOTING ON?

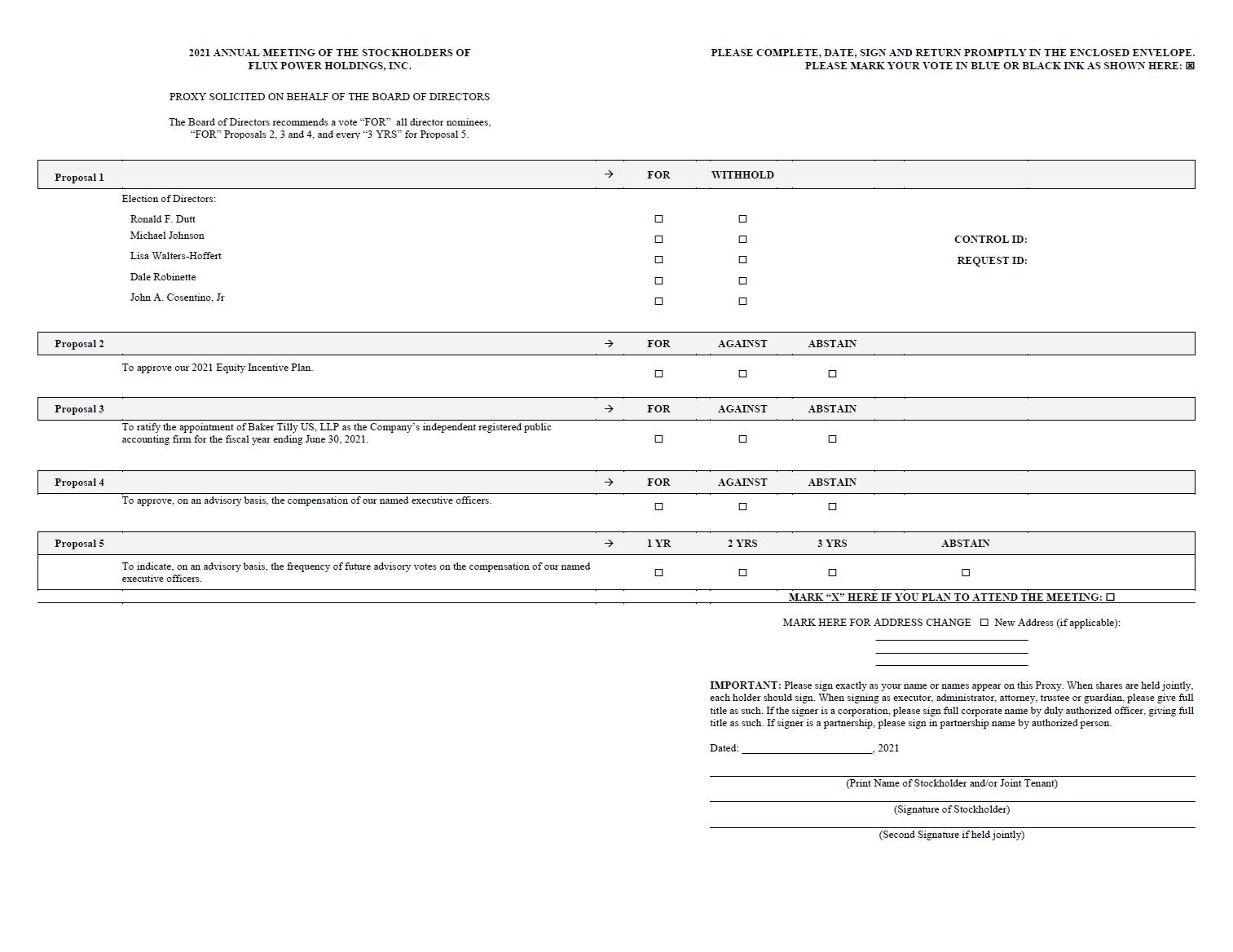

At the Annual Meeting, stockholders will be asked to take action on the following matters:

| 1. | To elect five (5) persons to the board of directors of the Company, each to serve until the next annual meeting of stockholders of the Company or until such person shall resign, be removed or otherwise leaves office; | |

| 2. | To approve our 2021 Equity Incentive Plan; | |

| 3. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2021; | |

| 4. | To approve, on an advisory basis, the compensation of our named executive officers; | |

| 5. | To indicate, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers; and | |

| 6. | To conduct any other business properly brought before the Annual Meeting. |

| 2 |

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Only holders of record of our common stock at the close of business on March 1, 2021 (the “Record Date”) will receive notice of, and be entitled to vote at, our Annual Meeting. At the close of business on the Record Date 12,703,847 shares of common stock, par value $0.001 per share, were outstanding and entitled to vote. Our common stock is our only class of outstanding voting securities.

Each share of our common stock as of the close of business on the Record Date is entitled to one vote on each matter presented at the Annual Meeting. There is no cumulative voting.

| ● | Stockholder of Record: Shares Registered in Your Name. If, on March 1, 2021, your shares were registered directly in your name with our transfer agent, Issuer Direct Corporation, then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. | |

| ● | Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Agent. If, on March 1, 2021, your shares were held not in your name, but rather in an account at a bank, brokerage firm, or other agent or nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your bank, broker or other agent or nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting or by proxy unless you request and obtain a power of attorney or other proxy authority from your bank, broker or other agent or nominee. |

WHAT CONSTITUTES A QUORUM FOR THE ANNUAL MEETING?

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of at least a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. On the Record Date, there were 12,703,847 shares of common stock outstanding and entitled to vote. At least 6,351,925 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

HOW ARE VOTES COUNTED AND HOW ARE BROKER NON−VOTES TREATED?

Votes will be counted by the inspector of election appointed for the Annual Meeting who will separately count “For” votes, “Against” votes, abstentions, withheld votes and broker non-votes. Votes withheld, broker non-votes and abstentions are deemed as “present” at the Annual Meeting and are counted for quorum purposes.

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our board of directors on all matters and as the proxy holder may determine in his/her discretion with respect to any other matters properly presented for a vote before the Annual Meeting.

