UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2020

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-31543

FLUX POWER HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 86-0931332 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) | |

| 2685 S. Melrose Drive, Vista, California | 92081 | |

| (Address of principal executive offices) | (Zip Code) |

877-505-3589

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | FLUX | NASDAQ Capital Stock |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| (Do not check if a smaller reporting company) | ||||

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of December 31, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $11,630,000.

The number of shares of registrant’s common stock outstanding as of September 25, 2020 was 11,419,737.

Documents incorporated by reference: None.

FLUX POWER HOLDINGS, INC.

FORM 10-K ANNUAL REPORT

For the Fiscal Year Ended June 30, 2020

Table of Contents

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should read these factors and the other cautionary statements made in this report and in the documents we incorporate by reference into this report as being applicable to all related forward-looking statements wherever they appear in this report or the documents we incorporate by reference into this report. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| ● | our ability to continue as a going concern; | |

| ● | our ability to secure sufficient funding and alternative source of funding to support our current and proposed operations, which could be more difficult in light of the negative impact of the COVID-19 pandemic on investor sentiment and investing ability; | |

| ● | our anticipated growth strategies and our ability to manage the expansion of our business operations effectively; | |

| ● | our ability to maintain or increase our market share in the competitive markets in which we do business; | |

| ● | our ability to grow net revenue and increase our gross profit margin; | |

| ● | our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances; | |

| ● | our dependence on the growth in demand for our products; | |

| ● | our ability to compete with larger companies with far greater resources than we have; | |

| ● | our continued ability to obtain raw materials and other supplies for our products at competitive prices and on a timely basis, particularly in light of the potential impact of the COVID-19 pandemic on our suppliers and supply chain; | |

| ● | our ability to diversify our product offerings and capture new market opportunities; | |

| ● | our ability to source our needs for skilled labor, machinery, parts, and raw materials economically; | |

| ● | our ability to retain key members of our senior management; | |

| ● | our ability to continue to operate safely and effectively during the COVID-19 pandemic; and | |

| ● | our dependence on our four major customers. |

| 3 |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and file as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

| ● | the “Company,” “Flux,” “we,” “us,” and “our” refer to the combined business of Flux Power Holdings, Inc., a Nevada corporation and its wholly-owned subsidiary, Flux Power, Inc., a California corporation (Flux Power). | |

| ● | “Exchange Act” refers the Securities Exchange Act of 1934, as amended; | |

| ● | “SEC” refers to the Securities and Exchange Commission; and | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| 4 |

ITEM 1 – BUSINESS

Overview

We design, develop, manufacture, and sell advanced rechargeable lithium-ion energy storage solutions for lift trucks, and other industrial equipment including airport ground support equipment (“GSE”), energy storage for solar applications, and industrial robotic applications. Our “LiFT Pack” battery packs, including our proprietary battery management system (“BMS”), provide our customers with a better performing, lower cost of ownership, and more environmentally friendly alternative, in many instances, to traditional lead acid and propane-based solutions.

We have received Underwriters Laboratory (“UL”) Listing on our Class 3 Walkie Pallet Jack LiFT Pack product line and our Class 1 Counterbalance/Sit-down/Ride-on LiFT Packs. Our Class 2 Narrow Aisle LiFT Packs are currently undergoing UL testing, and we intend to schedule our Class 3 End Rider LiFT Pack for testing in the coming months. We believe that a UL Listing demonstrates the safety, reliability and durability of our products and gives us an important competitive advantage over other lithium-ion energy suppliers. Many of our LiFT Packs have been approved for use by leading industrial motive manufacturers, including Toyota Material Handling USA, Inc., Crown Equipment Corporation, and The Raymond Corporation.

Within our industrial market segments, we believe that our LiFT Pack solutions provide cost and performance benefits over existing lead acid power products including:

| ● | longer operation and more shifts with fewer batteries; | |

| ● | reduced energy and maintenance costs; | |

| ● | faster recharging; and | |

| ● | longer lifespan. |

Additionally, the toxic nature of lead acid batteries presents significant safety and environmental issues as they are subject to Environmental Protection Agency lead acid battery reporting requirements, may create an environmental hazard in the event of a cell breach, and emit combustible gases during charging.

As a result of the advantages lithium-ion battery technology provide over lead acid batteries, we have experienced significant growth in our business. We believe the industry is at the early stage of a trend toward the adoption of lithium-ion technology to displace lead acid and propane-based energy storage solutions, and based on North American sales data from the Industrial Truck Association (“ITA”), we estimate the market to be a multi-billion dollar per year opportunity.

Critical to our success is our innovative and proprietary versatile power BMS that both optimizes the performance of our LiFT Packs and provides a platform for adding new battery pack features, including customized telemetry (pack data available anytime, anywhere) for customers. The BMS serves as the brain of the battery pack, managing cell balancing, charging, discharging, monitoring and communication between the pack and the forklift.

Our engineers design, develop, test, and service our products. We source our battery cells from multiple suppliers in China and the remainder of the components primarily from vendors in the United States. Final assembly, testing and shipping of our products is done from our ISO 9001 certified facility in Vista, California, which includes three assembly lines.

Recent Corporate Transactions

Equity Financings

On August 14, 2020, we priced an underwritten public offering of our common stock, and as a result of this equity offering and our compliance with other listing requirements, shares of our common stock commenced trading on The NASDAQ Capital Market under the symbol “FLUX.” Prior to the listing on The NASDAQ Capital Market, our common stock was quoted on the OTCQB. On August 18, 2020, we closed this underwritten offering which represented 3,099,250 shares of our common stock at a public offering price of $4.00 per share for gross proceeds of approximately $12.4 million to us prior to deducting underwriting discounts and commissions and offering expenses payable by us, and included the full exercise of the underwriters’ over-allotment option. The shares of common stock offered by us through this underwritten offering were offered pursuant to a registration statement on Form S-1 (File No. 333-231766), which was declared effective by the United States Securities and Exchange Commission on August 12, 2020.

| 5 |

On July 24, 2020, we sold and issued an aggregate of 800,000 shares of common stock, at $4.00 per share, for an aggregate purchase price of $3,200,000 in cash to accredited investors in a private placement.