If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 3 - Ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm is commonly considered as a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 3. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 - Election of Directors, Proposal 2 - Adoption of our 2021 Equity Incentive Plan, Proposal 4 - Advisory vote to approve the compensation of the named executive officers, and Proposal 5 - Advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

| 3 |

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

| ● | Proposal 1 - the election of five (5) directors, requires a plurality of the votes cast to elect a director. The five (5) nominees receiving the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Only votes “FOR” will affect the outcome. Withheld votes or broker non-votes will not affect the outcome of the vote on Proposal 1. | |

| ● | Proposal 2 - the adoption of our 2021 Equity Incentive Plan will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. | |

| ● | Proposal 3 - the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. | |

| ● | Proposal 4 - the advisory vote to approve the compensation of named executive officers will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. | |

| ● | Proposal 5 - the advisory vote to determine the frequency of future advisory votes on the compensation of named executive officers requires the affirmative vote of the holders of the majority of the votes cast by the holders of the Company’s common stock at the Annual Meeting. Stockholders may either vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” or “ABSTAIN.” If none of the alternatives receives the majority of votes cast, the Company will consider the alternative that receives the highest number of votes cast by stockholders to be the frequency selected by the stockholders. The approval of the advisory vote to approve the compensation of named executive officers and the approval of the advisory vote to determine the frequency of future advisory votes on the compensation of named executive officers are non-binding advisory votes. |

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the Annual Meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the Annual Meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the Annual Meeting.

WHO CONDUCTS THE PROXY SOLICITATION AND HOW MUCH DOES IT COST?

We are soliciting the proxies and will bear the entire cost of this solicitation, including the preparation, assembly, printing and mailing of this proxy statement and any additional materials furnished to our stockholders. Copies of solicitation material will be furnished to banks, brokerage houses and other agents holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to these beneficial owners. In addition, if asked, we will reimburse these persons for their reasonable expenses in forwarding the solicitation material to the beneficial owners. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. The original solicitation of proxies by mail may be supplemented by telephone, fax, Internet and personal solicitation by our directors, officers or other employees. Directors, officers and employees will not be paid any additional compensation for soliciting proxies.

| 4 |

HOW CAN I VOTE?

If you are a stockholder of record, you may:

| ● | VOTE AT THE ANNUAL MEETING - if you would like to vote at the Annual Meeting, please follow the instructions that will be available at https://agm.issuerdirect.com/flux during the Annual Meeting; | |

| ● | VOTE BY MAIL IN ADVANCE OF THE ANNUAL MEETING - if you request a paper proxy card, complete, sign and date the enclosed proxy card, then follow the instructions on the card: or | |

| ● | VOTE VIA THE INTERNET OR VIA TELEPHONE IN ADVANCE OF THE ANNUAL MEETING - if you would like to vote in advance of the Annual Meeting by phone please call 1(866) 752-VOTE (8683) or follow the instructions on the proxy card and have the proxy card available when you access the internet website or place your telephone call. |

If you submit your vote by fax or mail, your completed, signed and dated proxy card must be received prior to the Annual Meeting. Submitting your proxy, whether via the internet, via telephone or by mail if you requested a paper proxy card, will not affect your right to vote at the Annual Meeting should you decide to attend the meeting.

If you are not a stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE?

If you receive more than one Internet Notice or proxy card from us or your bank, this usually means that your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card via the internet, telephone or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

How Your Shares Will Be Voted

Shares represented by proxies that are properly executed and returned, and not revoked, will be voted as specified. If you sign a proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you hold your shares in street name and do not vote, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

| 5 |

HAS THE BOARD OF DIRECTORS MADE A RECOMMENDATION REGARDING THE MATTERS TO BE ACTED UPON AT THE ANNUAL MEETING?

Yes. Our board of directors recommends that you cast your vote:

| 1. | “FOR” the election of the five nominees for directors named in this proxy statement; | |

| 2. | “FOR” the approval of our 2021 Equity Incentive Plan; | |

| 3. | “FOR” the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2021; | |

| 4. | “FOR” the approval, on an advisory basis, of the compensation paid to our named executive officers; | |

| 5. | “FOR” the approval, on an advisory basis, of a THREE (3) YEAR advisory vote on the compensation of our named executive officers. |

CAN I CHANGE MY VOTE OR REVOKE MY VOTE IF I VOTE BY PROXY?

Yes. As a stockholder of record, if you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You may revoke your proxy by doing any of the following:

| 1. | Delivering a written notice that you are revoking your proxy to our Corporate Secretary at the address indicated below prior to the Annual Meeting. | |

| 2. | Signing and delivering another properly completed proxy card with a later date pursuant instructions on the proxy card. | |

| 3. | Voting again via internet or by telephone no later than 10 a.m. Pacific Time on April 29, 2021. | |

| 4. | Attending the Annual Meeting and vote at the meeting. Simply attending the meeting will not, by itself, revoke your proxy. |

Any written notice of revocation should be delivered to:

| Flux Power Holdings, Inc. | |

| Attn: Charles A. Scheiwe, Corporate Secretary | |

| 2685 S. Melrose Drive | |

| Vista, California 92081 |

If your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE ANNUAL MEETING?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our Current Report on Form 8-K within four (4) business days following the Annual Meeting.

ARE THERE ANY Interest of Officers and Directors in Matters to Be Acted Upon?

None of the Company’s officers or directors has any interest in any of the matters to be acted upon, except to the extent that a director is named as a nominee for election to the board of directors or a director or an officer may be granted equity award under our 2021 Equity Incentive Plan.

| 6 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to all of our directors, officers, and employees. Any waivers of any provision of this Code for our directors or officers may be granted only by our board of directors, or also Board, or a committee appointed by our board of directors.

We have filed a copy of the Code with the SEC and have made it available on our website at https://www.fluxpower.com/corporate-governance. In addition, we will provide any person, without charge, a copy of this Code. Requests for a copy of the Code may be made by writing to the Company at c/o Corporate Secretary, Flux Power Holdings, Inc., 2685 S. Melrose Drive, Vista, California 92081. We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code by posting such information on our website.

Board Leadership Structure and Role in Risk Oversight

Our board of directors as a whole has responsibility for risk oversight. Our board of directors exercises this risk oversight responsibility directly and through its committees. The risk oversight responsibility of our board of directors and its committees is informed by reports from our management teams to provide visibility to our board of directors about the identification, assessment and management of key risks, and our management’s risk mitigation strategies. Our board of directors has primary responsibility for evaluating strategic and operational risk, including related to significant transactions. Our audit committee has primary responsibility for overseeing our major financial and accounting risk exposures, and, among other things, discusses guidelines and policies with respect to assessing and managing risk with management and our independent auditor. Our compensation committee has responsibility for evaluating risks arising from our compensation and people policies and practices. Our nominating and corporate governance committee has responsibility for evaluating risks relating to our corporate governance practices. Our committees and management provide reports to our board of directors on these matters.