Debt Transactions

On July 9, 2020, we made a payment to Cleveland Capital, L.P., a Delaware limited partnership (“Cleveland”), in the amount of $200,000 as a partial payment of the outstanding principal balance under a loan for $1,000,000 (the “Cleveland Loan”). On July 27, 2020, in connection with the outstanding loan from Cleveland to us in the principal amount of $1,157,000, we entered into the Eighth Amendment to the Unsecured Promissory Note which extended the maturity date from July 31, 2020 to August 31, 2020, and capitalized all accrued and unpaid interest as of July 27, 2020 to the principal amount (the Eighth Amendment and together with the Original Note and all other previous Amendments, the “Cleveland Note”). All accrued and unpaid interest as of July 27, 2020 was capitalized to the principal amount. On August 19, 2020, we paid Cleveland the entire remaining principal balance due under the Cleveland Loan, together with all accrued interest payable as of August 19, 2020, in an aggregate amount of approximately $978,000.

In connection with a note originally issued to Esenjay Investments, LLC (“Esenjay”), an entity that is a principal stockholder and also controlled and solely owned by our director, Michael Johnson, for a loan in the principal amount of $1,400,000 (“Esenjay Note”), on July 22, 2020, one individual, who became a note holder pursuant to the assignment of such note to the note holder, elected to convert $400,000 in principal, into 100,000 shares of common stock at $4.00 per share.

In August 2020, we made an aggregate payment of $1,000,000 to some of Lenders, including $600,000 to Esenjay, as partial repayment of outstanding principal under the notes (the “Notes”) issued in connection witht a secured line of credit for up to $12,000,000 (“LOC”). On August 31, 2020, we entered into a certain Third Amended and Restated Credit Facility relating to the LOC to (i) extend the maturity date from December 31, 2020 to September 30, 2021, and (ii) to include outstanding obligations for an aggregate amount of approximately $564,000, consisting of $500,000 in principal and approximately $64,000 in accrued interest, under the Esenjay Note, into the LOC. As of August 31, 2020, there was approximately $4,396,000 in principal outstanding, of which $884,000 is due to Esenjay and approximately $7,604,000 available for future draws. See “ITEM 13 - CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE”

DESCRIPTION OF OUR BUSINESS

Our Business

We have leveraged our experience in lithium-ion technology to design and develop a suite of LiFT Pack product lines that we believe provide attractive solutions to customers seeking an alternative to lead acid and propane-based power products. We believe that the following attributes are significant contributors to our success:

Engineering and integration experience in lithium-ion for motive applications: We have been developing lithium-ion applications for the advanced energy storage market since 2010, starting with products for automotive electric vehicle manufacturers. We believe our experience enables us to develop superior solutions as we have sold over 7,000 packs in the field to customers.

UL Listing: We launched our Class 3 Walkie LiFT Pack product line in 2014 and obtained UL Listing for all three different power configurations in January 2016. We have also obtained UL Listing for our Class 1 LiFT Pack and our Class 2 LiFT Pack is in process, with our Class 3 End Rider to follow subsequently. We believe this UL Listing gives us a significant competitive advantage and provides assurance to customers that our technology has been rigorously tested by an independent third party and determined to be safe, durable and reliable.

Original equipment manufacturer (OEM) approvals: Our Class 3 Walkie LiFT Packs have been tested and approved for use by Toyota Material Handling USA, Inc., Crown Equipment Corporation, and The Raymond Corporation, among the top global lift truck manufacturers by revenue according to Material Handling & Logistics. We also provide a “private label” Class 3 Walkie LiFT Pack to a major forklift OEM.

| 6 |

Broad product offering and scalable design: We offer LiFT Packs for use in a variety of industrial motive applications. We believe that our modular and scalable design enables us to optimize design, inventory, and part count to accommodate natural product extensions of our products to meet customer requirements. Based on our Class 3 Walkie LiFT Pack design, we have expanded our product lines to include Class 1 Ride-on and 3 Wheel Class 2 Narrow Aisle & Turret Truck, Class 3 End Rider LiFT Pack product lines as well as airport GSE Packs. Natural product extensions, based on our modular, scalable designs, recently include solar backup power for electric vehicle (“EV”) mobile charging stations and robotic warehouse equipment.

Significant advantages over lead acid and propane solutions: We believe that lithium-ion battery systems have significant advantages over existing technologies and will displace lead acid batteries and propane-based solutions, in most applications. Relative to lead acid batteries, such advantages include environmental benefits, no water maintenance, faster charge times, greater cycle life, longer run times, and less energy used that provide operational and financial benefits to customers. Compared to propane solutions, lithium-ion systems avoid the generation of exhaust emissions and associated odor and environmental contaminates, and maintenance of an internal combustion engine, which has substantially more parts subject to wear than an electric motor.

Proprietary Battery Management System: We have developed our “next generation” versatile BMS that is currently being rolled out into our full product lines and which provides significant product features for improved customer productivity. Our BMS serves as the brain of the battery pack, managing cell balancing, charging, discharging, monitoring and communication between the pack and the forklift. Our BMS is specifically designed for the industrial motive application environment and is adaptable to meet custom requirements. Our BMS also enables ongoing feature development for reduced cost and higher performance.

Our Products

We have developed, tested, and sold our LiFT Packs for use in a broad range of lift trucks, including Class 3 Walkie and End Riders, Class 2 Narrow Aisle, and Class 1 Ride-on, as well as for airport GSE. Within each of these product segments, there is a range of power and equipment variations. Our LiFT Packs fit most of these variations, with only minor modifications needed to fit the remaining low volume applications. This equipment is described in more detail below.

| 7 |

Class 3 Walkie Pallet Jack

| ● | Our smallest product line by weight and size. | |

| ● | Dedicated assembly line for production with unique design to fit battery compartments. | |

| ● | Used in food and beverage delivery business, where the “walkie” often rides on-board a truck for deliveries in a very rugged environment. | |

| ● | UL Listing received in 2016 for all three power configurations. | |

| ● | Power ratings range from 1.7 to 4.3 kWh. |

Class 1 Counterbalance/Sit Down/Ride-on

| ● | Our “large product” line for Class 1 ride-on forklifts, to meet high power requirements. | |

| ● | Utilizes modular “blade” design. | |

| ● | Used in warehouses and production facilities, for demanding requirements, especially multi-shift operations. | |

| ● | Proven to support 3-shift operations and avoid the need for a battery for each shift. | |

| ● | Power ratings range from 21.6 to 32.0 kWh. |

| 8 |

Class 1 3-Wheel Forklift

| ● | Our solution for Class 1 3-wheel forklifts, to meet high power requirements. | |

| ● | Used in high-velocity warehouses and production facilities, typically with reduced rack spacing requiring greater maneuverability in tight spaces. | |

| ● | Proven to support 3-shift operations and avoid the need for a battery for each shift. | |

| ● | Power ratings range from 20.5 to 30.7 kWh. |

Class 2 Narrow Aisle

| ● | Our “medium product line” utilizes a modular design for medium-size packs. | |

| ● | Popular in new facilities focused on high efficiency operations. | |

| ● | Power ratings range from 21.6 to 31.1 kWh. |

Class 3 End Rider

| ● | Uses similar design to our Class 2 Narrow Aisle LiFT Packs. | |

| ● | Equipment and battery packs designed for use in high volume distribution centers (“DC”). | |

| ● | Power ratings range from 9.6 to 14.4 kWh. |

Airport GSE

| ● | Our first “large pack” product line, built on our “large pack” assembly line. | |

| ● | Utilizes similar modular design as our large forklift LiFT Packs with minor modifications. | |

| ● | Used to power airport GSE including: baggage and cargo trucks, scissor lifts, pushback tractors, and belt loaders, all used at airports. | |

| ● | Used by major airlines and ground support equipment “service” companies. | |

| ● | Power ratings range from 16.0 to 48.0 kWh. |

Energy Storage for Solar Power

| ● | Uses our stacked version of our recently launched Class 3 S24 | |

| ● | Currently sold on solar power electric vehicle (EV) charging stations. | |

| ● | Power ratings range from 9.6 to 14.4 kWh. |

| 9 |

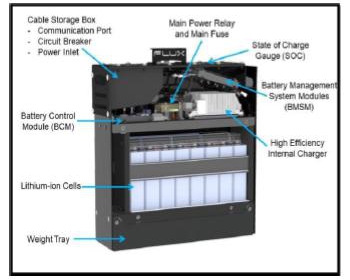

Because we are addressing a wide range of power and energy requirements across broad industrial motive applications, we have taken a modular approach to our battery pack system design. We have three core design modules that are used in our entire family of forklift products. Our core modules are designed for small, medium, and large packs. The design of each core module is driven by power requirements and physical space sizing. The core module for our small LiFT Pack, which fits a Class 3 Walkie, is a 24-volt lithium-ion pack (figure below) comprised of individual 3.2-volt cells. The medium and large cored modules are designed to accommodate larger equipment size and power by adding more cells and components. These larger designs support 36-volt, 48-volt, and 80-volt applications with power requirements up to 900Ah (amps per hour or “current” rating), which enables us to offer a full product line-up.

We offer varying chemistries and configurations based on the specific application. Currently, our LiFT Packs use lithium iron phosphate (LiFePO4) battery cells, which we source from a variety of overseas suppliers that meet our power, reliability, safety and other specifications. Because our BMS is not designed to work with a specific battery chemistry, and we do not develop or manufacture our own battery cells, we believe we can readily adapt our LiFT Packs as new chemistries become available in the market or customer preferences change.

We also offer 24-volt onboard chargers for our Class 3 Walkie LiFT Packs, and smart “wall mounted” chargers for larger applications. Our smart charging solutions are designed to interface with our BMS and integrate easily into most all major chargers in the market.

Industry Overview

Driven by overall growth in global demand for lithium-ion battery solutions, the supply of lithium-ion batteries has rapidly expanded, leading to price declines of eighty-five percent (85%) since 2010 according to BloombergNEF. BloombergNEF also estimates that lithium-ion battery prices, which averaged $1,160 per kilowatt hour in 2010, were $156 per kWh in 2019 and could drop below $100 per kWh in 2024.

The sharp decline in the price of lithium-ion batteries has commenced a shift in customer preferences away from lead acid and propane-based solutions for power lift equipment to lithium-ion based solutions. We believe our position as a pioneer in the field and our extensive experience providing lithium-ion based storage solutions makes us uniquely positioned to take advantage of this shift in customer preferences.

Lift Equipment - Material Handling Equipment

We focus on energy storage solutions for lift equipment and related industrial applications because we believe they represent large and growing markets that are just beginning to adopt lithium-ion based technology. We apply our scalable, modular designs to natural product extensions in the industrial equipment market. These markets include not only the sale of lithium-ion battery solutions for new equipment but also a replacement market for existing lead acid battery packs.

| 10 |

Historically, larger lift trucks were powered by internal combustion engines, using propane as a fuel, with smaller equipment powered by lead acid batteries. Over the past thirty (30) years, there has been a significant shift toward electric power. According to Liftech/ITA, over this time period the percentage of lift trucks powered electrically has doubled from approximately thirty percent (30%) to over sixty percent (60%).

According to Modern Materials Handling, worldwide new lift truck orders reached approximately 1.4 million units in 2017. The Industrial Truck Association has estimated that approximately 200,000 lift trucks had been sold yearly since 2013 in North America (Canada, the United States and Mexico), including approximately 242,000 units sold in 2019, with sales relatively evenly distributed between electric rider (Class 1 and Class 2), motorized hand (Class 3), and internal combustion engine powered lift trucks (Class 4 and Class 5). The ITA estimates that electric products represented approximately sixty-six percent (66%) of the North American market in 2019. Driven by growth in global manufacturing, e-commerce and construction, Research and Markets expects that the global lift truck market will grow at a compound annual growth rate of six and four-tenths percent (6.4%) through 2024.