In its governance role, and particularly in exercising its duty of care and diligence, our board of directors is responsible for ensuring that appropriate risk management policies and procedures are in place to protect the Company’s assets and business. Our board of directors has broad and ultimate oversight responsibility for our risk management processes and programs and executive management is responsible for the day-to-day evaluation and management of risks to the Company. We do not have a policy as to whether the roles of our chairman and chief executive officer should be separate. Instead, our board of directors makes this determination based on what best serves our Company’s needs at any given time.

Board Composition, Committees and Independence

Under the rules of NASDAQ, “independent” directors must make up a majority of a listed company’s board of directors. In addition, applicable NASDAQ rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent within the meaning of the applicable NASDAQ rules. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our board of directors has undertaken a review of the independence of each director and considered whether any director has a material relationship with us that could compromise the director’s ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our board of directors determined that Ms. Walters-Hoffert, Mr. Cosentino and Mr. Robinette are independent directors as defined in the listing standards of NASDAQ and SEC rules and regulations. A majority of our directors are independent, as required under applicable NASDAQ rules. As required under applicable NASDAQ rules, our independent directors will meet in regularly scheduled executive sessions at which only independent directors are present.

| 7 |

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation committee, and a nominating and governance committee. The composition and responsibilities of each of the committees is described below.

Audit Committee

Our audit committee currently consists of three independent directors of which at least one, the Chairman of the audit committee, qualifies as a qualified financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Ms. Walters-Hoffert is the Chairperson of the audit committee and financial expert, and Mr. Robinette and Mr. Cosentino are members of the audit committee. Mr. Cosentino also qualifies as a qualified financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. The audit committee’s duties are to recommend to our board of directors the engagement of the independent registered public accounting firm to audit our consolidated financial statements and to review our accounting and auditing principles. The audit committee reviews the scope, timing and fees for the annual audit and the results of audit examinations performed by any internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. The audit committee will at all times be composed exclusively of directors who are, in the opinion of our board of directors, free from any relationship that would interfere with the exercise of independent judgment as a committee member and who possess an understanding of consolidated financial statements and generally accepted accounting principles. Our audit committee operates under a written charter, which is available on our website at https://www.fluxpower.com.

Compensation Committee

Our compensation committee establishes our executive compensation policy, determines the salary and bonuses of our executive officers and recommends to the Board stock option grants for our executive officers. Mr. Robinette is the Chairperson of the compensation committee, and Ms. Walters-Hoffert and Mr. Cosentino are members of the compensation committee. Each of the members of our compensation committee are independent under NASDAQ’s independence standards for compensation committee members. Our chief executive officer often makes recommendations to the compensation committee and the Board concerning compensation of other executive officers. The compensation committee seeks input on certain compensation policies from the chief executive officer. Our compensation committee continues to engage third party consultants regarding market compensation for our employees. Our compensation committee operates under a written charter, which is available on our website at https://www.fluxpower.com.

Nominating and Governance Committee

Our nominating and governance committee is responsible for matters relating to the corporate governance of our Company and the nomination of members of the Board and committees of the Board. Mr. Cosentino is the Chairperson of the nominating and governance committee, and Ms. Walters-Hoffert and Mr. Robinette are members of the nominating and governance committee. Each of the members of our nominating and governance committee is independent under NASDAQ’s independence standards. The nominating and governance committee operates under a written charter, which is available on our website at https://www.fluxpower.com.

Board and Committee Meetings and Attendance

Our Board and audit committee meet regularly throughout the year, and also hold special meetings and act by written consent. During Fiscal 2020: (i) our Board met four (4) times; (ii) our audit committee met four (4) times; (iii) our compensation committee met one (1) time; and (iv) our nominating and corporate governance committee did not meet.

During fiscal year ended June 30, 2020, or Fiscal 2020, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

| 8 |

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. All of our directors intend to attend the Annual Meeting.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson or lead independent director, if any) may do so by letters addressed to the attention of our Corporate Secretary. All communications are reviewed by the Corporate Secretary and provided to the members of our board of directors as appropriate. The address for these communications is:

Flux Power Holdings, Inc.

Attn: Charles A. Scheiwe, Corporate Secretary

2685 S. Melrose Drive

Vista, California 92081

| 9 |

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

The nominating and corporate governance committee, or governance committee, is responsible for recommending to the board of directors nominees for election to our board of directors at each annual meeting of stockholders and for identifying one or more candidates to fill any vacancies that may occur on our board of directors. New candidates may be identified through recommendations from existing directors or members of management, consultants or third-party search firms, discussions with other persons who may know of suitable candidates to serve on our board of directors, and stockholder recommendations. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications by the nominating and corporate governance committee, interviews with the committee as a whole, one or more members of the committee, or one or more other board members, and discussions within the committee and the full board. The nominating and corporate governance committee then recommends candidates to the full board, with the full board of directors selecting the candidates to be nominated for election by the stockholders or to be appointed by the board of directors to fill a vacancy.

The nominating and corporate governance committee will consider director candidates proposed by stockholders as well as recommendations from other sources. Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth in section titled “Stockholder Proposals for the 2022 Annual Meeting.”

Director Qualifications

In accordance with its charter, the nominating and corporate governance committee develops and recommends to our board of directors appropriate criteria, including desired qualifications, expertise, skills and characteristics, for selection of new directors and periodically reviews the criteria adopted by our board of directors and, if appropriate, recommends changes to such criteria.

Board Diversity

Our board of directors seeks members from diverse professional backgrounds who combine a strong professional reputation and knowledge of our business and industry with a reputation for integrity. Our board of directors does not have a formal policy with respect to diversity and inclusion, but is in process of establishing a policy on diversity. Diversity of experience, expertise and viewpoints is one of many factors the nominating and corporate governance committee considers when recommending director nominees to our board of directors. Further, our board of directors is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. Our board of directors also seeks members that have experience in positions with a high degree of responsibility or are, or have been, leaders in the companies or institutions with which they are, or were, affiliated, but may seek other members with different backgrounds, based upon the contributions they can make to our company.

We believe that our current board composition reflects our commitment to diversity in the areas of gender and professional background.

| 10 |

ELECTION OF DIRECTORS

General

Our board of directors, or Board, has the authority to fix the number of director seats on our Board and, effective as of the date of the Annual Meeting of Stockholders, our Board has approved fixing the number of directors at five (5). Directors serve for a term of one (1) year and stand for election at our annual meeting of stockholders. Pursuant to our Amended and Restated Bylaws, a majority of directors may appoint a successor to fill any vacancy that occurs on the Board between annual meetings. At the Meeting, stockholders will be asked to elect the nominees for director listed below.