Customers

We currently sell products to customers through OEMs, lift equipment dealers, and battery distributors. Our customers vary from small companies to Fortune 500 companies.

During the year ended June 30, 2020, we had three (3) major customers that each represented more than 10% of our revenues on an individual basis, and together represented approximately $10,045,000 or 60% of our total revenues.

During the year ended June 30, 2019, we had four (4) major customers that each represented more than 10% of our revenues on an individual basis, and together represented approximately $8,072,000 or 87% of our total revenues.

Shift Toward Lithium-ion Battery Technologies

We expect that there will be a significant increase in demand for safe and efficient alternatives to lead acid and propane-based power products. There are a number of factors driving the change in customer preference away from these legacy products and toward lithium-ion energy storage solutions:

Duration of Charge/Run Times: Lithium-based energy storage systems can perform for a longer duration compared to lead acid batteries. Lithium-ion batteries provide up to 50% longer run times than lead acid batteries of comparable capacity, or amps-per-hour rating, allowing equipment to be operated over a long period of time between charges.

High/Sustained Power: Lithium-ion batteries are better suited to deliver high power versus legacy lead acid. For example, a 100Ah lead acid battery will only deliver 80Ah if discharged over a four-hour period. In contrast, a 100Ah lithium-ion system will achieve over 92Ah even during a 30 minute discharge. Additionally, during discharge, the LiFT Pack sustains its initial voltage, maximizing the performance of the forklift truck, whereas, lead acid voltages, and hence power, decline over the working shift.

Charging Time: Lead acid batteries are limited to one shift a day, as they discharge for eight hours, need eight hours for charging, and another eight hours for cooling. For multi-shift operations, this typically requires battery changeout for the equipment. Because lithium batteries can be recharged in as little as one hour and do not degrade when subjected to opportunity charging, hence, battery changeout is unnecessary.

Safe Operation: The toxic nature of lead acid batteries presents significant safety and environmental issues in the event of a cell breach. During charging, lead acid batteries emits combustible gases and increases in temperature. Lithium-ion (particularly LFP) batteries do not get as hot and avoid many of the safety and environmental issues associated with lead acid batteries.

Extended Life: The performance of lead acid batteries degrades after approximately 500 charging cycles in industrial equipment applications. In comparison, lithium-ion batteries last up to five times longer in the same application.

| 11 |

Size and Weight: Lithium is about one-third the weight of lead acid for comparable power ratings. Lower weight enables forklift OEMs the ability to optimize the design of the truck based on a smaller footprint for lithium-ion instead of lead acid.

Lower Cost: Lithium-ion batteries provide power dense solutions with extended cycle life, reduced maintenance and improved operational performance, resulting in lower total cost of ownership.

Less Energy Used: we believe our lithium-ion batteries use 20-50% less energy based on our internal studies comparing lithium-ion to lead acid.

Marketing and Sales

In the industrial motive market, OEMs sell their lift products through dealer networks and directly to end customers. Because of environmental issues associated with lead acid batteries and to preserve customer choice, industrial lift products are typically sold without a battery pack. Equipment dealers source battery packs from battery distributors and battery pack suppliers based on demand or in response to customer specifications. End customers may specify a specific type and manufacturer of battery pack to the equipment dealer or may purchase battery packs from battery distributors or directly from battery suppliers. Consequently, we sell our products through a number of different channels, including directly to end users, OEMs and lift equipment dealers or through battery distributors.

Our direct sales staff is assigned to major geographies throughout North America to collaborate with our sales partners who have an established customer base. We plan to hire additional sales staff to support our expected sales growth. In addition, we have developed a nation-wide sales network of relationships with equipment OEMs, their dealers, and battery distributors.

We have worked directly with a number of OEMs to secure “technical approval” for compatibility of our LiFT Packs with their equipment. Once we receive that approval, we focus on developing a sales network utilizing existing battery distributors and equipment dealers, along with the OEM corporate national account sales force, to drive sales through this channel.

As our LiFT Packs have gained acceptance in the marketplace, we have seen an increase in direct-to-end-customer sales, ranging from small enterprises to Fortune 500 companies. To expand our customer reach, we have begun to market directly to end users, primarily focusing on large fleets operated by Fortune 500 companies seeking productivity improvements. We have seen initial success in these efforts, including sales to a Fortune 100 heavy machinery conglomerate. Our marketing efforts to these customers focus on the economic and performance benefits of lithium-ion batteries over lead acid batteries in their equipment.

Our product development efforts have included pilot programs and trials with national account end users. This has resulted in increased sales to these end users as many of them seek to replace lead acid batteries with lithium-ion battery packs in their fleets as they buy new equipment.

To support our products, we have a nation-wide network of service providers, typically forklift equipment dealers and battery distributors, who provide local support to large customers. We utilize a discount price to our standard retail prices to compensate our partners for customer orders and service availability. We also maintain a call center and provide Tech Bulletins and training to our service and sales network out of our corporate headquarters.

Our warranty policy for our family of forklift products includes a warranty ranging from five-year to ten-year limited warranty depending on size of pack. Warranty claims are handled by our call center that determines the appropriate response path: return pack, field fix by approved technician on location, or technical resolution by the call center. Our approved field technicians are typically equipment dealers or battery distributors, charging agreed upon discounted rates to their “street rates.”

We partner with Averest, Inc., an experienced GSE distributor, to market our lithium-ion battery packs for airport GSE. Our sales cycle for GSE equipment has required initial multi-month evaluation periods of packs prior to ordering. After initial shipments, subsequent ordering is dependent upon operating requirements and capital budgeting.

We customarily maintain a relatively small inventory of Class 3 Walkie LiFT Packs, which typically have shorter customer timing requirements than other lift equipment. For larger packs, we seek to align our inventory and production with historical OEM order patterns. Typically, we deliver larger packs on a four-to-eight week lead time. Because of associated lead times, we provide six-month rolling forecasts to our battery cell suppliers who manufacture and deliver to our forecast.

| 12 |

Ordering patterns primarily reflect ordering patterns of new equipment, commonly done in monthly or quarterly stages by large customers, as single fleet-size orders would require significant planning and operational support to implement. Backlog varies with customers but is driven by operating timing. Customer payment terms are normally net 30 days, but certain large customers require extended payment terms, ranging from 45 to 60 days. We have typically experienced seasonality in our customers’ orders, often with lower sales in July, August and December.

Manufacturing and Assembly

We source our battery cells from multiple suppliers in China and the remainder of the components primarily from vendors in the United States. While we have experienced occasional supply interruptions, none have been material. Production rates aligned with our forecasts have helped us mitigate the risk of disruption. Our BMS is not dependent on a specific lithium-ion chemistry or cell manufacturer, as we are agnostic to chemistry and supplier. We monitor and test potential new cell technologies on an ongoing basis. Final assembly, testing and shipping of our products is done from our ISO 9001 certified facility in Vista, California, which includes three assembly lines.

We design our BMS modules/boards and have two granted patents: (i) a 12-volt battery design; and (ii) a battery display design. Component acquisition and assembly of the BMS modules/boards are outsourced to two local, Southern California board houses, both of whom meet our quality and other specifications.

We buy chargers from several sources, including a U.S. based supplier. Additionally, we are a qualified dealer for a well-known manufacturer of “high capacity, modular, smart chargers” which support our larger packs.

Research and Development

Our engineers design, develop, test, and service our products. We believe our core competencies and capabilities are designing and developing proprietary technology for our BMS, systems engineering, engineering application, and software engineering for both battery packs and telemetry. We believe that our ability to develop new features and technology for our BMS is essential to our growth strategy.

Research and development expenses for the fiscal years ended June 30, 2020 and 2019 were approximately $5.0 million and $4.1 million, respectively. Such expenses consist primarily of materials, supplies, salaries and personnel related expenses, stock-based compensation expense, consulting costs and other expenses. Research and development expenses in fiscal year ended June 30, 2020 were higher than fiscal year ended June 30, 2019 primarily due to the development, implementation, and UL testing of the higher capacity packs for Class 1, 2, and 3 forklifts.

As we continue to develop and expand our product offerings, we anticipate that research and development expenses will continue to be a substantial part of our focus. We perform our research and development at our facility in Vista, California. We seek to develop innovative new and improved products for cell and system management along with associated communication, display, current sensing and charging tools.

Competition

Our competitors in the lift equipment market are primarily major lead acid battery manufacturers, including Exide Technologies, East Penn Manufacturing Company, EnerSys Corporation, and Crown Battery Corporation. We do not believe that these suppliers offer lithium-based products for lift equipment in any significant volume to end users, equipment dealers, OEMs or battery distributors. Several OEMs offer lithium-ion battery packs on Class 3 forklifts for sale only with their own new forklifts. As the demand for lithium-ion battery packs has increased, a number of small lithium battery pack providers have entered the market, most of whom we believe are suppliers of other power products and have simply added a lithium product to their product lines.

The key competitive factors in this market are performance, reliability, durability, safety and price. We believe we compete effectively in all of these categories in light of our experience with lithium-ion technology, including our development capabilities and the performance of our proprietary BMS. We believe that the UL Listing covering our entire Class 3 Walkie LiFT pack product line is a significant differentiating competitive advantage and we intend to extend that advantage by seeking to obtain UL Listings for our other LiFT pack products in the coming months. In addition, because our BMS is not reliant on any specific battery cell chemistry, we believe we can adapt rapidly to changes in advanced battery technology or customer preferences.

| 13 |

Intellectual Property

Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents pending, patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology. In addition to such factors as innovation, technological expertise and experienced personnel, we believe that a strong patent position is important to remain competitive.

As of June 30, 2020, we have two issued patents and three trademark registrations protecting the Flux Power name and logo. We intend to file additional patent applications with respect to our technology, including our next generation BMS 2.0, which is now being rolled into production. We do not know whether any of our efforts will result in the issuance of patents or whether the examination process will require us to narrow our claims. Even if granted, there can be no assurance that these pending patent applications will provide us with protection. Our two issued patents include: (i) a 12-volt battery design and (ii) a battery display design. Based on our recently released next generation BMS, we plan to file four utility patents by December 2020.

Suppliers

We obtain a limited number of components and supplies included in our products from a small group of suppliers. During the year ended June 30, 2020, we had two (2) suppliers who accounted for more than 10% of our total purchases, on an individual basis, and together represented approximately $6,598,000 or 35% of our total purchases.

During the year ended June 30, 2019 we had three (3) suppliers who accounted for more than 10% of our total purchases, on an individual basis, and together represented approximately $6,855,000 or 62% of our total purchases.

Government Regulations

Product Safety Regulations. Our products are subject to product safety regulations by Federal, state, and local organizations. Accordingly, we may be required, or may voluntarily determine to obtain approval of our products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff and, if redesign were necessary, could result in a delay in the introduction of our products in various markets and applications.

Environmental Regulations. Federal, state, and local regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of advanced energy storage systems. Although we believe that our operations are in material compliance with current applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities.

Moreover, Federal, state, and local governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy storage systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy systems will not be imposed.

Occupational Safety and Health Regulations. The California Division of Occupational Safety and Health (Cal/OSHA) and other regulatory agencies have jurisdiction over the operations of our Vista, California facility. Because of the risks generally associated with the assembly of advanced energy storage systems we expect rigorous enforcement of applicable health and safety regulations. Frequent audits by, or changes, in the regulations issued by Cal/OSHA, or other regulatory agencies with jurisdiction over our operations, may cause unforeseen delays and require significant time and resources from our technical staff.

| 14 |

Employees

As of June 30, 2020, we had 103 employees. We engage outside consultants for business development, operations and other functions from time to time. None of our employees is currently represented by a trade union.