Nominees for Director

The nominees for director have consented to being named as nominees in this proxy statement and have agreed to serve as directors, if elected. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the five (5) nominees named below. If any nominee of the Company is unable or declines to serve as a director at the time of the Meeting, the proxies will be voted for any nominee designated by the present board of directors to fill the vacancy. The board of directors has no reason to believe that any of the nominees will be unavailable for election. The Directors who are elected will hold office until the next Annual Meeting of Stockholders or until their earlier death, resignation or removal, or until their successors are elected and qualified. There are no arrangements or understandings between any of our directors and any other person pursuant to which any director was selected to serve as a director of our company. Directors are elected until their successors are duly elected and qualified. There are no family relationships among our directors or officers.

The following sets forth the persons nominated by the board of directors for election and certain information with respect to those individuals:

| Director Nominee | Age | Position | Director Since | |||

| Ronald F. Dutt | 74 | Director, Chief Executive Officer and President | 2014 | |||

| Michael Johnson | 72 | Director | 2012 | |||

| Lisa Walters-Hoffert(1)(2) | 62 | Director | 2019 | |||

| Dale Robinette(1)(3) | 56 | Director | 2019 | |||

| John A. Cosentino, Jr.(1)(4) | 71 | Director | 2020 |

| (1) | Independent Director |

| (2) | Chairperson of the Audit Committee, Member of Compensation Committee, Member of Governance Committee |

| (3) | Chairperson of the Compensation Committee, Member of Audit Committee, Member of Governance Committee |

| (4) | Chairperson of the Governance Committee, Member of Audit Committee, Member of Compensation Committee |

Biographies of Nominees

Ronald F. Dutt. Chairman, Chief Executive Officer, President, and Director. Mr. Dutt has been our chief executive officer, former interim chief financial officer and director since March 19, 2014. He became our chairman on June 28, 2019. On September 19, 2017, he was also appointed as our president, chief financial officer and corporate secretary. He resigned as chief financial officer and corporate secretary as of December 16, 2018. Previously, he was our chief financial officer since December 7, 2012, and our interim chief executive officer since June 28, 2013. Mr. Dutt has served as the Company’s interim corporate secretary since June 28, 2013. Prior to Flux Power, Mr. Dutt provided chief financial officer and chief operating officer consulting services during 2008 through 2012. In this capacity Mr. Dutt provided financial consulting, including strategic business modeling and managed operations. Prior to 2008, Mr. Dutt served in several capacities as executive vice president, chief financial officer and treasurer for various public and private companies including SOLA International, Directed Electronics, Fritz Companies, DHL Americas, Aptera Motors, Inc., and Visa International. Mr. Dutt holds an MBA in Finance from University of Washington and an undergraduate degree in Chemistry from the University of North Carolina. Additionally, Mr. Dutt served in the United States Navy and received an honorable discharge as a Lieutenant.

| 11 |

Michael Johnson, Director. Mr. Johnson has been our director since July 12, 2012. Mr. Johnson has been a director of Flux Power since it was incorporated. Since 2002, Mr. Johnson has been a director and the chief executive officer of Esenjay Petroleum Corporation (Esenjay Petroleum), a Delaware company located in Corpus Christi, Texas, which is engaged in the business oil exploration and production. Mr. Johnson’s primary responsibility at Esenjay Petroleum is to manage the business and company as chief executive officer. Mr. Johnson is a director and beneficial owner of Esenjay Investments LLC, a Delaware limited liability company engaged in the business of investing in companies, and an affiliate of the Company owning approximately 40.2% of our outstanding shares, including common stock underlying options, warrants and convertible debt that were exercisable or convertible or which would become exercisable or convertible within sixty (60) days. As a result of Mr. Johnson’s leadership and business experience, he is an industry expert in the natural gas exploration industry and brings a wealth of management and successful company building experience to the board. Mr. Johnson received a Bachelor of Science degree in mechanical engineering from the University of Southwestern Louisiana.

Lisa Walters-Hoffert, Director. Ms. Walters-Hoffert was appointed to our Board on June 28, 2019. Ms. Walters-Hoffert was a co-founder of Daré Bioscience, Inc. and following the company’s merger with Cerulean Pharma, Inc. in July of 2017, became Chief Financial Officer of the surviving public company (NASDAQ: DARE). For over twenty-five (25) years, Ms. Walters-Hoffert was an investment banker focused on small-cap public companies in the technology and life science sectors. From 2003 to 2015, Ms. Walters-Hoffert worked at Roth Capital Partners as Managing Director in the Investment Banking Division. Ms. Walters-Hoffert has held various positions in the corporate finance and investment banking divisions of Citicorp Securities in San José, Costa Rica and Oppenheimer & Co, Inc. in New York City, New York. Ms. Walters-Hoffert has served as a member of the Board of Directors of the San Diego Venture Group, as Past Chair of the UCSD Librarian’s Advisory Board, and as Past Chair of the Board of Directors of Planned Parenthood of the Pacific Southwest. Ms. Walters-Hoffert currently serves as a member of the Board of Directors of The Elementary Institute of Science in San Diego. Ms. Walters-Hoffert graduated magna cum laude from Duke University with a B.S. in Management Sciences. As a senior financial executive with over twenty-five years of experience in investment banking and corporate finance and based on Ms. Walters-Hoffert’s expertise in audit, compliance, valuation, equity finance, mergers, and corporate strategy, the Company believes Ms. Walters-Hoffert is qualified to be on the Board.

Dale T. Robinette, Director. Mr. Robinette was appointed to our Board on June 28, 2019. Mr. Robinette has been a CEO Coach and Master Chair since 2013 as an independent contractor to Vistage Worldwide, Inc., an executive coaching company. In addition, since 2013 Mr. Robinette has been providing business consulting related to top-line growth and bottom-line improvement through his company EPIQ Development. From 2013 to 2019, Mr. Robinette was the Founder and CEO of EPIQ Space, a marketing website for the satellite industry, a member-based community of suppliers promoting their offerings. Mr. Robinette was with Peregrine Semiconductor, Inc., a manufacturer of high-performance RF CMOS integrated circuits, from 2007 to 2013 in two roles as a Director of Worldwide Sales as well as the Director of the High Reliability Business Unit. Mr. Robinette started his career from 1991 to 2007 at Tyco Electronics Ltd. (known today as TE Connectivity Ltd.), a passive electronics manufacturer, in various sales, sales leadership and product development leadership roles. Mr. Robinette received a Bachelor of Science degree in Business Administration, Marketing from San Diego State University. Based on the above qualifications, the Company believes Mr. Robinette is qualified to be on the Board.