Other Information

Our Internet address is www.fluxpower.com. We make available on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). Other than the information expressly set forth in this annual report, the information contained, or referred to, on our website is not part of this annual report.

The public may also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the SEC.

Our corporate headquarters and production facility totals approximately 63,200 square feet and is located in Vista, California. Our production facility is ISO 9001 certified. The telephone number at our principal executive office is (760)-741-FLUX or (760)-741-3589. In June 2019 we moved to our current facility, noted above, where we initially leased approximately 45,600 square feet of industrial space, and in April 2020, we leased an additional 17,600 rentable space under a lease which terminates concurrently with the term of the original lease, which expires on November 20, 2026. Rent for the corporate headquarters and production facility is approximately $58,700 per month and escalates approximately 3% per year through the end of the lease term. Total rent expense was approximately $673,000 and $168,000 for the years ended June 30, 2020 and 2019, respectively, net of sublease income.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You also should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risk Factors Relating to Our Business

We have a history of losses and negative working capital.

For the fiscal years ended June 30, 2020 and 2019, we had net losses of $14,336,000 and $12,414,000, respectively. We have historically experienced net losses and until we generate sufficient revenue, we anticipate to continue to experience losses in the near future.

In addition, as of June 30, 2020 and 2019, we had a negative working capital (including short term debt) of $5,959,000 and $3,644,000, respectively. As of June 30, 2020 and 2019, we had a cash balance of $726,000 and $102,000, respectively. We expect that our existing cash balances, credit facilities, and the net proceeds from our recent public offering will be sufficient to fund our existing and planned operations for the next twelve months. Until such time as we generate sufficient cash to fund our operations, we will need additional capital to continue our operations thereafter.

We have relied on equity financings, borrowings under short-term loans with related parties, our credit facilities and/or previous cash flows from operating activities to fund our operations. However, there is no guarantee we will be able to obtain additional funds in the future or that funds will be available on terms acceptable to us, if at all.

Any future financing may result in dilution of the ownership interests of our stockholders. If such funds are not available on acceptable terms, we may be required to curtail our operations or take other actions to preserve our cash, which may have a material adverse effect on our future cash flows and results of operations.

| 15 |

We will need to raise additional capital or financing to continue to execute and expand our business.

While we expect that our available cash, credit facilities, and the expected net proceeds from our recent public offering will be sufficient to sustain our operations for the next twelve months, we will likely need to raise additional capital to support our expanded operations and execute on our business plan. In order to support our anticipated growth, we intend to secure a revolving line of credit with a bank. In addition, we may be required to pursue sources of additional capital through various means, including joint venture projects, sale and leasing arrangements, and debt or equity financings. Any new securities that we may issue in the future may be sold on terms more favorable for our new investors than the terms in which our stockholders acquired their securities. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot assure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may have to reduce our operations accordingly.

Historically we were dependent on our existing credit facility to finance our operations. We currently have approximately $4.4 million in principal outstanding under the LOC and in the event of default, such default could adversely affect our business, financial condition, results of operations or liquidity.

As of June 30, 2020 and 2019, we had an outstanding principal balance of $5,290,000 and $6,405,000, respectively, under our line of credit for up to $12,000,000 bearing an interest rate of 15% (“LOC”) with Esenjay Investment, LLC (“Esenjay”), a majority stockholder and a company owned and controlled by Michael Johnson, our director, Cleveland, and other unrelated parties (Cleveland and Esenjay, together with additional parties that joined and may join as additional lenders, collectively the “Lenders”). In addition, as of June 30, 2020, we had an outstanding principal balance of $1,157,000 under our unsecured short-term promissory note with Cleveland (“Cleveland Note”), which note bears an interest of 15% and was due on July 31, 2020. In addition, as of June 30, 2020, we have an outstanding principal balance of approximately $900,000 under our unsecured short-term convertible promissory note with Esenjay, which note bears an interest rate of 15% (“Esenjay Note”). As of June 30, 2020, approximately $5,290,000 in principal outstanding under the LOC, and approximately $6,710,000 was available for future draws. In August 2020, we made an aggregate payment of $1,000,000 to some of our Lenders, including $600,000 to Esenjay, as partial repayment of the Notes under the LOC. On August 19, 2020, the Company paid Cleveland the entire remaining principal balance due under the Cleveland Note, together with all accrued interest payable as of August 19, 2020, in an aggregate amount of approximately $978,000. On August 31, 2020, outstanding obligations for an aggregate amount of approximately $564,000, consisting of $500,000 in principal and approximately $64,000 in accrued interest, under the Esenjay Note, was consolidated into the LOC. As of August 31, 2020, after the consolidation there was approximately $4,396,000 in principal outstanding under the LOC which is convertible, at the option of the note holder, into approximately 1,099,000 shares of common stock (subject to any beneficial ownership limitations) at $4.00 per share. As of August 31, 2020, there was approximately $7,604,000 available for future draws. However, our ability to borrow under the LOC is at the discretion of the Lenders. Also, the Lenders have no obligation to disburse such funds and have the right not to advance funds under the LOC. In addition, as a secured party, upon an event of default, the Lenders will have a right to the collateral granted to them under the line of credit, and we may lose our ownership interest in the assets.

Economic conditions may adversely affect consumer spending and the overall general health of our retail customers, which, in turn, may adversely affect our financial condition, results of operations and cash resources.

Uncertainty about the current and future global economic conditions may cause our customers to defer purchases or cancel purchase orders for our products in response to tighter credit, decreased cash availability and weakened consumer confidence. Our financial success is sensitive to changes in general economic conditions, both globally and nationally. Recessionary economic cycles, higher interest borrowing rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could continue to adversely affect the demand for our products. If credit pressures or other financial difficulties result in insolvency for our customers, it could adversely impact our financial results. There can be no assurances that government and consumer responses to the disruptions in the financial markets will restore consumer confidence.

| 16 |

We are dependent on a few customers for the majority of our net revenues, and our success depends on demand from OEMs and other users of our battery products.