John A. Cosentino, Jr., Director. Mr. Cosentino was appointed to our Board on May 7, 2020. Mr. Cosentino has been a director of Sturm, Ruger & Company, Inc. (NYSE: RGR), a firearm manufacturing company listed on the NYSE, since 2005 to the present, a partner of Ironwood Manufacturing Fund, LP, a private equity fund, since 2002, a director of Simonds International, Inc., a cutting tools manufacturer, since 2001, the Chairman of the Board of Habco Industries LLC, an aerospace equipment and services supplier, since 2012, and Senior Advisor of Ironwood Capital Holdings LLC, a private equity firm, since 2012. He was a director of Addaero LLC, Whitcraft LLC, Bilco Company, Chairman of North American Specialty Glass LLC, Vice-Chairman of Primary Steel LLC, and a director of the Wiremold Company. Mr. Cosentino was a partner of Capital Resource Partners, LP, a private capital firm, from 1999 to 2000, and served as a director in a number of its portfolio companies. Mr. Cosentino was the Vice President-Operations of the Stanley Works (NYSE:SWK), President and Co-owner of PCI Group, Inc., CEO and Co-owner of Rau Fastener, LLC, President of the Otis Elevator-North America division of United Technologies Corporation (NYSE:UTX), and Group Executive of the Danaher Corporation (NYSE:DHR). Mr. Cosentino received an undergraduate degree from Harvard University and an MBA from the University of Pennsylvania. The Board believes that Mr. Cosentino’s extensive executive management, investment management and board experience qualify him to serve on the Board of Directors.

| 12 |

Director Qualifications and Diversity

We seek directors with established strong professional reputations and experience in areas relevant to the strategy and operations of our businesses. We seek directors who possess the qualities of integrity and candor, who have strong analytical skills and who are willing to engage management and each other in a constructive and collaborative fashion. We also seek directors who have the ability and commitment to devote significant time and energy to serve on the Board and its committees. We believe that all of our directors meet the foregoing qualifications. We do not have a formal policy with respect to diversity.

Director Compensation

Director Compensation Table

Below is summary of compensation accrued or paid to our non-executive directors during fiscal years ended June 30, 2020 and 2019. Mr. Dutt, our chief executive officer and president, received no compensation for his service as a director and is not included in the table. The compensation Mr. Dutt receives as an employee of the Company is included in the section titled “Executive Compensation.”

| Name | Year | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards(3) ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

| Christopher Anthony(1) | 2020 | - | - | $ | - | - | $ | - | ||||||||||||||||

| 2019 | - | - | $ | 33,802 | - | $ | 33,802 | |||||||||||||||||

| James Gevarges (2) | 2020 | $ | 13,750 | - | $ | 28,287 | - | $ | 42,037 | |||||||||||||||

| 2019 | - | - | $ | 33,802 | - | $ | 33,802 | |||||||||||||||||

| Lisa Walters-Hoffert | 2020 | $ | 29,375 | - | $ | 28,287 | - | $ | 57,662 | |||||||||||||||

| Dale Robinette | 2020 | $ | 28,125 | - | $ | 28,287 | - | $ | 56,412 | |||||||||||||||

| John A. Cosentino Jr. | 2020 | $ | 13,750 | - | $ | 23,095 | - | $ | 36,845 | |||||||||||||||

| Michael Johnson | 2020 | $ | 17,500 | - | $ | 28,287 | - | $ | 45,787 | |||||||||||||||

| (1) | Mr. Anthony resigned as our director on June 28, 2019. |

| (2) | Mr. Gevarges resigned as our director on May 6, 2020. |

| (3) | The amounts shown in this column represent the full grant date fair value of the award granted, excluding any as computed in accordance with Financial Accounting Standards Board (“FASB”). The following table shows the aggregate number of stock options held by non-employee directors as of June 30, 2020 and June 30, 2019: |

| 13 |

| Name | Year | Vested Stock Options | ||||||

| Christopher Anthony(1) | 2020 | 1,500 | ||||||

| 2019 | 2,437 | |||||||

| James Gevarges(2) | 2020 | 6,761 | ||||||

| 2019 | 2,437 | |||||||

| Michael Johnson | 2020 | 1,993 | ||||||

| 2019 | 2,437 | |||||||

| Lisa Walters-Hoffert | 2020 | 493 | ||||||

| Dale Robinette | 2020 | 493 | ||||||

| (1) | Mr. Anthony resigned as our director on June 28, 2019. | |

| (2) | Mr. Gevarges resigned as our director on May 6, 2020. |

Compensation of Non-Executive Directors

In December 2019, our Board approved non-executive director compensation packages as recommended by the compensation committee. Below are the compensation packages for non-executive directors approved by the Board for 2020 calendar year:

Independent Non-Executive Director | Position | Base Retainer | Chair Fee | Committee Member | Stock Options | Total Comp | ||||||||||||||||||

| Lisa Walters-Hoffert | X | Audit Chair | $ | 35,000 | $ | 15,000 | $ | 8,750 | $ | 35,000 | $ | 93,750 | ||||||||||||

| Dale Robinette | X | Compensation Chair | $ | 35,000 | $ | 10,000 | $ | 11,250 | $ | 35,000 | $ | 91,250 | ||||||||||||

| John A. Cosentino Jr. | X | Governance Chair | $ | 35,000 | $ | 7,500 | $ | 12,500 | $ | 35,000 | $ | 90,000 | ||||||||||||

| Michael Johnson | Board Member | $ | 35,000 | $ | - | $ | - | $ | 35,000 | $ | 70,000 | |||||||||||||

In December 2020, pursuant to the recommendation and advice of the compensation committee of the Board of the Company, the Board approved the annual compensation package for non-executive directors of the Company for calendar year 2021 as follows:

Independent Non-Executive Director | Position | Base Retainer | Chair Fee | Committee Member | Total Comp | |||||||||||||||

| Lisa Walters-Hoffert | X | Audit Chair | $ | 50,000 | $ | 7,500 | $ | - | $ | 57,500 | ||||||||||

| Dale Robinette | X | Compensation Chair | $ | 50,000 | $ | 5,000 | $ | - | $ | 55,000 | ||||||||||

| John A. Cosentino Jr. | X | Governance Chair | $ | 50,000 | $ | 5,000 | $ | - | $ | 55,000 | ||||||||||

| Michael Johnson | Board Member | $ | 50,000 | $ | - | $ | - | $ | 50,000 | |||||||||||

Restricted Stock Units

In addition, our directors are eligible to receive an annual equity grant of restricted stock units, which terms are determined at the time of grant.

| 14 |

Vote Required

Directors are elected by a plurality of the votes properly cast in person or by proxy. If a quorum is present and voting, the five (5) nominees receiving the highest number of affirmative votes will be elected. Our Amended and Restated Articles of Incorporation do not permit stockholders to cumulate their votes for the election of directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five (5) nominees. Abstentions and broker non-votes will have no effect on the outcome of the election of directors.

Recommendation of the Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” THE ELECTION OF ALL THE DIRECTOR NOMINEES.

| 15 |

APPROVAL OF THE 2021 EQUITY INCENTIVE PLAN

General

Our 2021 Equity Incentive Plan was approved by our board of directors on February 24, 2021. Our board of directors and management believe that in order to attract, hire, and retain the caliber of executives and employees that will be required to help us position ourselves for growth, we will need to have the flexibility to grant stock awards, restricted stock units, stock options, stock appreciation rights and other equity instruments. The board of directors believes that equity incentive compensation is also an important component of our overall compensation and incentive strategy for employees, directors, officers and consultants. Without a broad based equity plan, we believe that we will be impaired in our efforts to hire new executives of the caliber that we believe is required, and will not be able to offer competitive packages to retain such executives. We intend to use the 2021 Equity Incentive Plan in order to incentivize and retain our employees, directors, officers and consultants.

Under the 2021 Equity Incentive Plan, the Company will reserve a total of two million (2,000,000) shares of our common stock for issuance under the 2021 Equity Incentive Plan. Currently there are no shares or options granted under the 2021 Equity Incentive Plan.

General Summary of the 2021 Equity Incentive Plan

The principal provisions of the 2021 Equity Incentive Plan are summarized below. This general summary is not a complete description of all of the 2021 Equity Incentive Plan’s provisions, and is qualified in its entirety by reference to the 2021 Equity Incentive Plan which is attached as Appendix A to this proxy statement. Capitalized terms in this summary not defined in this proxy statement have the meanings set forth in the 2021 Equity Incentive Plan.

Structure. The 2021 Equity Incentive Plan allows for the grant of incentive stock options, nonqualified stock options, stock appreciation rights, stock awards and restricted stock units (the “Awards”) at the discretion of the Administrator.

Number of Shares. Subject to adjustment as provided in Section 9.1 in the 2021 Equity Incentive Plan, the total number of shares of common stock reserved and available for delivery in connection with awards under the 2021 Equity Incentive Plan will be two million (2,000,000). Shares granted under the Plan may be authorized but unissued Shares or reacquired Shares bought on the market or otherwise.

Administration. Authority to control and manage the operation and administration of the 2021 Equity Incentive Plan will be vested collectively in our board of directors, and/or the compensation committee of the board of directors or such other committee appointed by the board of directors to administer the 2021 Equity Incentive Plan (“Committee”), and/or one or more executive officers of the Company designated by the board of directors (collectively, the “Administrator”) as appointed by the board of directors from time to time. The Administrator will have all powers and discretion necessary or appropriate to administer the Plan and to control its operation. Election for restricted stock grants will be allowed to receive grants in either stock shares or cash. The Administrator may delegate all or any part of its authority and powers to one or more directors of the Company in its discretion. Any decision or action of the Administrator in connection with the 2021 Equity Incentive Plan is final and binding.

Effective Date and Duration of Awards. The Plan is effective as of the Plan Adoption Date (subject to stockholder approval) and will remain in effect thereafter. However, without further stockholder approval, no Award may be granted under the Plan more than ten (10) years after the Plan Adoption Date.

Eligibility. Employees of the Company or its Affiliates, consultants who provide significant services to the Company or its Affiliates and directors of the Company or any of its Affiliates who are employees of neither the Company nor any Affiliate (each a “Participant”) are eligible to participate in the 2021 Equity Incentive Plan. Determinations as to which eligible persons will be granted awards will be made by the Administrator.

| 16 |

Nonemployee Director Award Limitations. No nonemployee Director may be paid, issued, or granted in any Fiscal year, awards with an aggregate value and any other compensation that, in the aggregate, exceed $500,000. Any Awards or other compensation paid or provided to an individual for his or her services as an Employee, or for his or her services as a Consultant (other than as a Nonemployee Director), will not count for purposes of the limitation under Section 10.7.

Limited Transferability. Unless provided otherwise by the Administrator, no Award granted under the 2021 Equity Incentive Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. All rights with respect to an Award granted to a Participant will be available during his or her lifetime only to the Participant.

Forfeiture Events. The Administrator may specify in an Award Agreement that the Participant’s rights, payments, and benefits with respect to an Award will be subject to reduction, cancellation, forfeiture, recoupment, reimbursement, or reacquisition upon the occurrence of certain specified events, in addition to any otherwise applicable vesting or performance conditions of an Award. Notwithstanding any provisions to the contrary under the 2021 Equity Incentive Plan, an Award will be subject to the Company’s clawback policy as may be established and/or amended from time to time to comply with Applicable Laws.

Change in Control. In the event of a Change in Control, as defined in the 2021 Equity Incentive Plan, event or Corporate Transaction, and unless otherwise provided in the instrument evidencing the Award or any other written agreement between the Company or any Affiliate and the Participant, or otherwise expressly provided by the Administrator at the time of grant of an Award, the Administrator will take one or more of the following actions with respect to Awards, contingent upon the closing or completion of the Corporate Transaction:

| (i) | arrange for the surviving corporation or acquiring corporation (or the surviving or acquiring corporation’s parent company) to assume or continue the Award or to substitute a similar Award for the Award; | |

| (ii) | arrange for the assignment of any reacquisition or repurchase rights held by the Company in respect of the Shares issued pursuant to the Award to the surviving corporation or acquiring corporation (or the surviving or acquiring corporation’s parent company); | |

| (iii) | accelerate the vesting, in whole or in part, of the Award (and, if applicable, the time at which the Award may be exercised) to a date prior to the effective time of such Corporate Transaction as the Administrator determines, with such Award terminating if not exercised (if applicable) at or prior to the effective time of the Corporate Transaction in accordance with the exercise procedures determined by the Administrator; | |

| (iv) | arrange for the lapse, in whole or in part, of any reacquisition or repurchase rights held by the Company with respect to the Award; | |

| (v) | cancel or arrange for the cancellation of the Award, to the extent not vested or not exercised prior to the effective time of the Corporate Transaction, in exchange for no consideration ($0) or such consideration, if any, as determined by the Administrator; or | |

| (vi) | cancel or arrange for the cancellation of the Award, to the extent not vested or not exercised prior to the effective time of the Transaction, in exchange for a payment, in such form as may be determined by the Administrator. |