Historically a majority of our product sales have been generated from a small number of OEMs and end-user customers, including three (3) customers who, on an aggregate basis, made up 60% of our sales for the year ended June 30, 2020, and four (4) end-user customers who, on an aggregate basis, made up 87% of our sales for the year ended June 30, 2019. As a result, our success depends on continued demand from this small group of customers and their willingness to incorporate our battery products in their equipment. The loss of a significant customer would have an adverse effect on our revenues. There is no assurance that we will be successful in our efforts to convince end users to accept our products. Our failure to gain acceptance of our products could have a material adverse effect on our financial condition and results of operations.

Additionally, OEMs, their dealers and battery distributors may be subject to changes in demand for their equipment which could significantly affect our business, financial condition and results of operations.

Our business is vulnerable to a near-term severe impact from the COVID-19 outbreak, and the continuation of the pandemic could have a material adverse impact on our operations and financial condition.

The COVID-19 pandemic has spread across the globe and is impacting worldwide economic activity. COVID-19 and another public health epidemic/pandemic could pose the risk that we or our employees, contractors, customers, suppliers, third party shipping carriers, government and other partners may be prevented from or limited in their ability to conduct business activities for an indefinite period of time, including due to the spread of the disease within these groups or due to shutdowns that may be requested or mandated by governmental authorities. While it is not possible at this time to estimate the impact that COVID-19 could have on our business, the continued spread of COVID-19 and the measures taken by the governments of states and countries affected could disrupt, among other things, the supply chain and the manufacture or shipment of our products. On March 19, 2020, the governor of California, the state where our facility is located, issued statewide stay-at-home orders for non-essential workers to help combat the spread of COVID-19. The Company was deemed to be an essential business consistent with announcements by Forklift OEMs and related supply chain, who support the logistics industry, critical to delivering food and supplies during COVID-19 crisis and we have instituted processes, policies and workplace procedures in an effort to keep our workers safe while productive. However, in the future, our manufacturing operations may be subject to closure or shut down for a variety of reasons. While the Company implemented COVID-19 measures in March 2020 as recommended by the CDC and governmental authorities, in early July, 2020 the Company was notified that two employees had recently tested positive for COVID-19. While manufacturing operations were not materially impacted, future operations could be affected by the COVID-19 pandemic. Any substantial disruption in our manufacturing operations from COVID-19, or its related impacts, would have a material adverse effect on our business and would impede our ability to manufacture and ship products to our customers in a timely manner, or at all.

The effect of the COVID-19 pandemic and its associated restrictions may adversely impact many aspects of our business, including customer demand, the length of our sales cycles, disruptions in our supply chain, lower the operating efficiencies at our facility, worker shortages and declining staff morale, and other unforeseen disruptions. The demand for our products may significantly decline if the COVID-19 pandemic continues, restrictions are implemented or re-implemented, or the virus resurges and spreads and our customers suffer losses in their businesses. For example, due to the COVID-19 crisis, we have experienced requests from airline customers to delay or reduce some of their orders. The supply of our raw materials and our supply chain may be disrupted and adversely impacted by the pandemic. The occurrence of any of the foregoing events and their adverse effect on capital markets and investor sentiment may adversely impact our ability to raise capital when needed or on terms favorable to us and our stockholders to fund our operations, which could have a material adverse effect on our business, financial condition and results of operations. The extent to which the COVID-19 outbreak impacts our results, its effect on near or long-term value of our share price will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact.

We do not have long term contracts with our customers.

We do not have long-term contracts with our customers. Future agreements with respect to pricing, returns, promotions, among other things, are subject to periodic negotiation with each customer. No assurance can be given that our customers will continue to do business with us. The loss of any of our significant customers will have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, the uncertainty of product orders can make it difficult to forecast our sales and allocate our resources in a manner consistent with actual sales, and our expense levels are based in part on our expectations of future sales. If our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

| 17 |

Real or perceived hazards associated with Lithium-ion battery technology may affect demand for our products.

Press reports have highlighted situations in which lithium-ion batteries in automobiles and consumer products have caught fire or exploded. In response, the use and transportation of lithium-ion batteries has been prohibited or restricted in certain circumstances. This publicity has resulted in a public perception that lithium-ion batteries are dangerous and unpredictable. Although we believe our battery packs are safe, these perceived hazards may result in customer reluctance to adopt our lithium-ion based technology.

Our products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands.

A catastrophic failure of our battery modules could cause personal or property damages for which we would be potentially liable. Damage to or the failure of our battery packs to perform to customer specifications could result in unexpected warranty expenses or result in a product recall, which would be time consuming and expensive. Such circumstances could result in negative publicity or lawsuits filed against us related to the perceived quality of our products which could harm our brand and decrease demand for our products.

We may be subject to product liability claims.

If one of our products were to cause injury to someone or cause property damage, including as a result of product malfunctions, defects, or improper installation, then we could be exposed to product liability claims. We could incur significant costs and liabilities if we are sued and if damages are awarded against us. Further, any product liability claim we face could be expensive to defend and could divert management’s attention. The successful assertion of a product liability claim against us could result in potentially significant monetary damages, penalties or fines, subject us to adverse publicity, damage our reputation and competitive position, and adversely affect sales of our products. In addition, product liability claims, injuries, defects, or other problems experienced by other companies in the solar industry could lead to unfavorable market conditions for the industry as a whole, and may have an adverse effect on our ability to attract new customers, thus harming our growth and financial performance. Although we carry product liability insurance, it may be insufficient in amount to cover our claims.

Tariffs could be imposed on lithium-ion batteries or on any other component parts by the United States government or a resulting trade war could have a material adverse effect on our results of operations.

In 2018, the United States government announced tariffs on certain steel and aluminum products imported into the United States, which led to reciprocal tariffs being imposed by the European Union and other governments on products imported from the United States. The United States government has implemented tariffs on goods imported from China, and additional tariffs on goods imported from China are under consideration.

The lithium-ion battery industry has been subjected to tariffs implemented by the United States government on goods imported from China. There is an ongoing risk of new or additional tariffs being put in place on lithium-ion batteries or related part. Since all of our lithium-ion batteries are manufactured in China, current and potential tariffs on lithium-ion batteries imported by us from China could increase our costs, require us to increase prices to our customers or, if we are unable to do so, result in lower gross margins on the products sold by us.

The President of the United States has, at times, threatened to institute even wider ranging tariffs on all goods imported from China. China has already imposed tariffs on a wide range of American products in retaliation for the American tariffs on steel and aluminum. Additional tariffs could be imposed by China in response to actual or threatened tariffs on products imported from China. The imposition of additional tariffs by the United States could trigger the adoption of tariffs by other countries as well. Any resulting escalation of trade tensions, including a “trade war,” could have a significant adverse effect on world trade and the world economy, as well as on our results of operations. At this time, we cannot predict how the recently enacted tariffs will impact our business. Tariffs on components imported by us from China could have a material adverse effect on our business and results of operations.

| 18 |

We are dependent on a limited number of suppliers for our battery cells, and the inability of these suppliers to continue to deliver, or their refusal to deliver, our battery cells at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We do not manufacture the battery cells used in our LiFT Packs. Our battery cells, which are an integral part of our battery products and systems, are sourced from a limited number of manufacturers located in China. While we obtain components for our products and systems from multiple sources whenever possible, we have spent a great deal of time in developing and testing our battery cells that we receive from our suppliers. We refer to the battery cell suppliers as our “limited source suppliers.” To date, we have no qualified alternative sources for our battery cells although we research and assess cells from other suppliers on an ongoing basis. We generally do not maintain long-term agreements with our limited source suppliers. While we believe that we will be able to establish additional supplier relationships for our battery cells, we may be unable to do so in the short term or at all at prices, quality or costs that are favorable to us.

Changes in business conditions, wars, regulatory requirements, economic conditions and cycles, governmental changes and other factors beyond our control could also affect our suppliers’ ability to deliver components to us on a timely basis or cause us to terminate our relationship with them and require us to find replacements, which we may have difficulty doing. Furthermore, if we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. In the past, we have replaced certain suppliers because of their failure to provide components that met our quality control standards. The loss of any limited source supplier or the disruption in the supply of components from these suppliers could lead to delays in the deliveries of our battery products and systems to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion phosphate cells, could harm our business.

We may experience increases in the costs, or a sustained interruption in the supply or shortage, of raw materials. Any such cost increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. For instance, we are exposed to multiple risks relating to price fluctuations for lithium-iron phosphate cells.

These risks include:

| ● | the inability or unwillingness of battery manufacturers to supply the number of lithium-iron phosphate cells required to support our sales as demand for such rechargeable battery cells increases; | |

| ● | disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and | |

| ● | an increase in the cost of raw materials, such as iron and phosphate, used in lithium-iron phosphate cells. |

Our success depends on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline.

Our success will depend on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors. There is no assurance that we will be able to successfully develop new products and capabilities that adequately respond to these forces. In addition, changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. If we are unable to offer products and capabilities that satisfy customer demand, respond adequately to changes in industry trends or legislative changes and maintain our competitive position in our markets, our financial condition and results of operations would be materially and adversely affected.

| 19 |

The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development efforts will be either successful or completed within anticipated timeframes, if at all. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the battery market. In addition, in order to compete effectively in the renewable battery industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delays in related product development and failure of new products to operate properly. Any failure by us to successfully launch new products, or a failure by our customers to accept such products, could adversely affect our results.

Our business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to protect our intellectual proprietary rights could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue, which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents (two issued patents), patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology.

The protections provided by patent laws will be important to our future opportunities. However, such patents and agreements and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons, including the following:

| ● | the patents we have been granted may be challenged, invalidated or circumvented because of the pre-existence of similar patented or unpatented intellectual property rights or for other reasons; | |

| ● | the costs associated with enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; and | |

| ● | existing and future competitors may independently develop similar technology and/or duplicate our systems in a way that circumvents our patents. |

Our patent applications may not result in issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we are the first creator of inventions covered by pending patent applications or the first to file patent applications on these inventions, nor can we be certain that our pending patent applications will result in issued patents or that any of our issued patents will afford protection against a competitor. In addition, patent applications that we intend to file in foreign countries are subject to laws, rules and procedures that differ from those of the United States, and thus we cannot be certain that foreign patent applications related to issue United States patents will be issued. Furthermore, if these patent applications issue, some foreign countries provide significantly less effective patent enforcement than in the United States.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that the patent applications that we file will result in patents being issued, or that our patents and any patents that may be issued to us in the near future will afford protection against competitors with similar technology. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain patents that we need to license or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

| 20 |

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

Our business depends substantially on the continuing efforts of the members of our senior management team, and our business may be severely disrupted if we lose their services.

We believe that our success is largely dependent upon the continued service of the members of our senior management team, who are critical to establishing our corporate strategies and focus, overseeing the execution of our business strategy and ensuring our continued growth. Our continued success will depend on our ability to attract and retain a qualified and competent management team in order to manage our existing operations and support our expansion plans. Although we are not aware of any change, if any of the members of our senior management team are unable or unwilling to continue in their present positions, we may not be able to replace them readily. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain their replacement. In addition, if any of the members of our senior management team joins a competitor or forms a competing company, we may lose some of our customers.

If we are forced to implement workforce reductions, our staff resources will be stretched making our ability to comply with legal and regulatory requirements as a Public Company difficult.

There can be no assurance that our management team will be able to implement and affect programs and policies in an effective and timely manner especially if subject to workforce reductions, that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

There have been changing laws, regulations and standards relating to corporate governance and public disclosure, including the (Sarbanes-Oxley) Act of 2002, new regulations promulgated by the SEC and rules promulgated by the national securities exchanges. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Members of our Board of Directors and our chief executive officer and chief financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. If the actions we take in our efforts to comply with new or changed laws, regulations and standards differ from the actions intended by regulatory or governing bodies, we could be subject to liability under applicable laws or our reputation may be harmed.