The Administrator need not take the same action or actions with respect to all Awards or portions thereof or with respect to all Participants. An Award may be subject to additional acceleration of vesting and exercisability upon or after a Change in Control as may be provided in the Award Agreement for such Award or as may be provided in any other written agreement between the Company or any Affiliate and the Participant, but in the absence of such provision, no such acceleration will occur.

| 17 |

Amendment, Suspension or Termination. The Administrator may grant awards pursuant to the 2021 Equity Incentive Plan until it is discontinued, suspended or terminated at any time of the board of directors in its sole discretion. No Award may be granted under the 2021 Equity Incentive Plan during any period of suspension or after termination of the 2021 Equity Incentive Plan; provided, however, that no Award may be granted under the 2021 Equity Incentive Plan more than ten (10) years after the adoption date of the plan. The Company will obtain stockholder approval of any material Plan amendment to the extent desirable to comply with Section 422 of the Code, or other Applicable Law.

Stock Options. Stock options, or Options, may be granted to Employees, Nonemployee Directors and Consultants. Options may be granted at any time and from time to time as determined by the Administrator in its discretion. The Administrator may grant Incentive Stock Options (“ISOs”), Nonqualified Stock Options (“NSOs”), or a combination thereof, and the Administrator will determine the number of Shares subject to each Option in its sole discretion. Each Option will be evidenced by an Award Agreement that will specify the Exercise Price, the expiration date of the Option, the number of Shares to which the Option pertains, any conditions to exercise the Option, and such other terms and conditions as the Administrator, in its discretion, will determine. The Award Agreement will also specify whether the Option is intended to be an Incentive Stock Option or a Nonqualified Stock Option.

For NSOs, the per Share exercise price will not be less than one hundred percent (100%) of the Fair Market Value of a Share on the Grant Date, as determined by the Administrator. For Incentive Stock Options, the Exercise Price will be not less than one hundred percent (100%) of the Fair Market Value of a Share on the Grant Date; provided, however, that if on the Grant Date, the Employee owns stock possessing more than ten percent ( 10%) of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries, then the Exercise Price will be not less than one hundred ten percent (110%) of the Fair Market Value of a Share on the Grant Date. Options will be exercised by the Participant’s delivery of a written notice of exercise to the Secretary of the Company (or its designee), setting forth the number of Shares with respect to which the Option is to be exercised, accompanied by full payment for the Shares and satisfaction of all applicable tax withholding. Upon the exercise of any Option, the Exercise Price will be payable to the Company in full in cash or its equivalent, or as determined by the Administrator in its discretion and consistent with the purposes of the 2021 Equity Incentive Plan.

With respect to the “unvested” Shares underlying a Participant’s Option, such Option will terminate immediately upon the date the Participant ceases his/her Continuous Status as an Employee or Consultant for any reason. With respect to the “vested” Shares underlying a Participant’s Option, unless otherwise specified in the Award Agreement, such Option will terminate in accordance with Section 5.4.1 of the 2021 Equity Incentive Plan. However, a Participant’s Continuous Status as an Employee or Consultant will not automatically terminate solely as a result of such change in status.

Notwithstanding Section 10.5, the Participant may, in a manner specified by the Administrator, (a) transfer a Nonqualified Stock Option to a Participant’s spouse, former spouse or dependent pursuant to a court-approved domestic relations order which relates to the provision of child support, alimony payments or marital property rights and (b) transfer a Nonqualified Stock Option by bona fide gift and not for any consideration to (i) a member or members of the Participant’s immediate family, (ii) a trust established for the exclusive benefit of the Participant and/or member(s) of the Participant’s immediate family, (iii) a partnership, limited liability company or other entity whose only partners or members are the Participant and/or member(s) of the Participant’s immediate family or (iv) a foundation in which the Participant and/or member(s) of the Participant’s immediate family control the management of the foundation’s assets.

Stock Appreciation Rights (SARs). A SAR may be granted to Employees, Nonemployee Directors and Consultants at any time and from time to time as will be determined by the Administrator. The Administrator will have complete discretion to determine the number of SARs granted to any Participant and the terms and conditions of SARs granted, including whether upon exercise the SARs will be settled in Shares or cash pursuant to the provisions set forth in Section 6.5. Each SAR grant will be evidenced by an Award Agreement that will specify the Exercise Price, the term of the SAR, the conditions of exercise and such other terms and conditions as determined by the Administrator. The Exercise Price of a SAR will be not less than one hundred percent (100%) of the Fair Market Value of a Share on the Grant Date. SARs will expire upon the date determined by the Administrator in its discretion as set forth in the Award Agreement, or otherwise pursuant to the provisions in Sections 5.4.

| 18 |

Stock Awards. Stock Awards may be granted to Employees, Nonemployee Directors and Consultants from time to time and in such amounts as the Administrator will determine in its discretion. Stock Awards may be granted as either Restricted Stock, subject to vesting conditions and other restrictions, or Unrestricted Stock, which will be free of restrictions and freely transferable. The Administrator will determine the form of Stock Award and the number of Shares to be granted to each Participant. Unrestricted Stock Awards will be evidenced by a Notice of Grant, while Restricted Stock Awards will be evidenced by a Restricted Stock Award Agreement.

The Restricted Stock Award Agreement will specify the Period of Restriction, the number of Shares granted, and such other terms and conditions as the Administrator, in its discretion, will determine. Shares of Restricted Stock will be held by the Company as escrow agent until the restrictions on such Shares have lapsed unless determined otherwise by the Administrator. The Administrator, in its discretion, will impose vesting conditions on Shares of Restricted Stock as it may deem advisable or appropriate. Shares of Restricted Stock that are not vested will be forfeited upon the termination of Participant’s Continuous Status as an Employee, Nonemployee Director or Consultant. On the date set forth in the Award Agreement, the Restricted Stock for which restrictions have not lapsed will revert to the Company and again will become available for grant under the Plan.

Restricted Stock Units. Restricted Stock Units may be granted to Employees, Nonemployee Directors and Consultants at any time and from time to time, as will be determined by the Administrator in its sole discretion. The Administrator will have complete discretion in determining the number of Restricted Stock Units granted to any Participant under an Award Agreement, subject to the limitations in Sections 4.1. The Administrator has sole discretion to set the vesting provisions, which may include any combination of time-based or performance-based vesting conditions. The grant of Restricted Stock Units will be evidenced by an Award Agreement, which will specify whether the Restricted Stock Units will be settled in Shares or cash, to be made as soon as reasonably practical upon vesting and upon satisfaction of the vesting conditions. On the earlier of the cancellation date set forth in the Award Agreement or upon the termination of Participant’s Continuous Status as an Employee, Nonemployee Director or Consultant, all unvested Restricted Stock Units will be forfeited to the Company, and again will be available for grant under the 2021 Equity Incentive Plan.

Federal Income Tax Matters

THE FOREGOING IS ONLY A GENERAL SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE 2021 EQUITY INCENTIVE PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF AN INDIVIDUAL’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE. THE U.S. FEDERAL TAX LAWS MAY CHANGE AND THE FEDERAL, STATE AND LOCAL TAX CONSEQUENCES FOR ANY PARTICIPANT WILL DEPEND UPON HIS OR HER INDIVIDUAL CIRCUMSTANCES. TAX CONSEQUENCES FOR ANY PARTICULAR INDIVIDUAL MAY BE DIFFERENT. WE ADVISE PARTICIPANTS TO CONSULT WITH A TAX ADVISOR REGARDING THE TAX IMPLICATIONS OF THEIR TAX AWARDS UNDER THE 2021 EQUITY INCENTIVE PLAN.

Withholding Requirements. Prior to the delivery of any Shares or cash pursuant to an Award or exercise of an Award, the Company will have the power and the right to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy federal, state, and local taxes.

Compliance with Section 409A. Awards will be designed and operated in such a manner that they are either exempt from the application of, or comply with, the requirements of Section 409A such that the grant, payment, settlement or deferral will not be subject to the additional tax or interest applicable under Section 409A, except as otherwise determined in the sole discretion of the Administrator. The 2021 Equity Incentive Plan and each Award Agreement under the 2021 Equity Incentive Plan is intended to meet the requirements of Section 409A and will be construed and interpreted in accordance with such intent, except as otherwise determined in the sole discretion of the Administrator. To the extent that an Award or payment, or the settlement or deferral thereof, is subject to Section 409A, the Award will be granted, paid, settled or deferred in a manner that will meet the requirements of Section 409A, such that the grant, payment, settlement or deferral will not be subject to the additional tax or interest applicable under Section 409A. The Company or any of its Subsidiaries or Parents will have no obligation or liability under the terms of the 2021 Equity Incentive Plan to reimburse, indemnify, or hold harmless any Participant or any other person in respect of Awards, for any taxes, interest, or penalties imposed, or other costs incurred, as a result of Section 409A.

| 19 |

Incentive Stock Options. ISOs granted under the 2021 Equity Incentive Plan are intended to qualify for favorable tax treatment under Section 422 of the Code. Under Section 422, an optionee recognizes no taxable income when the option is granted. Further, the optionee generally will not recognize any taxable income when the option is exercised if he or she has at all times from the date of the option’s grant until three months before the date of exercise been an employee of the Company. The Company ordinarily is not entitled to any income tax deduction upon the grant or exercise of an incentive stock option. This favorable tax treatment for the optionee, and the denial of a deduction for the Company, will not, however, apply if the optionee disposes of the shares acquired upon the exercise of an incentive stock option within two years from the granting of the option or one year from the receipt of the shares.

Nonstatutory Stock Options. All options that do not qualify as ISOs are referred to as NSOs. Under present law, an optionee will not recognize any taxable income on the date an NSO is granted pursuant to the 2021 Equity Incentive Plan. Upon exercise of the option, however, the optionee must recognize, in the year of exercise, compensation taxable as ordinary income in an amount equal to the difference between the option price and the fair market value of Company common stock on the date of exercise. Upon the sale of the shares, any resulting gain or loss will be treated as capital gain or loss. The Company will receive an income tax deduction in its fiscal year in which NSOs are exercised equal to the amount of ordinary income recognized by those optionees exercising options, and must comply with applicable tax withholding requirements.

Restricted Stock Awards. Generally, no income is taxable to the recipient of a restricted stock award in the year that the award is granted. Instead, the recipient will recognize compensation taxable as ordinary income equal to the fair market value of the shares in the year in which the risks of forfeiture restrictions lapse. Alternatively, if a recipient makes an election under Section 83(b) of the Code, the recipient will, in the year that the restricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date of the award. The Company normally will receive a corresponding deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Unrestricted Stock Awards. Generally, the recipient will, in the year that the unrestricted stock award is granted, recognize compensation taxable as ordinary income equal to the fair market value of the shares on the date of the award. The Company normally will receive a corresponding deduction equal to the amount of compensation the recipient is required to recognize as ordinary taxable income, and must comply with applicable tax withholding requirements.

Restricted Stock Units. A recipient will not recognize taxable income at the time a stock unit is granted and the Company will not be entitled to a tax deduction at that time. Upon settlement of stock units, the recipient will recognize compensation taxable as ordinary income (and subject to income tax withholding in respect of an employee) in an amount equal to the fair market value of any shares delivered and the amount of any cash paid by the Company, and the Company will be entitled to a corresponding deduction, except to the extent the deduction limits of Section 162(m) of the Code apply.

Plan Benefits

The awards that may be granted under the 2021 Equity Incentive Plan to any participant or group of participants are indeterminable at the date of this proxy statement because participation and the types of awards that may be granted under the 2021 Equity Incentive Plan are subject to the discretion of the Administrator. No awards will be granted under the 2021 Equity Incentive Plan before the Annual Meeting.

Vote Required

Assuming a quorum is present, the affirmative vote of a majority of the shares present at the Annual Meeting and entitled to vote, either in person or by proxy, is required for approval of our 2021 Equity Incentive Plan. For purposes of the approval of our 2021 Equity Incentive Plan, abstentions will have the same effect as a vote against this proposal and broker non-votes will have no effect on the result of the vote.

Recommendation of the Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

YOU VOTE “FOR” APPROVAL OF THE 2021 EQUITY INCENTIVE PLAN.

| 20 |

RATIFICATION

OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM